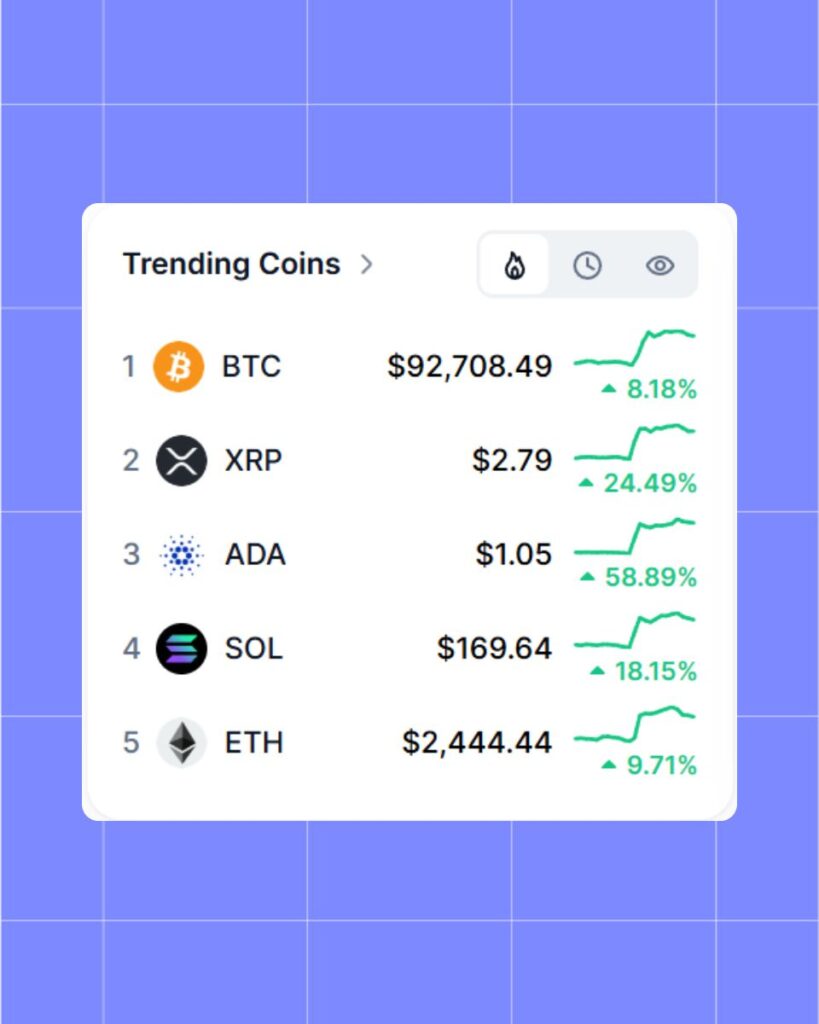

Bitcoin has long reigned as the undisputed king of cryptocurrency, its market dominance a towering metric of its supremacy. But on March 2nd, 2025, a seismic shift rattled that throne. Following President Donald Trump’s announcement of a U.S. Crypto Strategic Reserve including Bitcoin, Ethereum, XRP, Solana, and Cardano. Bitcoin’s dominance slips below 50% for the first time in years. By Sunday afternoon, its price had climbed 11% to $94,164, a respectable rebound. Yet the spotlight swiveled elsewhere, igniting a provocative question that’s echoing across trading floors and X threads alike: Is the King losing its crown?

The reserve news was a rising tide that lifted all boats, but altcoins rode the wave highest. XRP, Solana, and Cardano posted double-digit gains, outpacing BTC’s rally with a ferocity that turned heads. Ethereum held steady, bolstered by its own ecosystem buzz around decentralization efforts. This diversification of focus chipped away at BTC’s market share, a metric that once soared above 70% during calmer, less competitive times. On X, the crypto community erupted with speculation: “Bitcoin dominance under 50%, altseason confirmed?” one user crowed triumphantly, while another jabbed, “Trump just made BTC a sidekick in its own story.”

February had already left BTC battered, with a brutal 17% drop, its worst month since June 2022 driven by global sell-offs, tariff fears, and a broader economic chill. The reserve announcement arrived like a lifeline, injecting fresh optimism into a bleeding market. But it came with a catch: this wasn’t just Bitcoin’s moment anymore. The U.S. embracing a basket of cryptocurrencies signals a tectonic shift from Bitcoin’s singular narrative as a hedge against inflation or a digital gold standard. Now, it’s one piece of a broader, more crowded puzzle, forced to compete with altcoins pitched as faster, greener, or more versatile.

Bitcoin’s Dominance Slips: Is the King of Crypto Losing Its Crown?

This isn’t the first time Bitcoin’s dominance has wobbled altcoin booms in 2017 and 2021 saw similar dips, fueled by ICO mania and DeFi fever but the context here is unprecedented. A government stockpile isn’t fleeting market hype; it’s institutional validation of crypto’s diversity, a move that legitimizes rivals in a way speculative bubbles never could. Analysts see it as a double-edged sword. On one hand, Bitcoin’s brand remains unmatched, its scarcity and battle-tested security still drawing diehard holders and institutional whales. On the other, altcoins like Solana, with its lightning-fast transactions, and Cardano, with its sustainability cred, offer features BTC can’t replicate. XRP’s payment niche could siphon practical use cases, further eroding Bitcoin’s monopoly on real-world relevance.

The numbers paint a stark picture: as altcoin market caps ballooned overnight, Bitcoin’s slice of the $2 trillion-plus crypto pie shrank noticeably. Some investors cheered the shift diversification could stabilize the market long-term, smoothing out BTC’s wild volatility. Others fretted that its mystique, built on being the crypto, might fade if it’s reduced to just another asset in a government vault. “Bitcoin isn’t dead, but it’s not special anymore,” one X user lamented, capturing a sentiment that’s gaining traction among purists.

Does this spell the end of Bitcoin’s reign? Hardly. Its price surge shows resilience, and its cultural cachet forged through a decade of headlines and HODL memes endures. But the crown is tilting. The reserve could lock in billions of BTC, shrinking circulable supply and propping up value, yet it simultaneously elevates rivals to new heights. If altcoins sustain this momentum fueled by policy, not just hype, BTC might settle into a first-among-equals role rather than an unchallenged monarch.

March 3rd, 2025, may be remembered as the day BTC’s dominance became a relic of the past, a milestone etched not in its defeat, but in its dilution. The king isn’t dethroned yet, but the court just got a lot more crowded, and the jostling for power is only beginning.

The crypto market is always fluctuating, don’t forget to follow MevX so you don’t miss important information.

Share on Social Media: