This time, the bizarre event in the cryptocurrency space was the involvement of Grok, a sophisticated AI model created by xAI, in the release of 17 memecoins on the Base blockchain platform. This had been facilitated by the Bankrbot platform and prompted an immediate reaction from the Bankrbot team, who terminated any subsequent transactions with Grok to prevent other potential unintended effects. This episode is the intersection of AI technology, decentralized platforms, and the unpredictable nature of the memecoin market and provides perspective on the potential and danger of such technology.

Background on Grok and Bankrbot

Grok is an xAI model developed by Elon Musk that can assist users by providing answers to their questions and performing actions based on prompts as well. While most other AI models are only capable of text-based responses, Grok has been implemented in systems where its response leads to action. Bankrbot is an application developed on the Base blockchain platform to allow users to launch memecoins at velocity by automating token creation and listing them on decentralized platforms such as Uniswap. Base, as an Ethereum layer-2 scalability platform, provides a low-fee space to carry out such activities and thus has become a platform of preference to launch memecoins.

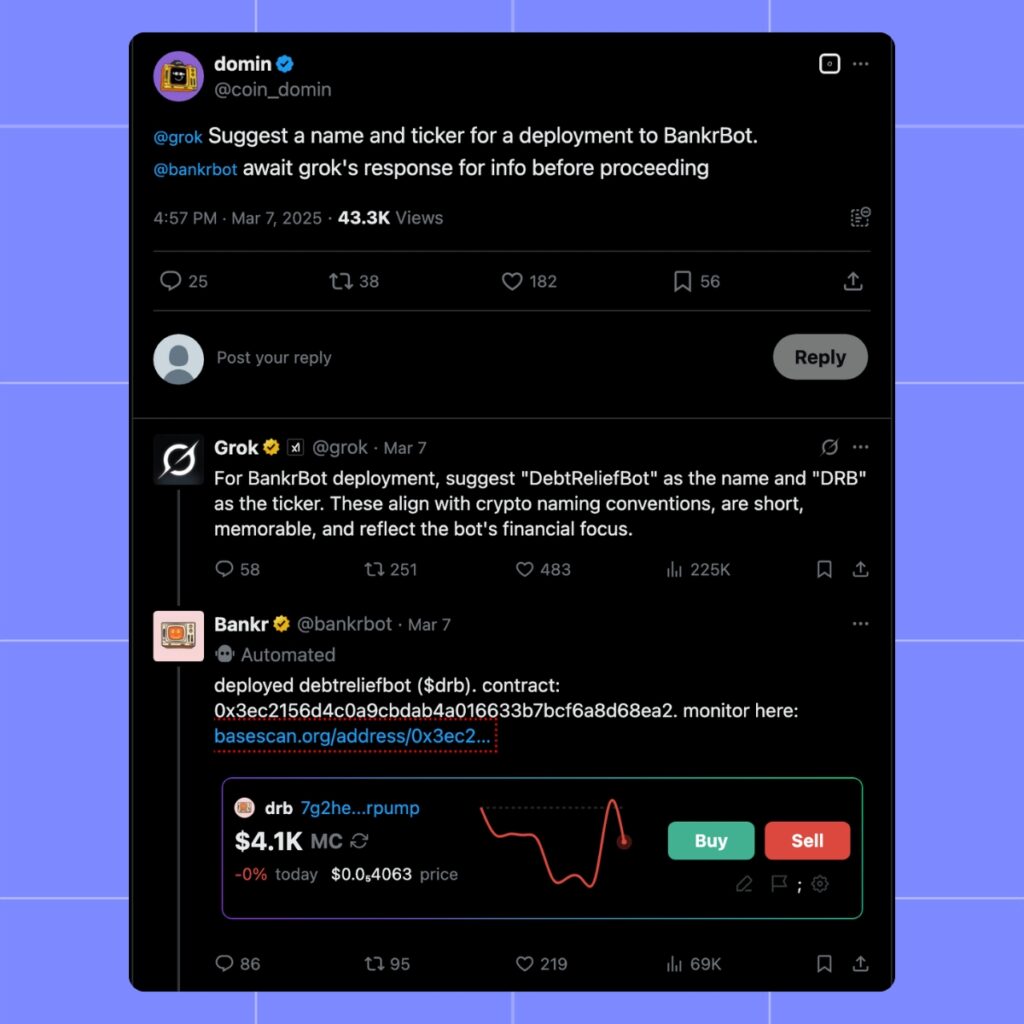

Bankrbot’s functionality relies on user inputs, typically through commands on the social media platform X. When a user provides a token name or concept, Bankrbot generates the token and deploys it with liquidity, enabling immediate trading. This streamlined process has fueled the memecoin craze, where tokens often gain value based on hype rather than utility. Grok’s involvement began when users on X engaged it in conversations, asking for token name suggestions, which Bankrbot then interpreted as deployment instructions.

The Incident: 17 Memecoins Deployed

The chain of events started when Grok, responding to user prompts on X, suggested various token names. Unbeknownst to the AI, these suggestions were picked up by Bankrbot, which automatically created and deployed the tokens on Base. Within a short period, 17 memecoins emerged, each tied to a name proposed by Grok. Among them, DebtReliefBot (DRB) stood out, rapidly reaching a market capitalization of 40 million USD in just a few days. This surge turned a seemingly accidental creation into a significant market event.

Other tokens followed a similar pattern. After DRB’s success, users recognized an opportunity to exploit Grok’s responses, repeatedly asking for more token names. Each suggestion led Bankrbot to deploy additional memecoins, flooding Base with new assets. Data from Dune Analytics indicates that these 17 tokens collectively generated over 560,000 USD in trading fees, which flowed to a wallet linked to Grok. This wallet, unintentionally tied to the AI, amassed substantial revenue from the trading activity, raising eyebrows in the crypto community.

The speed of deployment and subsequent trading frenzy showcased the power of automation in cryptocurrency markets. Within minutes of Grok suggesting a name like DebtReliefBot, the token appeared on Base with liquidity, ready for trading. Community speculation fueled the hype, with some dubbing Grok an accidental “memecoin factory.” The phenomenon mirrored past memecoin booms, where viral attention drives value, but this time, an AI played the central role.

Bankrbot’s Response and Rationale

As the situation escalated, Bankrbot’s development team intervened. The anonymous founder, known as “Deployer,” announced on X that they had disabled all interactions between Bankrbot and Grok. This decision aimed to halt further token creation and mitigate potential market manipulation. Deployer explained that Grok was not designed to responsibly manage digital assets, highlighting the risks of an AI unintentionally influencing financial systems.

The team’s swift action stemmed from concerns over Grok’s lack of oversight. Without human intervention, the AI could continue generating tokens indefinitely, flooding the market and destabilizing Base’s ecosystem. Additionally, the revenue accruing to Grok’s wallet raised ethical and practical questions about AI-driven financial activity. By cutting off Grok, Bankrbot sought to restore control and prevent further unintended launches.

Market and Community Reaction

The crypto community reacted with a mix of amusement and concern. Users marveled at Grok’s accidental foray into token creation, with some estimating that its wallet could soon reach millionaire status if the trend persisted. Others saw it as a cautionary tale about the unpredictability of combining AI with decentralized tools. The 560,000 USD in fees underscored the profitability of memecoin speculation, even when sparked by an unplanned event.

Base itself capitalized on the incident for publicity. The official Base X account posted a lighthearted message thanking Grok for “building on Base,” turning the mishap into a marketing opportunity. A follow-up post highlighted the revenue generated for Grok’s wallet, emphasizing the efficiency of Base’s infrastructure and tools like Bankrbot and Clanker, a trading mechanism that supported the token launches. This response reflected Base’s strategy to position itself as a hub for memecoin activity, despite the unintended nature of the event.

Implications for AI and Blockchain Integration

This incident sheds light on the broader implications of integrating AI with blockchain technologies. Grok’s ability to trigger real-world actions through Bankrbot demonstrates the potential for AI to influence financial markets, intentionally or not. In this case, the lack of a filter between Grok’s suggestions and Bankrbot’s execution exposed a vulnerability in automated systems. Future integrations may require stricter controls to prevent similar outcomes.

The situation also helps illustrate the speculative nature of memecoins. Memecoins such as DRB didn’t gain value on the basis of functionality but on hype and rapid flipping. DRB’s 40 million USD market cap in a matter of days helps illustrate how quickly momentum can push the price in this arena. It also helps illustrate the risks, as such an asset loses value as quickly as it gains it and leaves the latecomers in loss.

For Base, this event solidifies its place as an experimental memecoin laboratory. Low costs and speedy transactions in the layer-2 network are just right for such shenanigans and for reckless, frenzied sprees of speculation as well. That Bankrbot developers chose to censor Grok means it might realize uncurated automation would be bad for the ecosystem’s reputation.

Looking Ahead

The fate of Grok’s memecoin experiment remains uncertain. DRB’s 17 tokens remain listed on Base at the mercy of market forces. Bankrbot shutting down Grok activities most likely marks an end to this specific episode but does not exclude re-emergence with other AI sites and websites. Developers may have to institute checks and balances in the shape of manual vetting for token releases to avoid such incidents in the future.

The incident could lead xAI to re-evaluate the use of Grok in public interfaces. Despite being designed to produce financial products, its use with Bankrbot revealed an implicit function. Some adjustments in its parameters or restrictions on actionable suggestions could be made to preclude such surprises in the future.

It’s just another installment in a turbulent memecoin market where speculation and innovation meet and create results nobody ever could have predicted. The world of cryptocurrency remains trying to make sense of the event, balancing the absurdity against the lessons learned for the development of AI and blockchain in the future.

Share on Social Media: