TLDR:

- James Wynn’s Loss: James Wynn, a prominent high-leverage crypto trader, lost $60 million over seven days, dropping from a peak of $87 million to $25 million, before deciding to stop trading. His return with a x10 leveraged Pepe position worth $10 million indirectly boosted Moonpig.

- Moonpig’s Rollercoaster: Moonpig ($MOONPIG) fell from its ATH of $125.7 million to $45.78 million after Wynn’s departure but was able to recover to $92 million upon his return to trading.

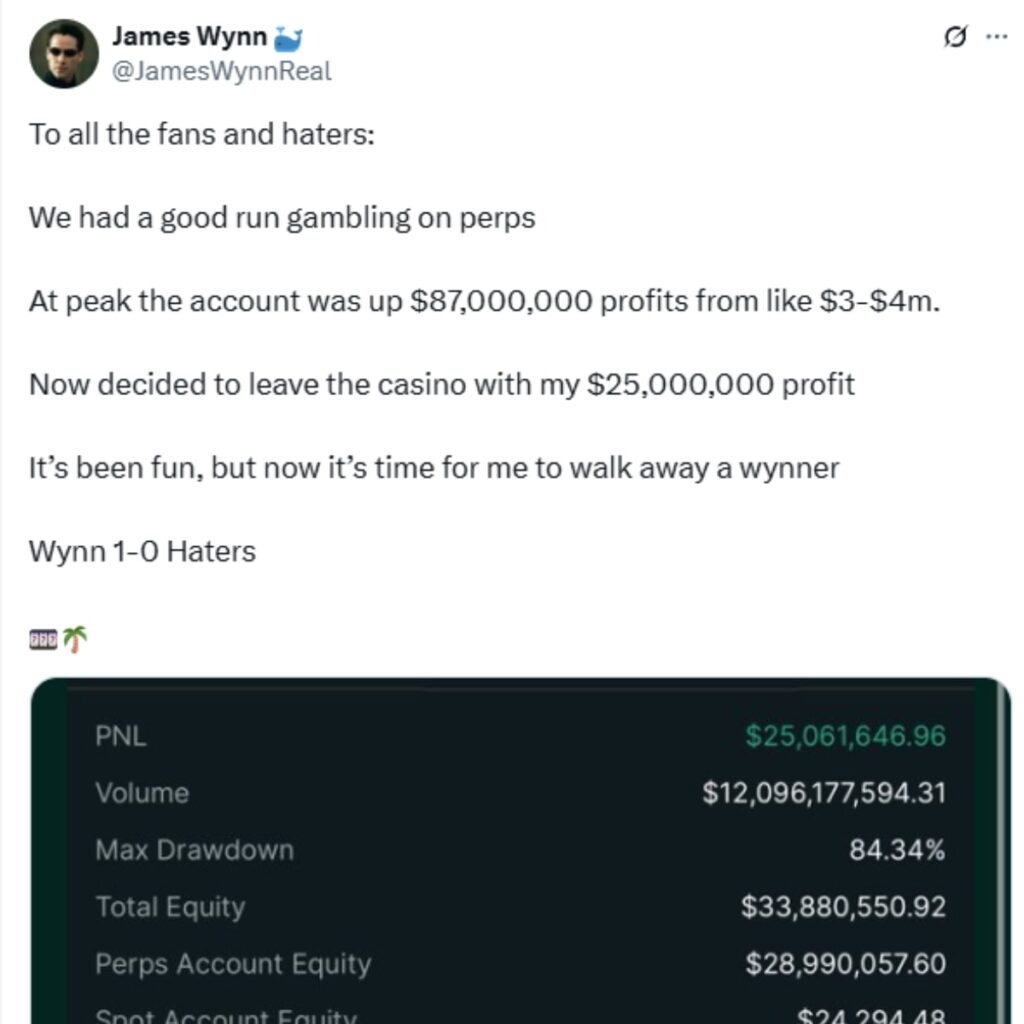

Moonpig token trader James Wynn experienced one of his trading career’s worst losses recently worth $60 million. The record fall occurred after reaching a peak of $87 million that earlier left him with a balance of $25 million after he chose to end trading. However, his influence on Moonpig ($MOONPIG), a token he was touting plenty, has been enormous when it comes to its market value.

Moonpig, which had soared to an all-time high (ATH) of $125.7 million, plummeted to $45.78 million following Wynn’s decision to stop trading. This sharp decline reflected the loss of confidence among investors who had tied their faith to Wynn’s promotional efforts. His departure directly caused the token to fall because his presence created a gap in the story that once drove Moonpig’s value.

Despite the disadvantage, Wynn’s market entry yesterday with a x10 leveraged Pepe holding of $10 million (1 million margin) rekindled momentum in Moonpig. The activity was not Moonpig-specific, yet it indirectly pushed the value of the token to $92 million. The rebound serves to demonstrate speculation of meme coins and the disproportionate power whales like Wynn have over community assets.

Visit $MOONPIG on MevX to see the details.

His spate of poor trading on his Hyperliquid high-margin Bitcoin and altcoin holdings started with a $15.87 million loss from closing out a short $1 billion BTC position on 26 May. He had opened the 40x 5,520 BTC long at $103,302 on 19 May, which he increased to over $1 billion by 21 May. These solidly profitable-looking trades ultimately proved to lead to a $60 million drawdown that encompassed losses on Ethereum and Sui positions.

Wynn’s partial comeback with the Pepe play reflects a readiness to re-enter the market, if cautiously. The play not just revived his own trading but also spurred a ripple to Moonpig to demonstrate how personal trading tactics and market holdings within the world of crypto are connected. The token’s recovery from $45.78 million to $92 million reflects the volatile but opportunistic meme coin space where narrative and trader influence can switch market conditions instantaneously.

Read more meme coin narratives on the MevX Blog!

Share on Social Media: