Solana (SOL) seems to be flexing its muscles in the field of decentralized finance (DeFi) with a key advantage over Ethereum (ETH) while building momentum on many levels. New data underlines a sharp uptick in the activity of Solana-based decentralized exchanges (DEXs) the first signal of changing fortunes for this cryptocurrency.

Solana Outperforms Ethereum

SOL Breakout Fuels Bullish Sentiment

The price ratio of Solana gained more than 1% last week, marking the end of a prolonged stalemate between bulls and bears. This breakout defined a turn in market action confirmed by bullish patterns depicted by the moving average convergence/divergence (MACD) histogram crossing above zero. The sharp uptrend reflects growing confidence among investors in the SOL token.

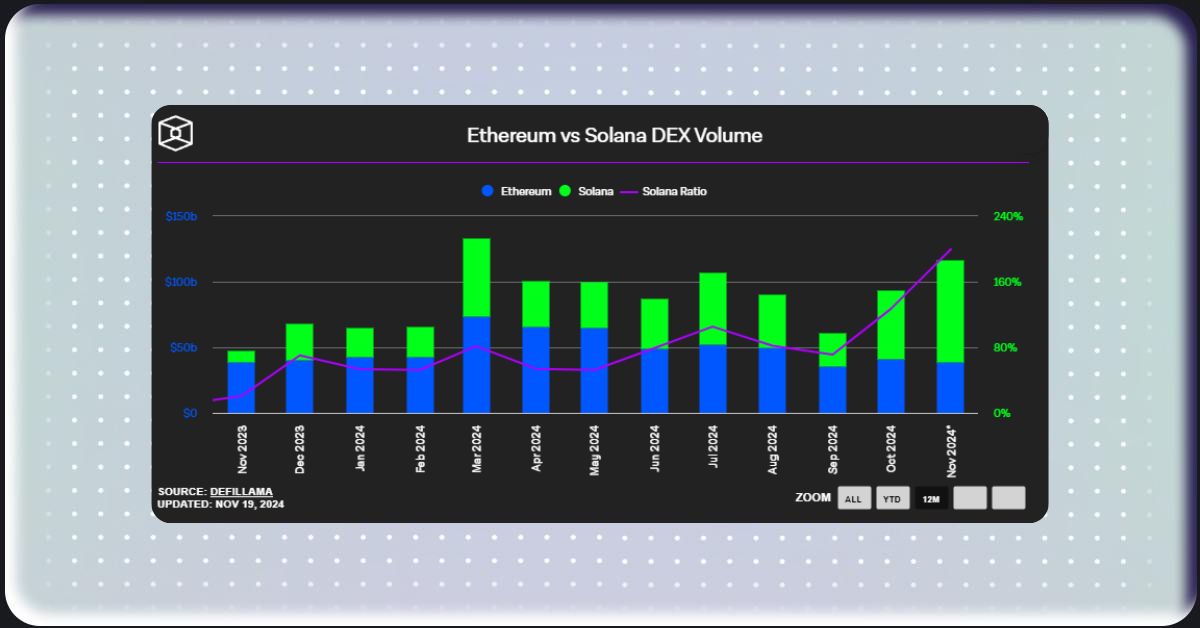

Ethereum vs Solana DEX Volume

Record DEX Volume

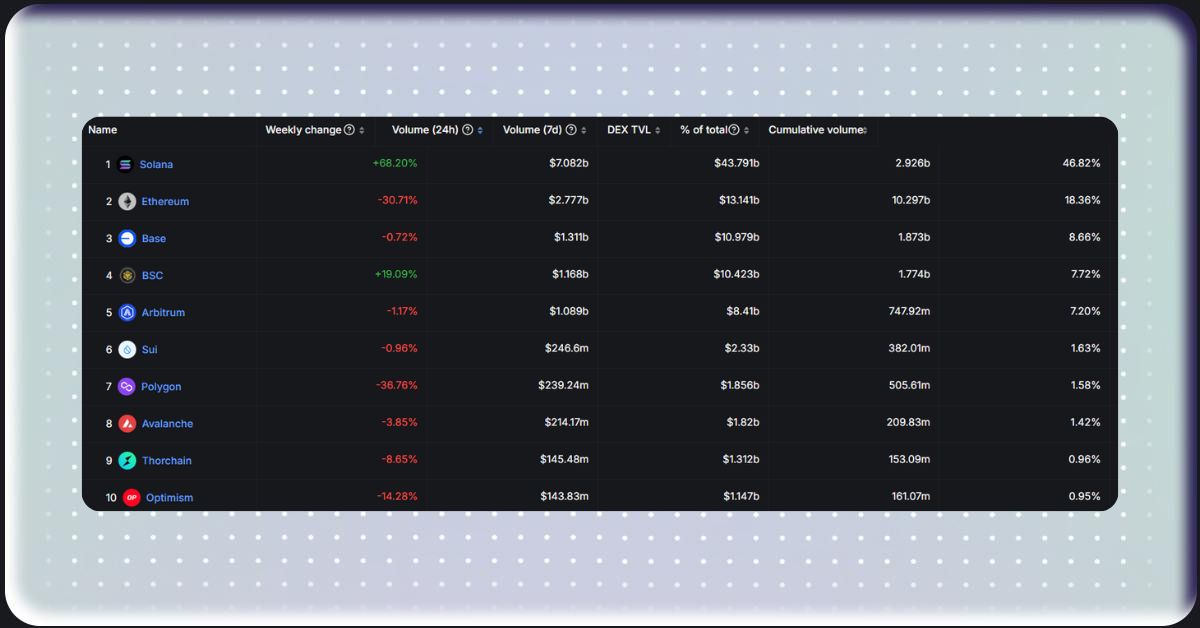

According to data from DeFiLlama, Solana-based DEXs reached a staggering over $43 billion in weekly trading volume, far outpacing Ethereum, Base, and Binance Smart Chain, which altogether saw $34.5 billion. Among its competitors, Ethereum accounted for $13.14 billion of $34.5 billion of combined DEX activity, while Base and BSC chipped in just a little more than $10 billion each.

Chain – DEXs Volume (Source: DeFiLlama)

Investor and Developer Appeal, Memecoin Market Boost

In this respect, Solana easily outperformed its competitors, mainly because of the friendly environment that attracted a broad diversity of retail investors and developers, along with its pretty low transaction fees. Retail investors especially crowd Solana for its lively memecoin ecosystem that has recently seen a surge in popularity. Lower entry barriers than Ethereum’s make the Solana blockchain a hot spot for speculative trades in memecoins such as Bonk and other hyped tokens.

This active memecoin market makes for a considerable amount of Solana’s trading volume on the DEXs. This high level of engagement by retail traders fuels liquidity, but perhaps more importantly, it greatly amplifies the visibility of the ecosystem within the crypto market. This heady activity thus underpins bullish feelings for Solana and its reinstitution as a go-to blockchain for any serious user engaging in DeFi applications to casual investors seeking high-speed, low-cost trading.

Beyond this, the flourishing memecoin culture also makes for an onboarding mechanism that brings new users into the broader family of DeFi offerings on Solana, thereby paving the way for sustained growth.

A Competitive Advantage in Fee Revenue

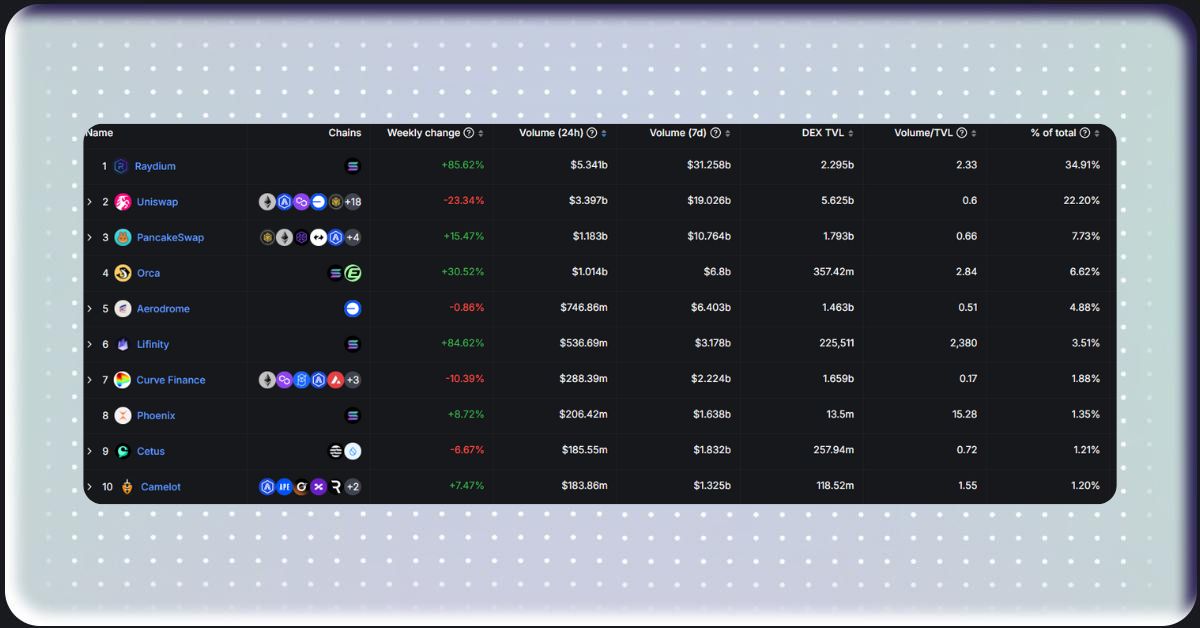

Despite its reputation for low transaction costs, Solana continued to compete closely with Ethereum in generating fee revenue. In the past week, Solana-based DEX Raydium reported $81.2 million in fees, outpacing Ethereum’s $71.45 million by 9%.

DEXs volume (Source: DeFiLlama)

Solana’s substantial revenue despite its cost-efficient structure is a demonstration of efficiency and appeal among traders and further cements its position as a leading blockchain for DeFi applications.

Outlook

Paired with breakout price momentum and unparalleled DEX activity, Solana has all the makings of a leader in decentralized trading. The ability of the blockchain to consistently outperform its peers in terms of fee revenue and trading efficiency makes it increasingly likely that it will surpass Ethereum.

As Solana continues to attract users and sustain its competitive advantages, its future in the DeFi landscape looks brighter than ever.

Share on Social Media: