Main Takeaways

- This article features the prominent dApps on the TRON network in 2024.

- It also covers the key features of each dApp mentioned.

TRON’s prominent dApps in 2024

Introduction

TRON solidifies its place as one of the best platforms for dApps development with multiple prominent dApps in 2024. These dApps offer various services like decentralized finance, lending, cross-chain swaps, and many more. The purpose of this post is to highlight a few exceptional dApps within the TRON ecosystem in 2024.

1. JustLend DAO

JustLend DAO is the first official decentralized lending platform on the TRON network. This dApp allows users to borrow and supply tokens without the need for any intermediaries. The amount users can borrow depends on the tokens users input in the app as collateral. However, most users use JustLend DAO to supply tokens and earn APY. At the time this article was written, the APY for staking TRX was 9.49%, which is really tempting.

JustLend DAO is TRON’s first official decentralized lending platform

Key Features

Borrowing Service: Users can borrow tokens for many purposes. For example, instead of swapping TRX into USDT, users can lend USDT by using TRX as the collateral. This helps users reduce transaction fees.

Staking Service: Staking, or supplying, on JustLend DAO means users will lend their tokens to the app and earn APY. Then these tokens will be lent to the borrowers of the app.

Competitive Interest Rates: JustLend DAO provides competitive interest rates for both suppliers and borrowers.

Energy Rental: You can rent Energy to process transactions on the TRON blockchain for a more affordable price on JustLend DAO. If you want to learn more about it, you can visit our article on Sending and Receiving TRX.

Updates for 2024

In October 2024, JustLend DAO is lowering the collateral factor of various markets. The collateral factor of the WBTT and USDCOLD markets is expected to be adjusted from 60% to 0%. This makes it more flexible for users to borrow from JustLend DAO.

JustLend has had a wonderful year. At the current time, JusLend DAO has a TVL (total value locked) of $6,01B with 469,055 users.

2. JustStables

JustStables is TRON’s CDP (collateralized debt position), enabling users to mint the USDJ stablecoin by collateralizing their TRX holdings. This design helps users avoid traditional borrowing requirements, providing access to stable assets directly on the blockchain.

JustStables enables users to mint USDJ

Key Features

Community Governance via JST: Holders of the governance token JST can vote on system parameters like risk thresholds, stability fees, and even adjust governance policies, ensuring a community-driven platform. This decentralized approach enables flexibility and user engagement in system decisions.

Stability Mechanism: JustStables maintains its USD peg through automated adjustments. When USDJ falls below $1, the smart contract reduces supply by buying back and burning tokens, and when it is above $1, it mints additional tokens to restore the peg.

Debt Ceiling: JustStables limits the total USDJ users can mint. By capping this issuance, JustStables aims to prevent users from borrowing excessively, which could increase the risk for the system.

Penalty Fees: If an account does not have enough collateral to back up the amount of USDJ they borrowed, that account will suffer penalty fees.

Liquidation Ratio: This ratio sets a threshold for the amount of collateral users must keep depending on the amount they borrowed. If the collateral is below this threshold, the system will solve a part of their collateral to cover the loan.

Updates for 2024

Up to October 24, 2024, the total supply of USDJ is over 129 million, and total TRX collateralization is over 9.97 billion. The current TLV of JustStables is $1.649B.

3. SUN.io

SUN.io combines multiple features from other exchanges into one. It is a dApp with a variety of helpful tools, aiming to provide convenience to users by equipping everything on a single platform.

SUN.io combines multiple features into one platform

Key Features

SunPump: SunPump is a newly released system on SUN.io specifically designed for meme coins. This platform enables users to create and trade meme coins on the TRON network. Unlike other meme coin communities, SunPump provides a review process to reduce the risk of rug pulls and other common scams.

SunSwap: SunSwap is one of the initial applications of blockchain technology on SUN.io. This token-swapping system allows users to exchange various cryptocurrencies. SunSwap utilizes a virtual liquidity model to offer the best possible prices for users. With four different fee tier options, SunSwap supports various swapping strategies and liquidity provision methods. SunSwap V3 is the newest model of this feature.

SunCurve: SunCurve is another swap platform on SUN.io. Similar to SunPump, this platform uses an Automated Market Maker (AMM) model but is focuses on stablecoins. SunCurve supports USDD, USDT, TUSD, and USDC.

PSM (Peg Stability Module): PSM is SUN.io’s peg stability module. This swap tool allows users to trade between USDD and other stablecoins, prioritizing keeping USDD pegged closely to the US dollar, thus reducing slippage risk. Currently, the platform supports all major stablecoins, including USDT and USDC.

Farming: SUN.io protocol is a popular choice for yield farming. Through its farming system, users can temporarily provide tokens to liquidity pools in exchange for higher returns. Those interested in becoming liquidity providers have numerous options on SUN.io, allowing them to choose specific assets and proportions they want to supply.

SUN DAO: SUN DAO is the governance system for the entire SUN.io platform. Users can vote on various proposals and have a say in the future direction of the decentralized exchange (DEX). The DAO determines crucial elements such as earning rates for liquidity pools, ensuring community-driven decision-making.

Updates for 2024

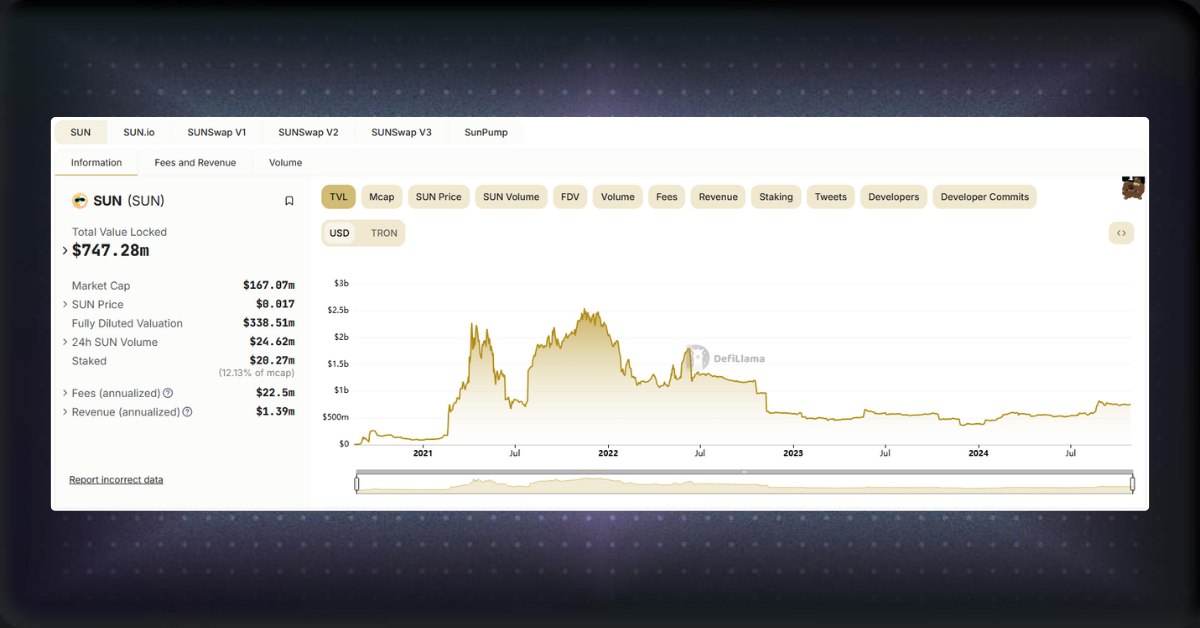

This year, SUN.io has formed multiple important partnerships, such as Coins.xyz and Pionex. With its diverse ecosystem, this dApp has reached a TLV of $747M.

SUN.io’s TVL, according to Defilama

Conclusion

TRON’s ecosystem in 2024 is expanding rapidly, with dApps like JustLend, JustStables, and SUN.io. These platforms not only enhance TRON’s utility but also pave the way for continued growth in its decentralized ecosystem. With further upgrades and developments, these dApps will remain crucial pillars of TRON’s future success.

Disclaimer: The content of this article is provided for informational purposes only and should not be considered investment advice, financial advice, or any other type of professional advice.

Share on Social Media: