Total Value Locked (TVL) is an indicator for funds staked or locked in DeFi on a chain overall and is an important indicator for measuring adoption rate and health for a chain. In this article, we look at Solana’s and Ethereum’s TVL, two of the most prominent DeFi chains, to try to find shifting dynamics for DeFi. Comparing now to one year ago, we highlight Solana’s rising market share as Ethereum’s declining dominance with an explanation for why money is moving to Solana due to higher yields, more speed, and lower fee.

Solana And Ethereum TVL Analysis

Current Solana and Ethereum TVL

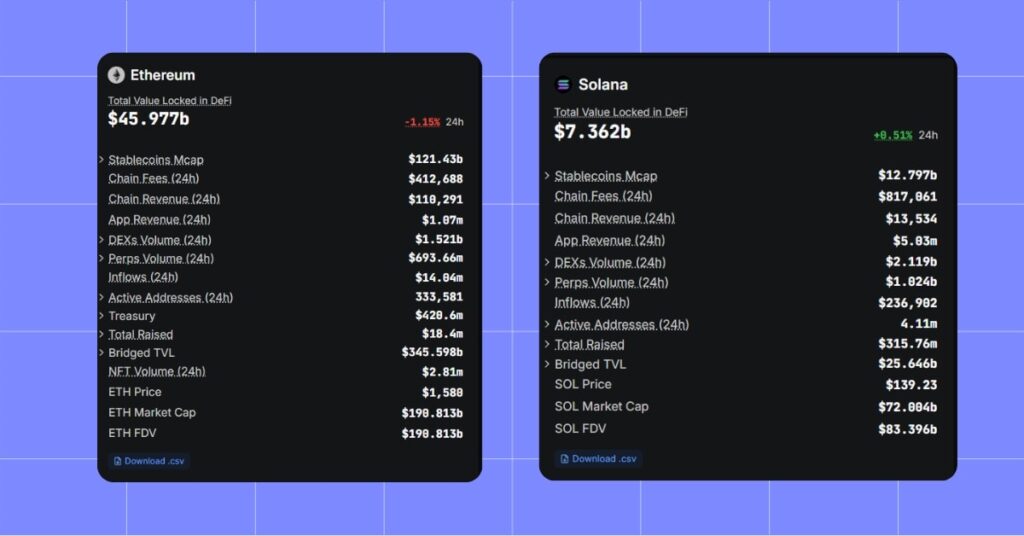

Ethereum TVL is at $45.977 billion as of 22 April 2025, compared to that for Solana at $7.362 billion. Ethereum dwarfs Solana in absolute terms, but the rapid appreciation in value for Solana makes it a serious contender in DeFi.

Comparison with Last Year

One year ago, on April 21, 2024, TVL on Ethereum was at $54.133 billion, compared to $3.931 billion on Solana. In one year, TVL on Solana increased by 85.4% to $7.288 billion, while TVL on Ethereum fell 15.4% to $45.812 billion. The gap is indicative of an extreme shift in allocations, with Solana having reported huge inflows while Ethereum reported outflows.

Market Share Dynamics

In April 2024, DeFi’s total TVL stood at $85.227 billion, 63.5% belonging to Ethereum and 4.6% to Solana. In April 2025, DeFi’s overall TVL is at $89.591 billion, 51.1% in dominance by Ethereum and 8.1% by Solana. This shift, wherein Ethereum lost 12.4 percentage points but Solana picked up 3.5, reflects the increased influence of Solana as Ethereum’s dominance is diminishing in DeFi.

Why Capital Is Flowing to Solana

Several reasons exist for why capital flows to Solana:

Higher Yields on Solana

DeFi investors are driven by yield opportunity. Yield-based protocols such as Jito offer compelling annual percentage rates, with staking on JitoSOL yielding about 7.27%. This is contrasted with staking offered by Ethereum, for example, on Lido at about 2.9% after fees. Additional yield on Solana offers an attraction for those investors looking for yield.

Faster Transaction Speeds

Solana is built for high performance with 65,000 transactions per second in an ideal environment. Ethereum’s 15-30 top transactions per second cannot match that kind of performance. DeFi application performance will be enhanced by Solana’s performance, particularly for high-frequency use cases such as decentralized exchange trades or yield farming.

Lower Transaction Fees

Solana’s fees are very low, averaging just $0.00025 per transaction. Ethereum fees vary from a few dollars to dozens of dollars, depending on network demand. Solana’s fees have low friction for users as well as for builders, which leads to increased on-chain usage and adoption in DeFi projects.

Implications of TVL Trends

The TVL trends reflect massive alterations in DeFi. The rapid growth in Solana reflects competition to Ethereum’s years-long dominance. That growth reflects diversified DeFi with multiple blockchains competing for users and funds and therefore innovating. The declining market share for Ethereum reflects that it must address the scalability and fee challenges in order to remain competitive despite its maturity and a strong ecosystem.

Conclusion

Solana’s TVL has soared by 85.4% from $3.931 billion to $7.362 billion in a year, while Ethereum’s TVL has fallen 15.4% from $54.133 billion to $45.977 billion. Solana’s market share has grown from 4.6% to 8.1%, while Ethereum’s has dropped from 63.5% to 51.1%. Higher yields, higher speed of transactions, and reduced fees are all propelling Solana’s rise, and it’s now a serious contender to Ethereum. Ethereum is bigger and more prominent at present, but Solana’s trajectory means that it will keep dictating DeFi’s face if it can stay in front. The war between these chains will define decentralized finance’s future.

Share on Social Media: