Navigating the volatile world of cryptocurrency can be overwhelming. Copy trade crypto offers a solution by allowing you to replicate the trades of experienced professionals. This approach simplifies investing and helps you leverage expert strategies with ease.

What is Copy trade crypto in the World of Cryptocurrency?

The volatile world of cryptocurrency trading can be daunting for newcomers. With prices fluctuating wildly and a constant influx of new information, knowing where to start can feel overwhelming.

This is where copy trading emerges as a potential solution, offering a simplified approach to navigating the crypto market. Copy trade crypto, in essence, allows novice investors to mirror the trades of seasoned professionals in the field.

Think of it as a form of social trading where you can automatically copy the actions of experienced crypto copy traders, replicating their portfolio and potentially their returns.

Demystifying Crypto Copy Trading

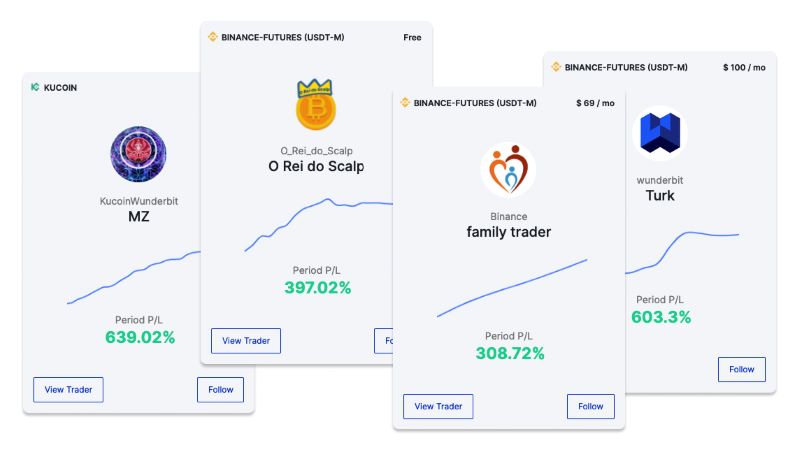

Crypto copy trading platforms serve as a bridge between novice and experienced traders. These platforms provide a space where users can browse through profiles of crypto copy traders, examining their trading histories, risk appetites, and overall performance.

Once you identify a trader whose strategies resonate with your investment goals, you can allocate a portion of your funds to automatically copy their trades. This means that when they buy or sell a particular cryptocurrency, your portfolio will mimic those actions.

Benefits of Copy Crypto Trading for Beginners

For those dipping their toes into the crypto waters, copy crypto trading presents several advantages. First and foremost, it eliminates the need for in-depth market knowledge and technical analysis.

Beginners can leverage the expertise of seasoned traders without needing to decipher complex charts or understand intricate trading indicators. This accessibility makes it easier to enter the market and potentially generate profits from day one.

Secondly, copy trading offers a degree of automation, freeing up time and mental energy. Once you’ve chosen a trader to follow, your portfolio updates automatically based on their decisions, eliminating the need for constant monitoring.

Risks Associated with Copy Crypto Trading

While copy trading might seem like a surefire path to success, it’s essential to acknowledge the inherent risks involved. The cryptocurrency market, by its very nature, is highly volatile and unpredictable. Even experienced traders can make losing trades, and those losses will be reflected in your portfolio as well.

Furthermore, the success of copy trading hinges on choosing the right crypto copy trader to follow. Past performance is not always indicative of future results, and a trader’s strategy might not align with your risk tolerance or financial goals.

How Does Crypto Copy Trading Work?

Understanding the mechanics of copy trading is crucial before diving in. Let’s break down the process step-by-step to gain a clear picture of how it functions in the real world.

Choosing the Right Platform for Copy trade crypto

The first step involves selecting a reputable crypto copy trading platform. There are numerous options available, each with its unique features, fee structures, and communities of traders. Conduct thorough research, considering factors like security protocols, user interface, available trading pairs, and the track record of traders on the platform.

Selecting Experienced Crypto Copy Traders to Follow

Once you’ve chosen a platform, you can start browsing through the profiles of available crypto copy traders. Look for traders who have a proven track record of success, a transparent trading history, and a risk management strategy that aligns with yours. Consider diversifying your portfolio by copying the trades of multiple traders to mitigate potential losses.

Setting Up and Managing Your Copy Trading Portfolio

After selecting your traders, you’ll need to determine the amount of capital you’re comfortable allocating to each one. Most platforms allow you to set stop-loss orders to limit potential losses. Regularly monitor your portfolio’s performance and adjust your allocations or chosen traders as needed to stay aligned with your investment goals.

Top Strategies and Tips for Successful Crypto Copy Trading

While copy trading can simplify the trading process, certain strategies can enhance your chances of success.

Understanding Risk Management in Copy Trading

Never invest more than you can afford to lose, especially in a volatile market like cryptocurrency. Diversify your portfolio by copying multiple traders with varying risk appetites and trading styles. Utilize stop-loss orders to protect your capital from significant drawdowns.

Analyzing the Performance of Crypto Copy Traders

Don’t solely rely on a trader’s win rate. Dig deeper into their trading history, examining their average win size, maximum drawdown, and risk-reward ratio to gain a comprehensive understanding of their performance.

Diversifying Your Crypto Copy Trading Portfolio

Just as you would diversify a traditional investment portfolio, spread your risk in copy trading by following traders who specialize in different cryptocurrencies or trading strategies. This approach can help cushion your portfolio from losses in any single asset or trading style.

Exploring the Future of Crypto Copy Trading

The world of copy trading is constantly evolving, with new technologies and trends shaping its future.

The Rise of AI and Automated Trading Bots

Artificial intelligence and advanced algorithms are playing an increasingly prominent role in trading. Expect to see more AI-powered copy trading bots that can analyze market data and execute trades with even greater speed and efficiency.

Regulations and Their Potential Impact on Copy Trading

As the cryptocurrency market matures, regulatory frameworks are being developed around the world. These regulations could impact the way copy trading platforms operate and the services they offer to users.

Choosing the Right Copy Trade crypto Platform for Your Needs

With the rapid growth of the crypto copy trading industry, new platforms are constantly emerging. Carefully research and compare different platforms, considering factors like security, transparency, fees, and user experience to find the one that best aligns with your needs and preferences.

Ready to dive into the world of crypto copy trading? Follow MevX for expert insights, strategies, and the latest updates in cryptocurrency trading!