The week of June 9 to 15 brought plenty of movement in the crypto markets, especially in the memecoin sector. While Bitcoin held steady between $100,000 and $105,000, traders shifted their attention to faster-moving plays in the form of community-driven tokens. On platforms like Solana and Sui, newer names drew strong volume and social media buzz, with themes ranging from pop culture to sarcastic branding and experimental tools.

Meme Coin Weekly Recap: June 9 – 15, 2025

The week from June 9 to 15 was a clear reminder that narratives drive momentum. From nostalgic branding to ironic token names, memecoins continued to shape a unique corner of the market.

Pchu ($PCHU) Brings Pokémon Nostalgia to Sui

Pchu, a Pikachu-inspired token on the Sui blockchain, climbed 50 percent and reached a $20 million market cap by June 13. Much of the excitement came from its connection to a beloved childhood icon. On X, users shared memes and visuals that quickly gained traction. With $5 million in daily volume, Pchu stood out as one of Sui’s most successful memecoin stories to date.

Bad Bunny ($BUNNY) Surfs the TikTok Trend

$BUNNY rode a wave of TikTok videos that referenced Puerto Rican superstar Bad Bunny. The token rose 40 percent over the week and hit a $25 million market cap. It also pulled in $6 million in trading volume. This growth reflects how quickly tokens tied to pop culture can find footing if community interest lines up.

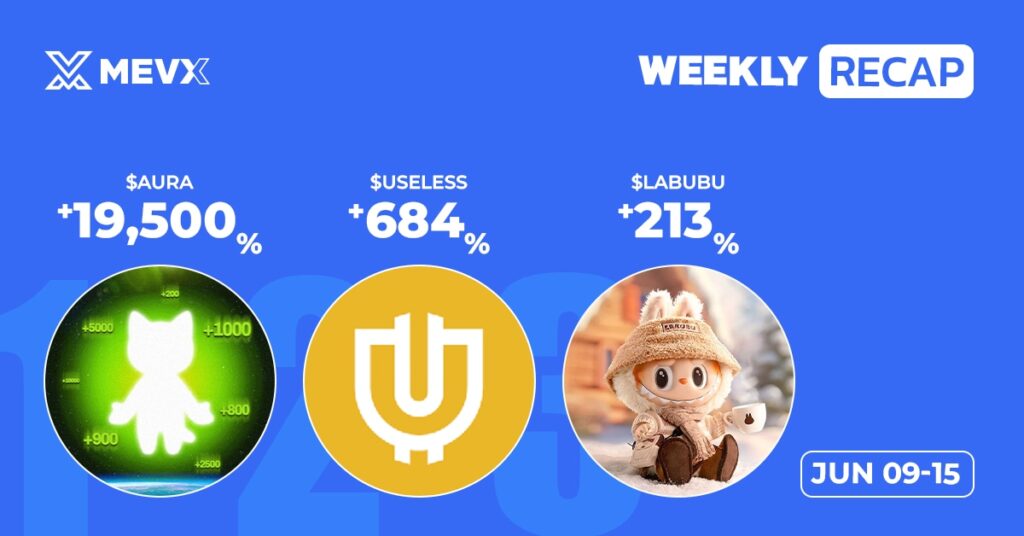

Useless Coin ($USELESS) Delivers the Opposite of Its Name

On Solana, Useless pushed to an all-time high of $48.77 million after gaining 30 percent for the week. Despite the name, the project attracted serious attention. Community campaigns on Launchgram helped boost awareness, and with $8 million in daily trading volume, it showed that irony still plays well in the memecoin space.

Sui-Based Tokens Continue to Impress

Several other Sui tokens had a strong week:

- Clam ($CLAM), sometimes called the “silent meme king,” rose 35 percent to a $15 million market cap.

- Fusion ($FUSION), a no-code token powered by AI tools, increased 25 percent to $12 million.

- Lofi ($LOFI), with a chilled yeti-themed aesthetic, gained 20 percent and ended the week at $10 million.

All three benefited from Sui’s growing visibility and improved trading infrastructure.

Culturally Driven Tokens Make Noise

Beyond irony and nostalgia, a handful of tokens drew from broader culture:

- GTA ($GTA), short for Grand Theft America, jumped 45 percent to $18 million. It blended gaming references with political themes and attracted attention fast.

- Costco ($COSTCO), which had lost its creator’s backing, still gained 30 percent and closed the week at $14 million. Retail nostalgia appears to be a strong motivator.

- Aura ($AURA) and its companion platform Aurafarm ($AURAFARM) added 20 percent to reach $9 million. The project merges yield farming mechanics with meme appeal.

Niche and Controversial Plays

Some more niche or controversial projects also had their moment:

- Trump ($TRUMP) fell 10 percent to $9.66 million, partly due to political drama involving its namesake. A large purchase by World Liberty Financial helped reduce further downside.

- We ($WE), inspired by an Elon Musk X poll, surged 60 percent to $22 million with $7 million in daily volume.

- Crybaby ($CRYBB), themed around a casino vibe, rose 15 percent.

- Big Cousin ($BC), a project linked to a profile change by Binance founder CZ, gained 25 percent and hit $11 million.

Other Notable News: June 9 – 15, 2025

While memecoins delivered the headlines, broader market events played a critical role in shaping sentiment.

Bitcoin Holds Steady

Bitcoin traded in a relatively tight range between $100,000 and $105,000. Daily volume hovered between $15 and $18 billion. Though not particularly volatile, this period of consolidation helped maintain a sense of stability in the market. Many traders shifted their focus to memecoins while Bitcoin remained flat.

Conflict Between Israel and Iran Escalates

Tensions in the Middle East escalated significantly. On June 13, Israel launched targeted strikes on Iran’s nuclear and military infrastructure. Iran retaliated with missile strikes on Tel Aviv and Haifa, leading to at least eight deaths in Israel. By June 15, the Iranian death toll reached 224, mostly civilians. Global leaders addressed the situation at the G7 meeting, with many warning of the risks of wider regional conflict. Market uncertainty increased as a result.

Public Clash Between Trump and Musk Affects Tokens

A heated dispute between Donald Trump and Elon Musk spilled into the crypto world. Their disagreement, mainly centered on a government spending bill, caused ripple effects for related memecoins. Combined trading volume for $TRUMP and $WE hit $355 million over the week. The feud became a case study in how real-world drama can impact digital assets.

Pump.fun Raises Eyebrows with $1 Billion Goal

Solana launchpad Pump.fun announced plans to raise $1 billion at a $4 billion valuation. While the announcement confirmed its growing influence, it also triggered concerns about whether the move could absorb liquidity from other memecoins. Opinions were split between those who saw it as a step forward and those who worried it might signal market overheating.

SEC Flags Punisher Coin

The SEC identified Punisher ($SPUN) as an illegal asset due to concerns over unregistered promotions and manipulation tactics. This marked another reminder that regulatory scrutiny remains a constant risk, especially for smaller or rapidly growing tokens with unclear structures.

Sui Ecosystem Expands, But Security Questions Linger

The Sui network continued its momentum, with tokens like $PCHU, $CLAM, and $FUSION gaining strong community support. MevX’s multi-chain integration helped push trading accessibility. However, fallout from the recent Cetus Protocol exploit, along with its $260 million refund plan, kept investor attention focused on platform security.

Speculation Grows Around a Memecoin ETF

Analysts at Bloomberg raised the possibility of a memecoin ETF by 2026. Dogecoin, Bonk, and $TRUMP were among the names expected to be considered. While the news generated excitement, traders on Polymarket dropped the probability of approval to 44 percent. Institutional recognition may be coming, but it’s still not guaranteed.

Final Thoughts

The second week of June showed just how quickly things can shift in the world of memecoins. Projects like Pchu and Useless proved that strong narratives still drive performance. Meanwhile, external developments — including political conflict, regulatory updates, and public spats — shaped risk perception and trading patterns.

With Bitcoin taking a breather, memecoins had room to run. But with growing interest from regulators and institutional players, the stakes are rising. Traders looking to ride the wave should stay nimble, ask the hard questions, and stay informed.

This market rewards speed, creativity, and timing. It also punishes complacency. That’s the memecoin world.

Share on Social Media: