The August 18-24, 2025, week was a rollercoaster week of recovery and volatility in the crypto market, as the total market cap managed to hold between $3.81 trillion and $4.1 trillion. Bitcoin fell to $112,800 before it rose to $113,000, while Ethereum saw a record high of $4,953.73 following a bout of $2.3 billion ETF purchases. Solana hit 100,000 TPS on testing, while the BNB rose to an intra-week high of $899.70. Memecoins thrived in the mania of the altcoin season, whereby Solana and Ethereum tokens led the way in speculative purchases. This snapshot focuses on the week’s top-performing memecoins and trends.

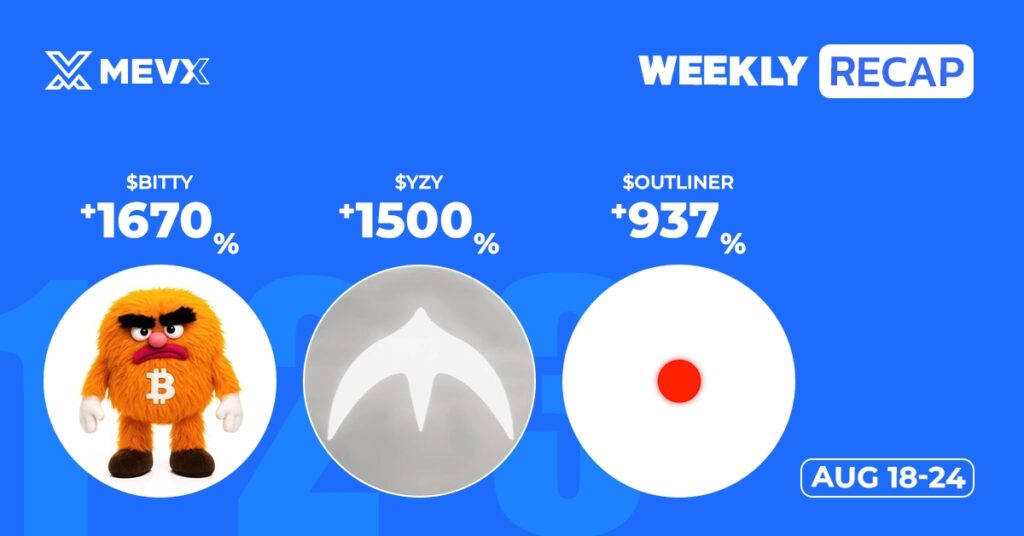

Meme Coin Weekly Recap: August 18 – 24, 2025

The week of August 18 – 24, 2025 features speculative memcoins, such as $YZY, $BOATKID, $CLANKER, $BITTY, and $LUMEN, spearheading the pack, blending celebrity frenzy, satire, and novelties. In spite of an August 20 market drop, Community-driven news powered by the communities and Solana’s ecosystem propelled explosive gains.

$YZY: Kanye’s Meteoric Rise and Crash

$YZY by Kanye West on Solana reached a whopping $3.2 billion market cap on the first hour on August 21 but crashed 85% to $0.66 on August 22, stabilizing on a $700 million cap with $50 million traded within 24 hours. Based on the $TRUMP owned 70% by Yeezy Investments LLC, it was blamed for a pump-and-dump scheme, and this was the catalyst for the uproar on X over insider gains and store losses.

$BOATKID: 20x Surge on MevX Call

$BOATKID attained an all-time market cap of $13.28 million, 20 times MevX’s original estimate, a market cap of $7.5 million, and 3.8 million volume by 19 August. The Solana token was on the heels of a tongue-in-cheek, grassroots tale of origin, profiting from the launchpad from Pump.fun and enthusiastic speculative trader demand.

$CLANKER: Satirical Jab at AI Dominance

$CLANKER reached a market cap of $17.43 million, stabilizing at $13 million with a 24-hour volume of $3.2 million by August 20. It was listed on Solana’s Pump.fun and capitalized on the viral meme buzzword term “clanker,” an insult used to describe robots and AIs, drawing on complaints surrounding automation and speculative growth.

$BITTY: Bitcoin Nostalgia Fuels Rally

$BITTY hit a $14.9 million all-time high, settling at $10.7 million with a $6.2 million 24-hour volume by August 22. Reviving the obscure 2015 Bitty mascot from bitcoin.org, this Solana token tapped nostalgic appeal and community hype, amplified by Solana’s vibrant market.

$LUMEN: Bridging Coders to Data Economy

$LUMEN broke $5.53 million, valued at $2 million, with 24-hour volume of $2 million on August 23. On Solana, it eliminated the issue of “trapped code” by anonymizing and pricing code for on-chain rewards, attracting developers and speculators into the narrative of the data economy.

Solana’s Viral and Thematic Tokens

$IMPERFECT, $ORGANIC, $OUTLIER, $JAKPOT, $SHOWGIRL, $HODL, $RAWR, $HOLYPUMP, $SINS, and $PMP featured different stories. $IMPERFECT ($1.32 million peak) accepted imperfect starts. $ORGANIC ($2.22 million) advocated for “grass-fed” development with its cow mascot. $OUTLIER ($3.54 million) honored crypto outliers. $JAKPOT ($3.5 million peak) mixed arcade-like competition. $SHOWGIRL ($2.8 million) borrowed Taylor Swift’s tour frenzy. $HODL, $RAWR, $HOLYPUMP, $SINS, and $PMP took themes from HODLing to farming satire and redemption, with 100% to 233% gains on Pump.fun and Heaven DEX.

Ethereum’s Emerging Meme Coins

$HYPR, $DRMUTANT, $BabyWLFI, $MM, and $FRED led Ethereum’s meme scene. $HYPR ($5.94 million peak) positioned as a Web3 investment bank alternative. $DRMUTANT ($2.55 million) rode Matt Furie’s Cortex Vortex hype. $BabyWLFI ($500K) surged 111% on DexScreener but raised rug pull concerns. $MM ($3 million) and $FRED ($1.5 million) capitalized on celebrity parody and playful kitten themes, reflecting Ethereum’s growing meme diversity.

Heaven DEX and Pump.fun Milestones

$LIGHT and $DARK thrived on Heaven DEX, which hit $1.02 million in daily revenue on August 21, burning 1 million $LIGHT tokens. Pump.fun reached $800 million in lifetime revenue, driven by a 1% swap fee and tokens like $HODLess ($731K) and $lesgo, though 98.7% of launches faced scam risks.

Other Notable News: August 18 – 24, 2025

The market saw regulatory shifts and institutional moves amid volatility.

Market Volatility and Recovery

A 2.22% market cap drop to $3.81 trillion on August 20 followed ETF outflows and Fed speech anticipation. Ethereum’s 15% surge to $4,885 and BNB’s $899.70 ATH signaled altcoin strength, with the Altcoin Season Index at 37. Bitcoin dipped to $112,800, with $460 million in liquidations.

Regulatory and Stablecoin Developments

The EU eyed a digital euro on Ethereum or Solana by 2026. MetaMask’s mUSD, backed by USD, launched on Ethereum and Linea. China explored a yuan-backed stablecoin, and BNB Chain’s stablecoin market cap hit $10.5 billion, up 49.6% in Q2. Kraken halted Monero deposits amid 51% attack fears.

Institutional and Network Moves

BlackRock’s Bitcoin ETF held 3% of BTC supply. OKB surged to $192 after a 65M token burn and X Layer’s Polygon CDK integration. Tron adjusted fees as TRX prices rose, aiming to rival Solana. A survey showed 65% of dual-asset investors favoring crypto over stocks for the next decade.

Conclusion

The week of Aug 18 – 24, 2025, showcased memecoins’ speculative nature as $YZY dipped, $BOATKID climbed 20x, and satire made $CLANKER a Solana leader. Ethereum’s $HYPR and $DRMUTANT showed diversification at ETH’s ATH moment. Trading platforms such as Heaven DEX and Pump.fun and regulatory developments drove growth, but volatility and the threat of scams warned the traders. MevX commentary leads the trader through the volatile market.

Share on Social Media: