TLDR:

- Market: USDe, from Ethena Labs, no contract available, created an all-time high (ATH) market capitalization of $9.5 billion, and became the world’s third-largest stablecoin when its 24-hour volume rose to around $500 million on August 5, 2025.

- Narrative: USDe’s 75% market cap appreciation since mid-July, fueled by regulatory clarity from the GENIUS Act and a partnership agreement with Anchorage Digital, positions it as a delta-neutral, revenue-generating stablecoin.

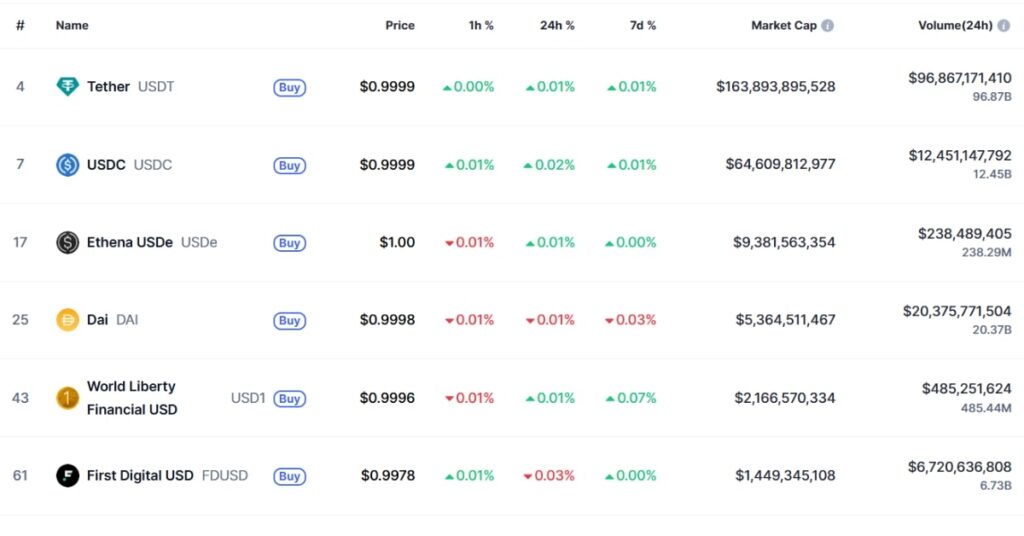

USDe, Ethena Labs’ yield-earning stablecoin, has achieved a historic milestone in reaching a record-high market capitalization of $9.5 billion and ranking third in global stablecoins, after Tether’s USDT ($164 billion) and Circle’s USDC ($63 billion). On August 5, 2025, its 24-hour traded volume was around $500 million, and the protocol’s total value locked (TVL) of Ethena was approximately $9.7 billion, sixth in DeFi. USDe’s 75% market cap growth since approximately mid-July is a milestone for the Solana-compatible stablecoin that debuted in early 2024. Its stratospheric growth, fueled by regulatory tailwinds as well as creative construction, is indicative of its ability to disrupt the stablecoin market map.

Unlike Terra’s UST in 2022, which crashed after it became under-collateralized and algorithmic, USDe follows a delta-neutral approach by mixing on-chain collateral (USDT and BTC) and short positions in perpetual futures on derivatives exchanges to produce a stable $1 peg. Ethena’s diversification of collateral, increased exchange agreements, and third-party audits also stand out in allaying skepticism and building credibility. Stablecoin’s 10-19% APY, from staking and funding rates, beats U.S. Treasury yields and draws retail and institutional buyers. Specifically, sUSDe—the staked USDe—is changing hands at a premium range of $1.08-$1.19, supported by over $5.2 billion in supply, showing strong demand for staking.

USDe follows in behind historical precedents. President Donald Trump signed the GENIUS Act, the first comprehensive U.S. regulatory framework on dollar-backed stablecoins, on July 18, 2025, requiring 1:1 reserve ratios. Ethena took advantage of this clarity, pairing up with Anchorage Digital, a federally regulated custodian, to release USDtb, a stablecoin compliant in terms of the GENIUS Act, earning an initial amount in circulation of $1.5 billion. That activates USDe’s U.S. market transition but maintains its yield-bearing format. Solana’s low-cost, high-performance network powers USDe’s high accessibility, funding its Ethereum-based operation and leading adoption within DeFi protocol applications such as lending and liquidity pools.

At $9.5 billion market cap, USDe remains volatile in step with fiat-backed giants USDT and USDC alike. Its own volume, high as it is, cannot keep pace with USDT’s $152 billion daily trades. Ethena’s 75% TVL growth in just three weeks bespeaks strong ecosystem demand, but in-store risks like volatility of collateral and regulatory vigilance are not far behind, witness German skepticism toward Ethena’s reserve sufficiency. Relative to memecoins like $NUB ($28.87 million market cap) or $WATER ($2 million), USDe’s grand size and utility set it apart. For investors looking for yield-yielding price stability and prospectors seeking Solana DeFi growth, USDe will be a can’t-look-away ride within a stablecoin’s revolutionary potential within an ever-bustling universe.

Read the latest news on the MevX Blog!

Share on Social Media: