This crypto market recap dives into the day’s most notable developments as the cryptocurrency landscape continues to evolve amid macroeconomic shifts.

The total market capitalization hovered around $3.81-3.83 trillion, down slightly by 0.9-1%, influenced heavily by Federal Reserve Chair Jerome Powell’s Jackson Hole speech hinting at potential interest rate cuts in September. This optimism fueled selective gains, particularly in Ethereum, while Bitcoin faced minor dips.

Ethereum Steals the Spotlight in Crypto Market Recap

Ethereum (ETH) emerged as the star performer in today’s crypto market recap, surging nearly 15% to shatter its all-time high (ATH) from 2021, peaking at $4,885 before settling around $4,300-4,800.

This rally was propelled by institutional treasury holdings exceeding 4.1 million ETH (valued at ~$17.6 billion) and JPMorgan’s bullish outlook on ETH outperformance due to staking ETFs, treasury buys, and clearer regulations. The ETH/BTC ratio hit a 2025 peak, underscoring Ethereum’s dominance in this crypto market recap cycle.

Bitcoin’s Volatility and Institutional Moves

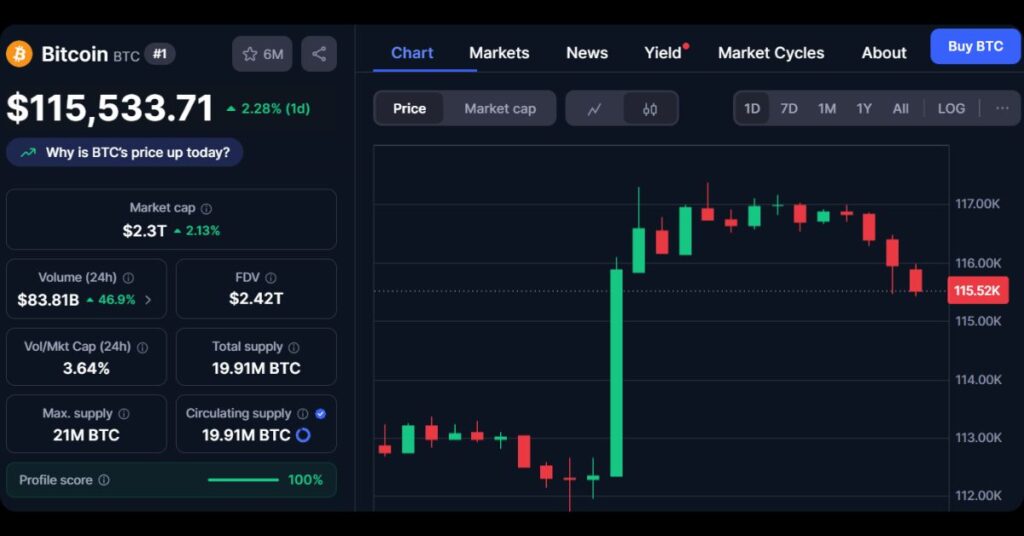

Bitcoin (BTC) experienced a rollercoaster, dipping over 5% weekly to $112,800 before rebounding to ~$113,000 post-Powell. Liquidations totaled $229 million, mostly shorts. Key institutional actions included:

- DDC Enterprise is acquiring 100 BTC (~$11.36 million).

- Ming Shing (Hong Kong) is planning a $483 million BTC purchase.

- Verb Technology is investing $713 million in TON. BTC’s declining volatility signals maturing market dynamics.

Altcoins and Meme Coins: Mixed Bag in Crypto Market Recap

Altcoins showed varied performance:

- XRP rose 3-7% to ~$3 on Fed cues.

- Solana (SOL) gained 3.5%, while Morpho (MORPHO) led with +22% to $1.98.

- Chainlink (LINK) up 8.8%; OKB down 6-7%; BIO surged 57%. Meme coins were volatile: Kanye West’s YZY token pumped to $3.14 billion market cap before crashing 70-75%, causing $50 million losses. Others like TROLL and FARTCOIN trended on Solana.

Meme coin highlights

- $MACHO (Right-Hook Dog): Punchy dog-themed meme coin on Solana with bots compounding profits for a financial independence narrative.

- $JESU (JESUS): Achieved 182x growth from $3.4k to $622k market cap, backed by long-term community holders.

- $TITANIUM (SOL TITANIUM): Satirical metal-strength themed meme coin on Solana focusing on unbreakable community and viral events.

- $LIGT (Light): Surged to over $200 million market cap in one week post-launch on Heaven DEX.

- $HODLess (HODLess Coin): Rocketed 128% in 24 hours, growing from $32k to $731k market cap rapidly.

- $Ben (Dover): Dog-inspired meme coin blending social-fi, game-fi, and memes for engaging the Solana community.

- $TROLL (TROLL): Exploded 800-900% recently, hitting new ATHs with dominant Solana mindshare.

- $BITTY (The Bitcoin Mascot): Witnessed over 500% weekly growth, fueled by strong Twitter hype and BTC mascot appeal.

- $lesgo (dababy): Viral meme coin capturing DaBaby’s “lesgo” catchphrase for energetic Solana market pumps.

- $SSX (Solana Stock Index): Expanded from $40k to $4.2M market cap via treasury-backed Solana meme indexing.

Also see Top New Ethereum Meme Coins Today

Regulatory and Stablecoin Updates

Stablecoins advanced with MetaMask launching mUSD on Ethereum and Linea, backed 1:1 by USD and integrated with Mastercard.

Coinbase added Trump-backed USD1 to its roadmap (supply: $2.4 billion).

Regulatory news included China’s yuan-backed stablecoin exploration, the EU’s digital euro push on Ethereum/Solana, and CFTC’s “Crypto Sprint Initiative.”

ETF Flows and Institutional Trends Bitcoin spot ETFs saw $194 million outflows, contrasted by $288 million Ethereum inflows. BlackRock sold portions of BTC and ETH holdings.

Other moves: Gemini’s MiCA license in Malta, DBS Singapore’s tokenized notes on Ethereum, Invesco Galaxy’s Solana ETF filing, and Starknet’s BTC staking approval.

Top Crypto Prices (24h Changes):

- BTC: ~$113,000 (-1.5%)

- ETH: ~$4,300-4,800 (+14-15%)

- SOL: ~$182 (-3.6%)

- XRP: ~$2.87-3.03 (+0.3-7%)

- DOGE: ~$0.216 (+0.7%)

Overall, this crypto market recap highlights a bullish tilt driven by ETH and regulatory progress, though volatility persists. Always DYOR before investing.

Stay updated with the latest crypto market recaps, follow our MevX blog for daily insights!

Share on Social Media: