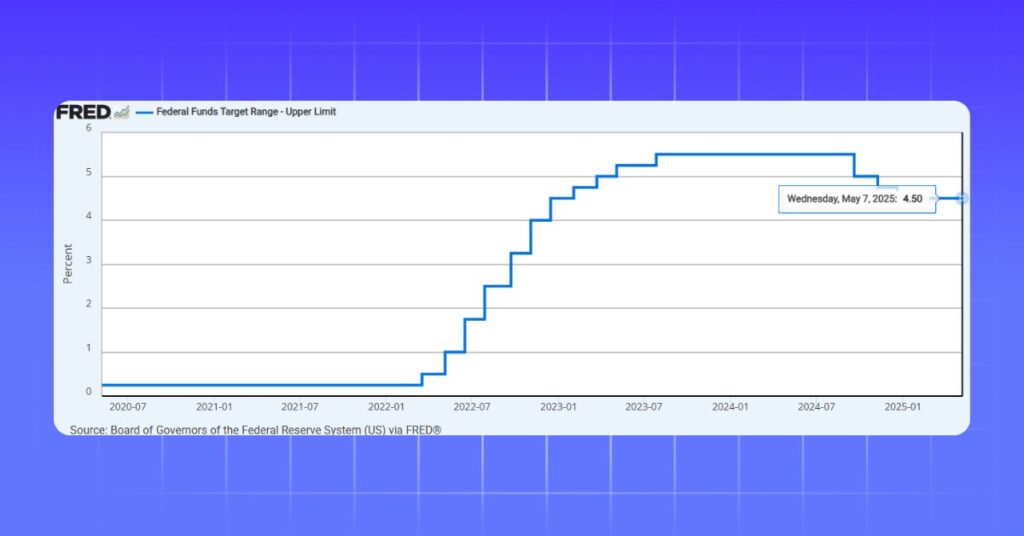

On May 8, 2025, the U.S. Federal Reserve maintains interest rates at 4.25%–4.5%, aligning with market expectations. The Fed’s cautious stance was driven by balanced risks to its employment and inflation goals.

Federal Reserve Maintains Interest Rates

- Revised 2025 projections anticipate only two 25-basis-point rate cuts, down from four.

- The inflation forecast for 2025 increased to 2.5% from 2.3%.

- Fed Chairman Jerome Powell emphasized data-dependent rate decisions, citing persistent inflation and a strong economy.

Bitcoin Surpasses $99,000

Bitcoin’s price initially dipped to $96,800 as investors took profits after reaching $108,268 earlier in December. However, it quickly rebounded, surpassing $99,000 within hours, driven by:

- Optimism around a pro-crypto Trump administration, with reports of a potential executive order for a strategic Bitcoin reserve.

- Growing institutional adoption, such as MicroStrategy’s inclusion in the Nasdaq 100.

The broader crypto market also rallied:

- Ethereum rose 4.5% to $3,800.

- Total market capitalization reached $3.53 trillion.

Analysts remain bullish, projecting that Bitcoin could hit $120,000 by early 2025, supported by:

- Favorable crypto policies under the Trump administration.

- Increasing mainstream acceptance of cryptocurrencies.

However, uncertainties persist:

- Trump’s proposed tariffs could drive inflation, potentially influencing future Fed rate decisions.

- Such macroeconomic shifts may introduce volatility to crypto markets.

Despite short-term fluctuations, Bitcoin’s resilience and the market’s positive sentiment underscore its growing role in the financial landscape.

Don’t miss the latest, follow MevX for nonstop updates!

Share on Social Media: