The daily market recap shows stability in majors, and new projects stole the spotlight. Let’s have a look:

Daily recap – Market Movements

- Bitcoin (BTC): Hovering around ~$85,000 with minimal volatility. Spot Bitcoin ETFs in the US saw $169.9M in net outflows, signaling cautious investor sentiment. BTC’s market dominance dipped slightly to 62.92%.

- Ethereum (ETH): Steady at ~$1,600, mirroring the broader market’s calm.

- Market Volume: Total trading volume reached ~$51.2B (down 26.03%), with 90.88% from stablecoins and 9.84% from DeFi.

- Standout Performers:

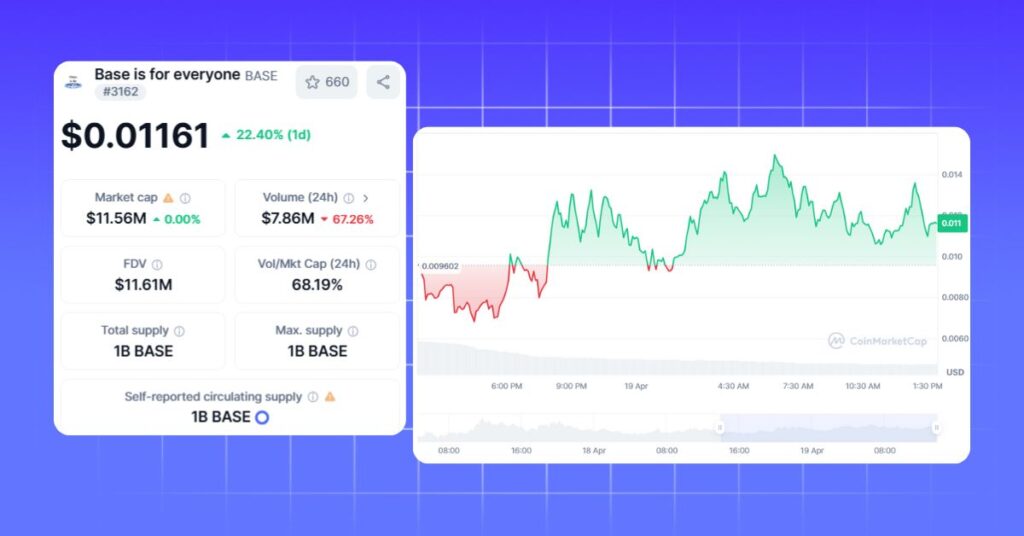

- Meme coin “Base is for everyone” hit a $20M market cap, sparking community buzz.

- Trending coins on CoinGecko: Sonic SVM (+12.2%), Hyperliquid (-15.1%), ai16z (-17.3%).

- Pi surged from $0.5-0.6 to ~$0.78, drawing significant attention.

Daily market recap – What’s Trending

The X platform remains a pulse for crypto sentiment:

- Panama Embraces Crypto: Panama City now accepts Bitcoin, Ethereum, USDC, and USDT for taxes, public transport, and services, a major milestone for mainstream adoption.

- Meme Coins & New Projects: Posts about meme coins and Binance’s new Launchpool project Initia ($INIT) are gaining traction, reflecting short-term speculative interest.

- Macro Concerns: Discussions around US-China trade tensions and the Fed’s reluctance to cut rates highlight their impact on crypto sentiment.

Top News

- Binance Launches Initia ($INIT): The 68th Launchpool project debuted, poised to drive short-term market excitement.

- Solana’s DEX Surge: Trading volume on Solana-based decentralized exchanges spiked, bolstering SOL’s position among top altcoins.

- Macro Pressures:

- US-China Trade Tariffs: Trump’s new tariff policies briefly pushed BTC down to ~$84,000.

- Fed Policy: Fed Chair Jerome Powell’s stance on delaying rate cuts weighed on risk assets like crypto.

- Gold vs. Crypto: JPMorgan noted inflows into gold as a safe haven, while Bitcoin ETFs faced outflows, signaling competition amid uncertainty.

Stay tuned to the MevX blog for the latest opportunities.

Share on Social Media: