As June draws to a close, the memecoin market has once again proven how quickly narratives can shift and assets can soar or collapse. This past week saw Pokémon-inspired tokens rocket upward, comedy coins make quiet gains, and controversial launches unravel in real time. Meanwhile, global headlines, from U.S. military strikes to surprising moves from the Federal Reserve, created sharp swings in Bitcoin and shaped the emotional temperature of the market.

This recap breaks down the most notable memecoin movements and the larger forces that influenced crypto from June 23 – June 29, 2025.

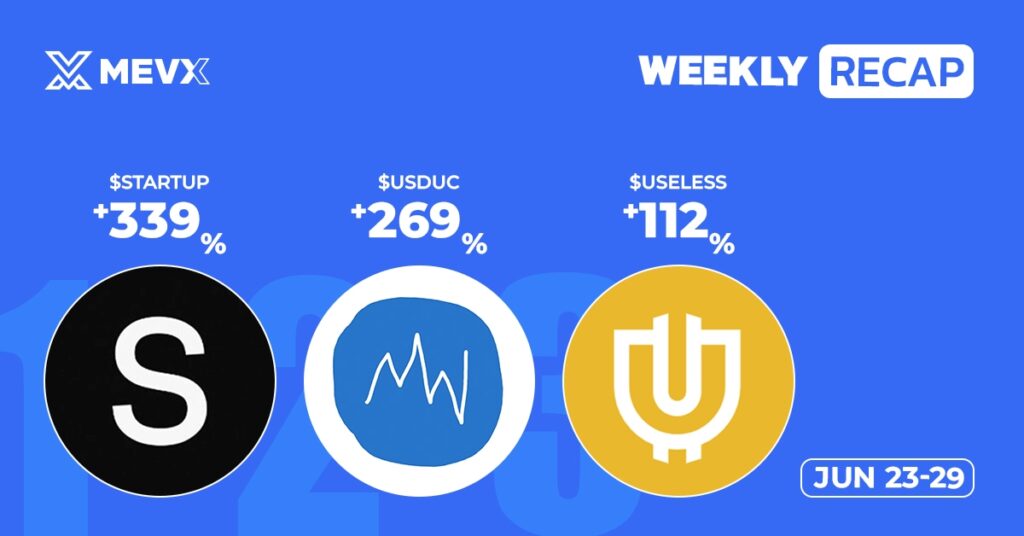

Meme Coin Weekly Recap: June 23 – 29, 2025

June 23 – 29, 2025 was a wild week. Memecoins were the most active part of the market, fueled by trend chasing in the cultural arena, launchpad trading, and speculation related to public figures.

Pikachu ($PIKACHU) Electrifies the Market

Sui-based token Pikachu surged 70% to an $82.33 million market cap on June 28, trading $15 million in daily volume. Pokémon branding and instant community support on X propelled the coin to the top performer in the Sui ecosystem.

Hello Kitty ($KITTY) Reaches New Heights

Hello Kitty jumped 40 percent to an all-time high of $12.7 million. It posted $5 million in trading volume, supported by global brand recognition and strong traction in Solana’s fan bases.

Girlies ($GIRLIES) Gains Momentum via Solana

Girlies, backed by Monkephone, went up 50% to $20 million market cap. Volume was $6 million, with the fantasy nature of the project attracting speculative supporters and the meme crowd.

Zeus ($ZEUS), DMC ($DMC), and Friends Build on Solana and Sui

Zeus, combined with the Furieverse, grew 30 percent to $15 million. Orange cat meme token Gary grew 25 percent to end the week at $10 million. DMC, which features a Web3 DeLorean-themed storyline, grew 35 percent to $12 million on Sui. Solami rose 20 percent to end at $9 million.

AI and Offbeat Tokens Continue to Rise

Acid, an AI-based token on the Solana blockchain, rose 40 percent to $14 million, riding the coattail of tech-savvy investor demand. Six Sigma, the bookie spin on the meme idea, rose 30 percent to $11 million. Fartbook and Chillhouse rose 25 and 20 percent, respectively, to finish the week at $10 million and $8 million.

BUNK and Others Spark Controversy

The Manhattan Project ($BUNK) advanced 60 percent to $18 million before losing 40 percent in pump-and-dump speculation. Digital Oil, backed by Peter Schiff, rose 15 percent to $7 million. Refund Your Sol and Tokabu rose 20 and 15 percent on themes of fee recovery and gaming.

Other Notable News: June 23 – 29, 2025

Key market drivers had an effect on memecoins last week, but macroeconomic decisions, war, and emerging platforms shifted investor sentiments.

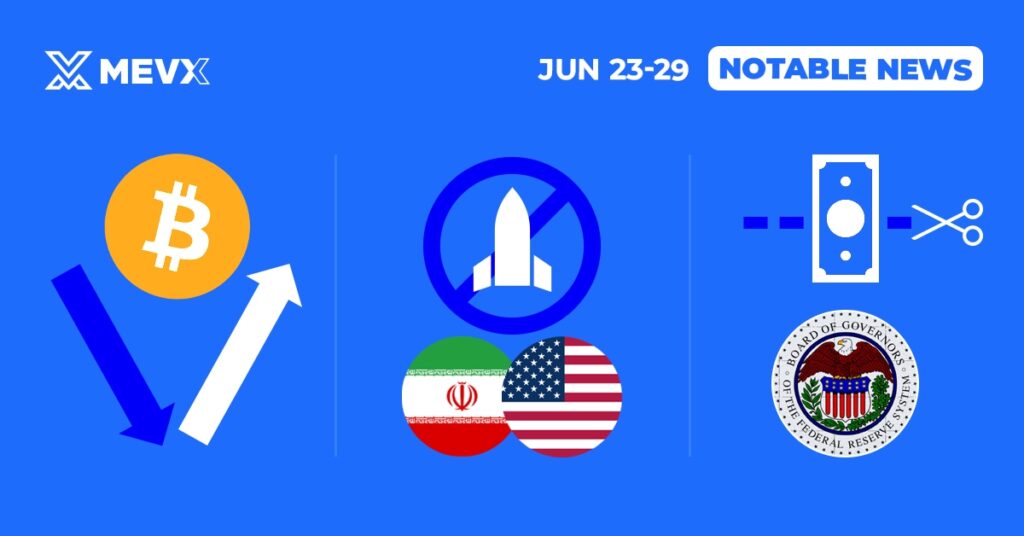

Bitcoin Recovers After Brief Dip

Bitcoin dipped below $99,000 at the beginning of the week, following increased military action. It rallied to $105,000 to $106,000 on 29 June, supported by $15 to $18 billion of day-by-day trade. The sense of optimism returned following signals of monetary easing and political easing.

U.S. Strikes and Ceasefire Shape the Week

US bombers attacked Iranian nuclear sites on June 21, and there were heavy casualties. Iranian retaliation caused Israeli casualties, which increased regional tensions. Donald Trump’s declaration of a June 27 ceasefire, however, reassured markets even though underlying tensions persisted.

Federal Reserve Signals Aggressive Rate Cuts

The new Federal Reserve chair announced plans for a quick rate reduction on June 25. The 10-year Treasury rate fell to 4.25 percent. The policy turn created new risk-on sentiment across digital assets, particularly in altcoins and memecoins.

WLFI’s Public Debut Lifts Market Confidence

World Liberty Financial (WLFI), which is closely affiliated with Trump-associated tokens, listed on June 26. It made the announcement of auditing its stablecoin and releasing a mobile app. Tokens like T1 and BUNK witnessed positive sentiment waves, but concerns regarding transparency remain.

Senate Pushes Bitcoin Reserve Bill Forward

On June 25, the U.S. Senate moved to create a national Bitcoin reserve. The bill, spearheaded by crypto-friendly senators Cynthia Lummis, further legitimized digital assets and breathed life into the larger market.

X Launches a Dedicated Memecoin Trading Platform

X debuted its new trading interface focused on memecoins on June 27. The platform boosted interest in assets like GIRLIES and PIKACHU by making discovery and execution easier. Still, concerns around compliance and security were raised almost immediately.

Conclusion

The final week of June summed up the best and craziest of the memecoin world. Leaders like Pikachu, Hello Kitty, and Girlies proved the power of cultural trends, while BUNK reminded traders of the risks of uncontrolled hype once again. Bitcoin’s run, fueled by macro forces and political rapprochement, created the environment for speculative tokens to take off.

Institutional news like WLFI’s market launch and news of Senate Bitcoin reserves lent validity to the fact that memecoins are no longer a sideshow. Meanwhile, sites like X continue to blur the line between finance and social media. For investors, the opportunity is still present, as is the risk. Vigilance and managing exposure remain the keys to success for the next few weeks.

Share on Social Media: