TLDR:

- Market: On 29 July 2025, the Ethereum Layer 2 blockchain network, Linea, publicly disclosed its tokenomics structure, valued at $0.15-$0.3 per unit of LXP through its forthcoming $LINEA airdrop.

- Narrative: Linea’s deflationary mechanism through the use of ETH as gas and burning 20% of fees in ETH and 80% in $LINEA gives ecosystem development incentives.

On July 29, 2025, Linea, an Ethereum Layer 2 network developed by ConsenSys, released its long-awaited tokenomics framework on 29 July 2025, in long-awaited news as Ethereum celebrated its 10-year jubilee. The framework, explained by Odaily’s chief scribe Asher (@Asher_0210), breaks down the composition of the $LINEA token and the valuation of Linea Experience Points and predicts an estimated $0.15-$0.3 valuation per LXP point of the Token Generation Event (TGE) of Linea, soon set to launch, now delayed beyond the previously anticipated Q1 2025. With 72 billion of combined supply of all tokens of $LINEA tokens on the table and an emphasis on compensating early users, Linea’s framework places it as a serious player within Ethereum’s scaling ecosystem, with impact potentially as far as broader marketplace sentiment within Solana-established meme currencies amid recent marketplace correction.

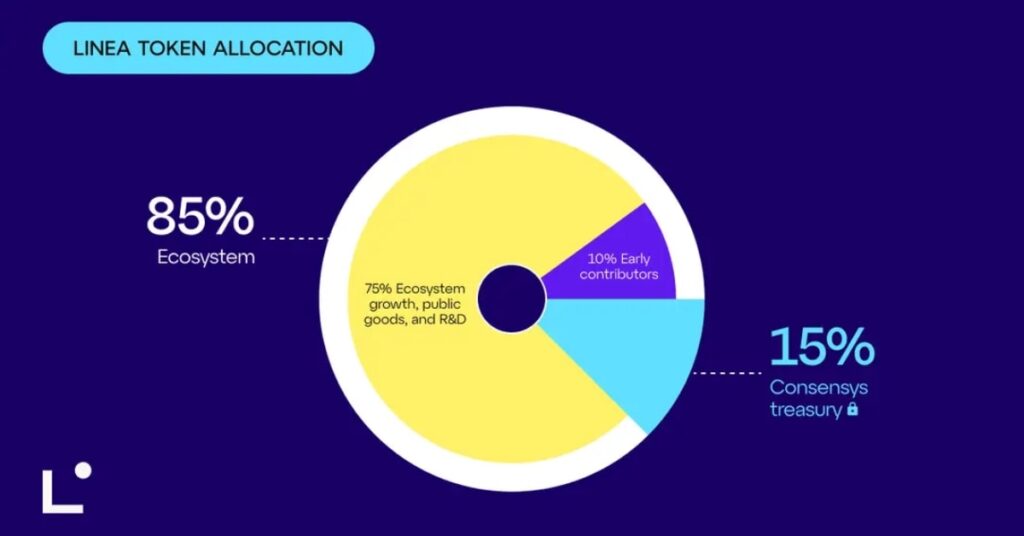

Linea tokenomics prefers building the ecosystem over classical governance. The token is unlike most Layer 2 protocols because it is not a gas token and is not being used for on-chain distribution of governance rights, since the protocol is at present owned by ConsenSys and does not have a DAO. The 72-billion token supply is divided, with 85% being allocated towards the ecosystem, of which 9% (6.48 billion tokens) is set aside for the first users being rewarded with LXP through bridging assets as well as DeFi action, with no lock-up. 1% is set aside for strategic builders, released on TGE as well, while 75% is used for the Ecosystem Fund, managed by the Linea Alliance (which includes members like ENS Labs, Eigen Labs, and ConsenSys). The remaining 15% is set aside for the ConsenSys treasury, locked for five years but can be used in liquidity or staking. About 22% (15.8 billion tokens) of the token supply is expected at TGE, at an estimated initial tokenization capital of anywhere between $600 million and $1 billion, presenting a cost of $LINEA of anywhere between $0.035 and $0.06.

The airdrop targets users with over 1,500 LXP, though addresses with high on-chain activity (transaction volume, wallet age, number of transactions) may also qualify. With around 495,000 addresses holding 1.5 billion LXP, each point is estimated to yield 4.32 $LINEA tokens, translating to $0.15-$0.3 per LXP based on the projected TGE valuation. Linea’s fee structure, burning 20% of L2 gas fees in ETH (after L1 costs) and 80% in $LINEA, creates deflationary pressure to enhance token scarcity. Declan Fox, Linea’s project head, confirmed that snapshots for the airdrop are complete, with sybil filtering ensuring fair distribution, and no CEX listings or asset dilutions are planned, reinforcing a community-focused approach.

Read the latest news on the MevX Blog!

Share on Social Media: