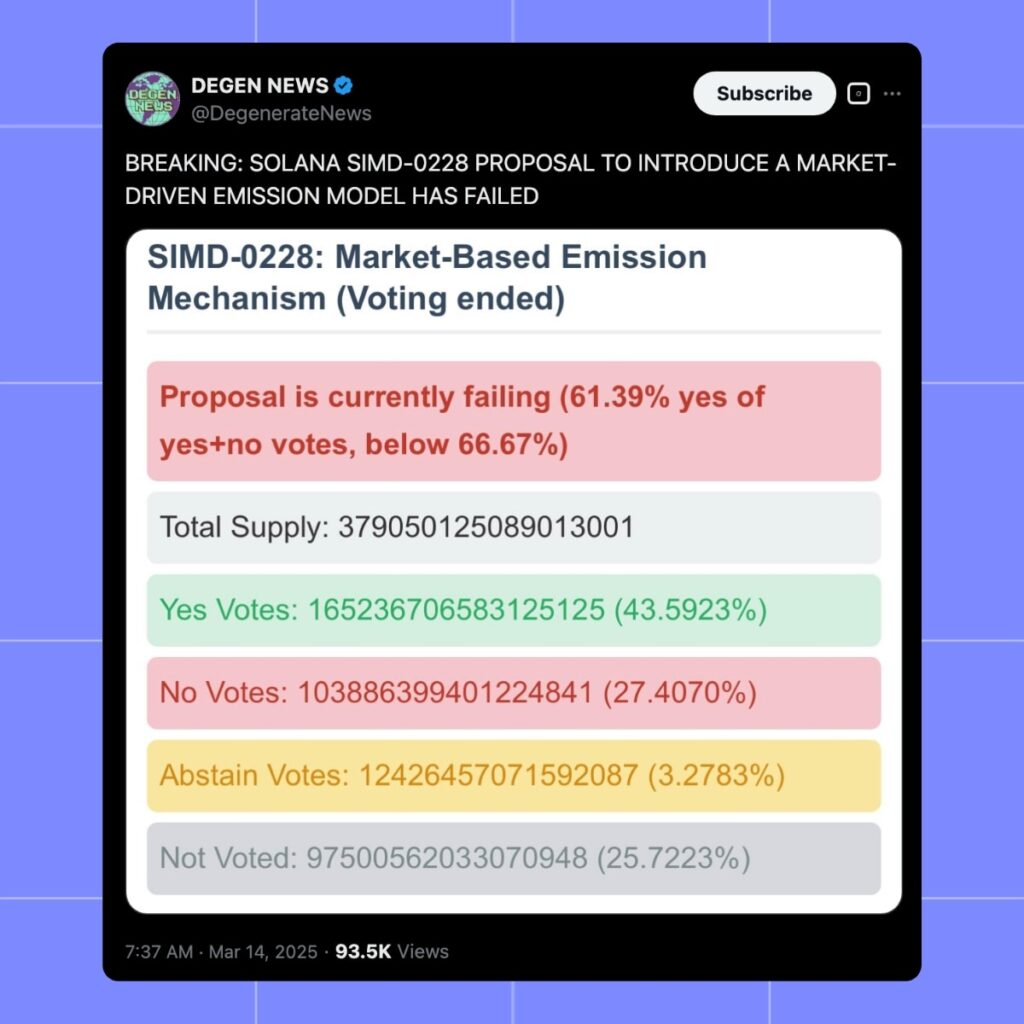

The Solana inflation reduction proposal on March 14, 2025, as proposed in SIMD-0228, failed in a governance vote. This means Solana’s existing annual inflation rate of 4.7% remains in place. It would have reduced it to 0.87%, a drastic reduction that would have transformed the blockchain economy. Failing to achieve the majority support needed means fractures in the Solana ecosystem and leaves the network questioning in what direction it will proceed in the future. Here, we dissect the proposal, the vote result, and what this means for Solana.

Details of the Solana Inflation Reduction Proposal

Solana is a significant layer-1 blockchain with fast transactions and low costs. It competes with Ethereum in supporting decentralized finance (DeFi) applications and non-fungible token (NFT) marketplaces. It differs from other proof-of-stake (PoS) blockchains in the market due to its 4.7% rate of inflation. In comparison, Ethereum’s rate is at approximately 1% following its shift to PoS. Solana’s rate is higher, such that more SOL tokens are introduced into the system to reward validators and stakers but also to expand the total in the system.

The SIMD-0228 proposal, supported by investors including Multicoin Capital, proposed dropping this rate to 0.87% over approximately 100 days. This would have reduced the annual issuance of new SOL tokens and eliminated the approximated $3 billion in sell pressure caused by inflation. Some 65% of SOL tokens are staked now and support the network. At this participation level supporting security with less reward, supporters believed this reduction in inflation rate would make SOL scarce and potentially valuable and desirable to investors concerned with dilution.

The inflation reduction proposal also intended to redefine Solana’s economic direction. By capping staking rewards, it could push users into DeFi and other on-chain behavior rather than holding tokens passively. This was in an effort to make Solana an Ethereum-like blockchain in tokenomics in order to be more prestigious in the cryptocurrency space.

The Governance Vote and Its Outcome

Solana operates a governance mechanism in which the validators operating the network vote on propositions like SIMD-0228. The proposition failed to achieve the consent needed, and the specific numbers to vote were not disclosed. This means there wasn’t a consensus on the proposed adjustment by validators. Some likely wanted to maintain the current rate as it rewards network security better. Solana itself had, at some point, technology issues like outages, and rewarding validators is what most prefer.

Smaller stakers and validators may have been against the reduction. Reducing to 0.87% may have eaten into their margins and favored larger validators with larger resources. This tension between keeping the network decentralized and adjusting incentive structures likely decided the vote. The outcome keeps the existing structure of inflation in place, at least temporarily.

Impact on Solana’s Ecosystem

With SIMD-0228 denied, Solana’s inflation rate remains at 4.7%. The option maintains staking rewards elevated at over 36 million SOL staked. It benefits small validators and stakers as it provides constant income. It keeps creating fresh tokens nevertheless, and this will reduce SOL’s price if demand does not match the production of supplies. Solana’s ecosystem demonstrated positive movement at $113 billion in DEX volume in the past month, beating Ethereum at $78.9 billion. Maintaining this growth will contribute significantly to mitigating inflationary effects.

The static rate could hurt Solana’s appeal to some investors. Less inflationary and deflationary blockchain frameworks, including Bitcoin, have attracted institutional investors in the shape of exchange-traded funds (ETFs). Solana’s increased inflation could make it less attractive in this regard. Loss in the vote illustrates the community prefers validator support over near-future economic adjustments but leaves unanswered the sustainability issues of the long term.

Future Considerations for Solana

The rejection of SIMD-0228 does not end discussions about Solana’s inflation. The community has adapted to challenges before, such as network upgrades and recovery from the FTX collapse in 2022. New proposals could emerge to address inflation more gradually. For example, Multicoin Capital previously suggested a system where inflation adjusts based on staking levels, offering a middle ground. Such ideas might gain traction if framed to balance validator needs with economic goals.

Solana could also mitigate inflation concerns through technological improvements. The recent SIMD-0215 update, introducing the “Accounts Lattice Hash,” aims to enhance network efficiency. Lower operating costs for validators could reduce reliance on high rewards, indirectly addressing economic pressures. For now, the ecosystem continues to operate under its current model, with stakeholders watching how inflation impacts growth.

Conclusion

As of March 14th, 2025, Solana holds its inflation rate at 4.7% due to its failure to pass SIMD-0228. This result reflects the community preference for validator support over token reduction in issuance. While this stabilizes stakers as much as possible, it keeps on fueling the issues of growth in the supply. Solana remains a leading blockchain, but its economics will remain an issue as it ages.

Find more articles about Solana on the MevX Blog!

Share on Social Media: