Ready to elevate your forex trading? Discover how a Forex Trading Bot can transform your trading strategy with automation and precision. From understanding what a forex trading bot is to selecting the right one, setting up risk management, and choosing the best platform, get all the insights you need to boost your trades and optimize your performance.

What is a Forex Trading Bot?

In the fast-paced world of foreign exchange (forex), traders are constantly seeking an edge to navigate the complexities of the market. A forex trading bot has emerged as a popular tool, offering the allure of automated trading and potential profits.

Essentially, a forex trading bot is a sophisticated software program designed to execute trades automatically based on pre-defined rules and algorithms. These bots connect to a trader’s brokerage account and utilize technical indicators, chart patterns, and other market data to identify potential trading opportunities.

Benefits and risks of using trading bots

The attraction of forex trading bots lies in their potential to remove emotional factors from trading decisions. By adhering to a strict set of rules, bots aim to eliminate impulsive actions that can often lead to losses.

Additionally, these bots can analyze vast amounts of market data at lightning speed, identifying opportunities that might escape the notice of even seasoned traders.

However, it’s crucial to acknowledge the inherent risks associated with trading bots. Technical glitches, unforeseen market events, and improper configuration can lead to significant losses.

Key Features To Look For in a Forex Trading Bot

When selecting a forex trading bot, certain features are paramount. Traders should prioritize bots that are compatible with reputable brokers, offer customizable trading strategies, and provide robust risk management tools. Transparency is key, and traders should seek bots with clear and concise reporting features to track performance

How to Boost Your Trades with a Forex Trading Bot

Forex trading bots are automated tools designed to enhance your trading strategies by executing trades on your behalf based on pre-defined criteria. Using a Forex trading bot can help optimize your trading performance, reduce emotional decision-making, and execute trades with precision. Here’s how you can effectively boost your trades using a Forex trading bot:

Understand What trading bot forex is

A Forex trading bot is a software application that uses algorithms to analyze market conditions and execute trades. These bots can be programmed to follow specific strategies, such as trend following, scalping, or mean reversion. They can operate 24/7, which is crucial in the forex market due to its continuous nature.

Choose the Right Trading bot forex

To boost your trades effectively, select a trading bot that aligns with your trading style and goals. Consider these factors:

- Strategy Compatibility: Ensure the bot supports the trading strategies you use or wish to implement.

- Customizability: Look for bots that allow you to customize settings and parameters according to your trading preferences.

- Reputation and Reviews: Check user reviews and ratings to ensure the bot is reliable and has a proven track record.

Backtest Your Strategy

Before deploying your trading bot in a live environment, conduct thorough backtesting. This involves running the bot with historical data to evaluate how it would have performed in the past. Backtesting helps you understand the bot’s effectiveness and make necessary adjustments to improve performance.

Set Up Proper Risk Management

Risk management is crucial in forex trading. Configure your bot with appropriate risk management settings, such as:

- Stop-Loss Orders: Define the maximum loss you’re willing to tolerate for each trade.

- Take-Profit Orders: Set targets for profit-taking to secure gains.

- Position Sizing: Adjust the bot’s position sizing according to your risk tolerance and account size.

Monitor and Adjust Settings

Even though a trading bot operates autonomously, regular monitoring is essential. Periodically review the bot’s performance and make adjustments as needed. Stay updated on market conditions and news that may impact trading, and tweak the bot’s settings to adapt to changing market dynamics.

Ensure Continuous Operation

For a Forex trading bot to be effective, it needs to operate continuously without interruption. Use reliable hardware or cloud-based solutions to ensure the bot is always running. Downtime or connectivity issues can affect performance and trading outcomes.

Stay Informed About Market Conditions

While a bot can handle the technical aspects of trading, staying informed about broader market conditions is still important. Economic events, geopolitical developments, and market trends can influence forex prices. Use this information to make informed decisions and adjust your trading strategy accordingly.

Evaluate and Refine Your Strategy

Regularly evaluate the performance of your trading bot. Assess metrics such as profitability, drawdown, and win rates. Based on this evaluation, refine your trading strategy and bot settings to enhance performance. Continuous improvement is key to long-term success.

Top 5 Platforms for Trading bot Forex

When it comes to enhancing your forex trading strategy with automation, several platforms stand out for their support of trading bots. Here’s a summary of the key features of each platform:

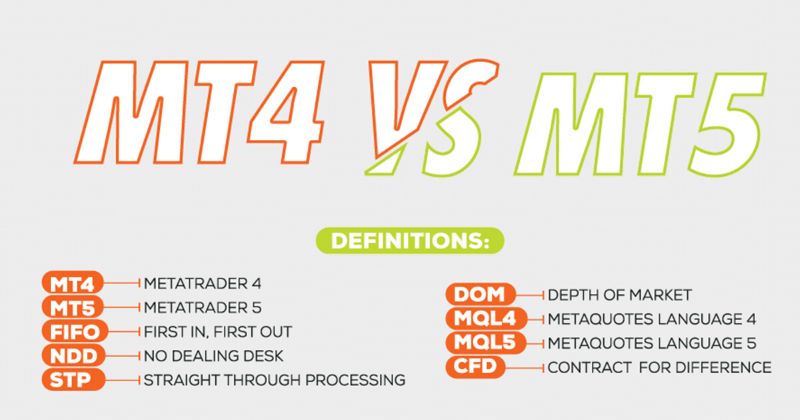

MetaTrader 4/5 (MT4/MT5)

MetaTrader platforms are highly favored in the forex trading community for their robust support of trading bots through Expert Advisors (EAs). They provide extensive customization options, allowing traders to tailor their strategies precisely. Additionally, MT4 and MT5 offer advanced backtesting features, which help evaluate the performance of trading bots before live deployment.

cTrader

cTrader excels in offering advanced trading capabilities with its support for trading bots known as cAlgo. The platform is renowned for its exceptional charting tools and intuitive interface, making it a preferred choice for those who seek both powerful trading features and ease of use.

TradingView

Although TradingView is primarily recognized for its superior charting and analysis tools, it also supports trading bots through integrations with brokers that offer automated trading solutions. This makes it a versatile option for traders who value both in-depth technical analysis and the convenience of automated trading.

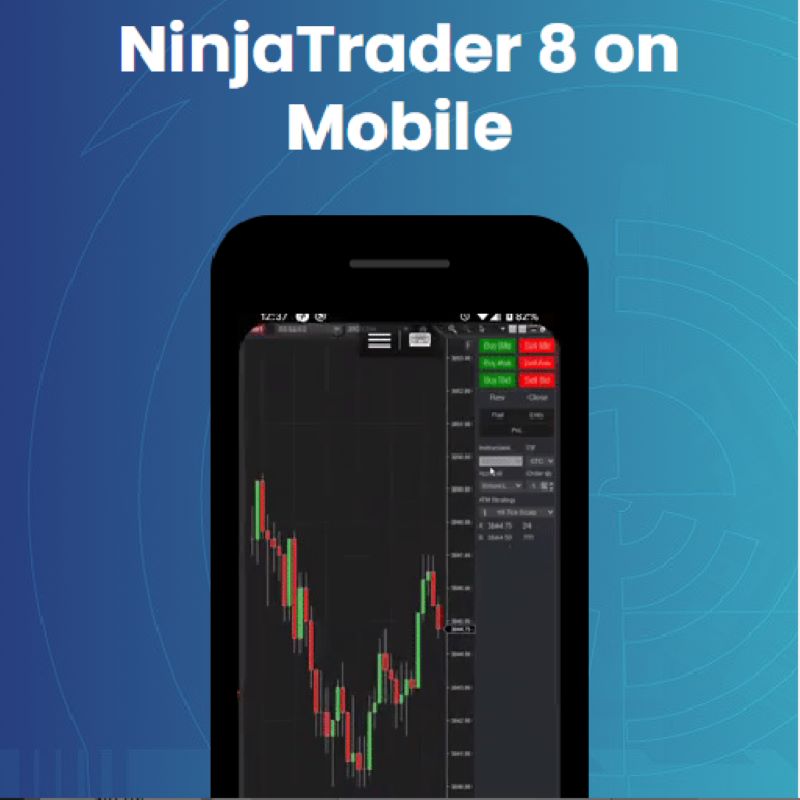

NinjaTrader

NinjaTrader is a formidable platform in the realm of forex trading bots, distinguished by its comprehensive backtesting and strategy development tools. It caters to traders who need advanced features for developing and testing their trading strategies, making it a robust choice for those focused on strategy refinement and automation.

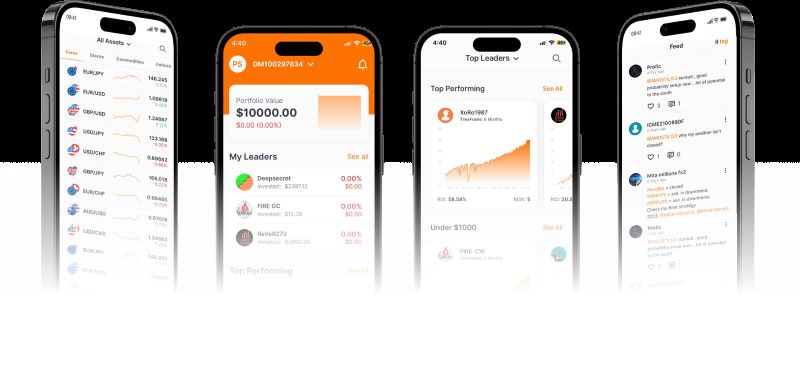

ZuluTrade

ZuluTrade stands out as a social trading platform that not only allows users to follow and replicate the trades of seasoned forex traders but also provides options for integrating trading bots. This dual approach offers both social trading benefits and the flexibility of automated trading solutions, catering to a wide range of trading preferences.

In conclusion, incorporating a forex trading bot into your strategy can significantly enhance your trading performance by automating decision-making and executing trades with precision. By choosing a reliable trading bot, performing thorough backtesting, and maintaining effective risk management, you can maximize your trading potential.

For more insights and updates on trading bots and forex strategies, follow MevX for expert tips and the latest trends in automated trading solutions.