The crypto market recap dives into the latest developments shaking the digital asset landscape. As of September 27, 2025, the crypto market has endured significant turbulence, with widespread sell-offs and liquidations dominating headlines. Investors are navigating a bearish phase, but glimmers of long-term optimism persist amid regulatory shifts and innovative projects.

Key Highlights in This Crypto Market Recap

- Massive Market Losses and Liquidations

- The crypto market shed over $160 billion in just a few days this month, escalating to an additional $300 billion weekly loss due to leveraged position unwinds and ETF outflows.

- In the past 24 hours alone, liquidations totaled $442 million, primarily from long positions.

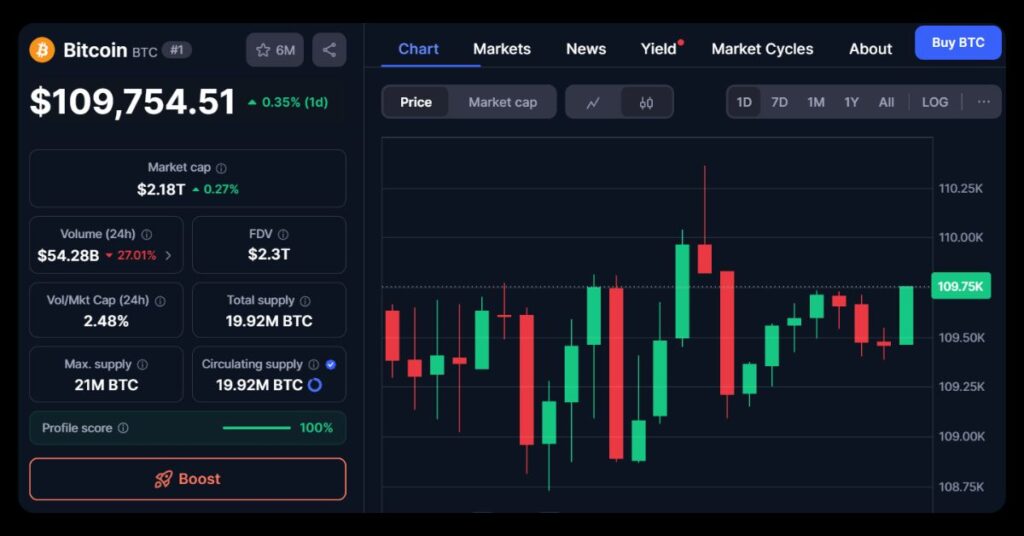

- Bitcoin dipped below $111,000, while Ethereum fell under $4,000, fueling panic selling and weakening investor sentiment.

- Bitcoin’s Cyclical Dip and Bullish Outlook

- Echoing the 2017 cycle, Bitcoin’s Q3 decline, now hovering around $108,888, could signal a pre-bull “dip.”

- Analysts predict a surge to $200,000, despite briefly touching lows under $110,000 after a $112,000 peak.

- Ethereum Emerges as Wall Street’s Safe Bet

- Forbes highlights Ethereum as the most secure blockchain for trillions in Wall Street funds, thanks to its robust infrastructure.

- Expert Danny Ryan discussed the “rewire Wall Street” race in a Q&A, positioning ETH as a top choice amid the crypto market recap‘s volatility.

Emerging Projects and Sector Wins Despite the downturn, pockets of growth shine through in this crypto market recap:

- HIVE Digital’s Mining Surge: The Bitcoin mining firm captured 2% of global output, aiming for 3% by Thanksgiving, boosting its stock amid the crypto market‘s woes.

- Political Boost from Eric Trump: Labeling Bitcoin the “new gold,” Eric Trump touted his father’s potential to spearhead a crypto revolution if elected, injecting political intrigue into the market narrative.

- New Entrants Gaining Traction

- BullZilla’s presale promises 5,604% ROI potential, while Amadeus Protocol debuts as the first “thinking” blockchain, merging AI with mining power.

- Altcoins like Solana, with $72 million in futures, remain watch-worthy despite a painful week for Bitcoin and peers.

Meme Coin Highlights

- $WURK (WURK): Solana-based meme coin driven by community hype and viral social media engagement for rapid growth.

- $ASTEROID (ASTEROID): BNB ecosystem meme token blending viral narratives with community-driven adoption in emerging markets.

- $Q4 (The Final Quarter $500): Solana presale meme coin focusing on explosive ROI potential and institutional DeFi integration narratives.

- $CPMM (rarecoin): Raydium-supported meme platform emphasizing structured tokenomics and community governance for sustainable expansion.

- $TROLL (TROLL): Solana meme coin surging on social media hype and cultural trolling themes in 2025.

- $CLIPPED (Clipped.Fun): Solana-based privacy-focused meme token gaining traction through viral community resistance narratives.

- $APEX (Apex Token): Ethereum DEX token redefining decentralized trading with utility-driven growth and institutional partnerships.

- $AsterINU (Aster INU): BNB meme token blending cross-chain utility with viral meme culture for community expansion.

- $ASTER (Aster): Decentralized perp exchange token exploding via Binance ecosystem support and innovative narratives.

- $NYX (Nyx Eternal): Solana AI idol meme token powered by decentralized compute for self-improving virtual narratives.

Overall, this crypto market recap underscores a high-volatility environment, with short-term pains potentially paving the way for rebounds. As sentiment sways, staying informed is key.

Follow our MevX blog for daily crypto market recaps and the freshest news updates.

Share on Social Media: