The cryptocurrency markets were in for a wild ride of volatility on December 3, 2024, after South Korean President Yoon Suk Yeol declared “emergency martial law.” The sudden political unrest sent shockwaves of panic across South Korean exchanges, with major tokens like Bitcoin (BTC) briefly plummeting as much as 30% and XRP falling as much as 55% in value against the Korean won before stabilizing.

The Declaration of Martial Law

The surprise declaration from President Yoon late Tuesday evening accused opposition parties of hindering governance work, being empathetic toward North Korean authorities, and paralyzing legislation. This declaration attempted to deal with what he referred to as “threats posed by communist forces in North Korea” and “anti-state elements.”

As the announcement came over live television, the reverberations echoed across the globe, drawing instant responses—including a few words of concern from the White House.

The South Korean constitution provides for martial law in extreme emergencies but also requires parliamentary approval for its continuation. That safeguard kicked in as a majority of lawmakers in the National Assembly quickly voted to reject Yoon’s decree.

Impact on the Crypto Markets

Within minutes of the martial law declaration, negative sentiment gripped South Korea’s vibrant cryptocurrency trading community. Upbit, the nation’s leading exchange, reported delays and performance issues amid a surge in trading activity.

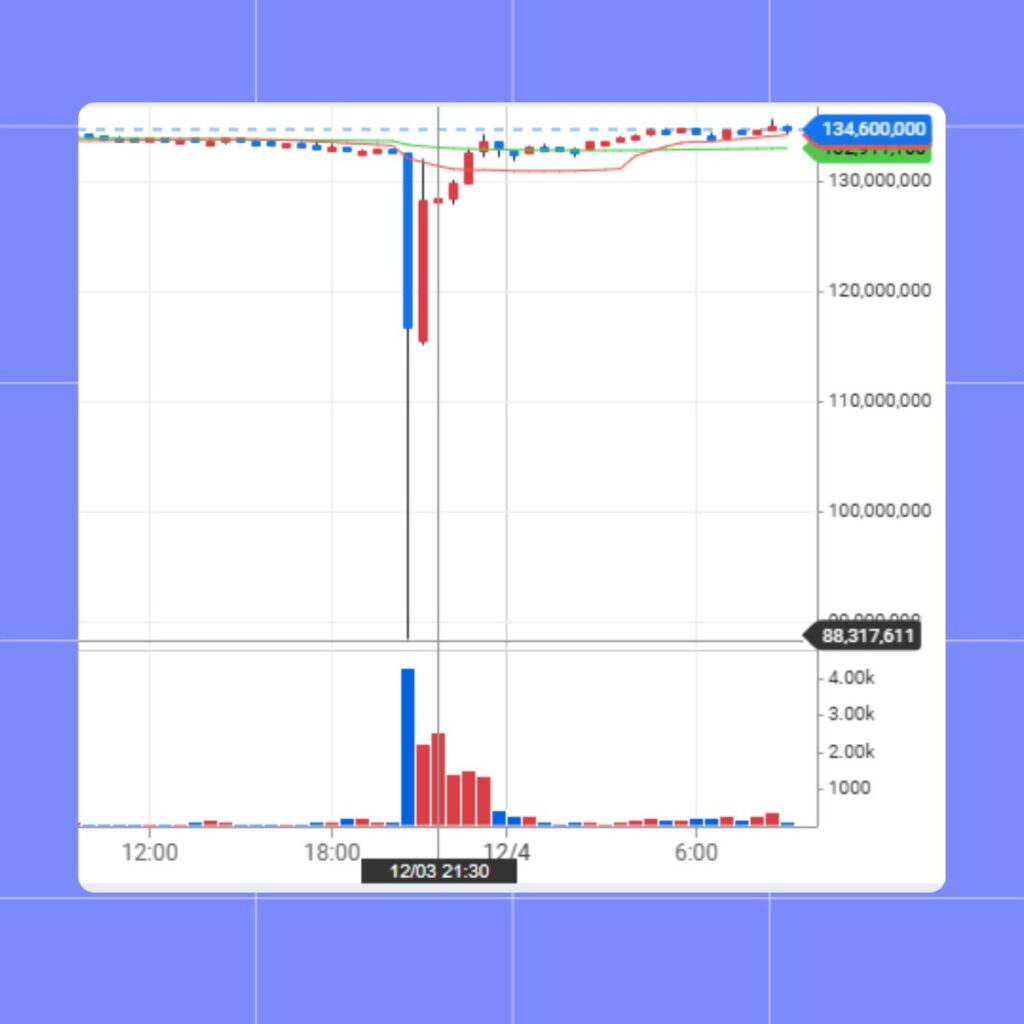

Bitcoin, a major favorite among South Korean traders, plunged from ₩135 million (approximately $96,000) to ₩88 million (around $63,000). Then, it immediately recovered.

XRP and other altcoins experienced similar sharp declines. Specifically, XRP drops 55% of its value, from ₩3,600 (around $2.55) to ₩1,600 (approximately $1.13). The price of XRP recovered after 2 hours.

This was especially important because South Korea is considered one of the countries affected by “crypto fever.” Local exchanges often record larger trading volumes compared to world leaders such as Binance and Coinbase.

This volatility underlined the leading role of South Korean traders as the main driver of this market. A quick recovery above its pre-announcement price showed that even geopolitical shocks are resilient to this market.

Reversal of Martial Law and Market Stabilization

President Yoon rescinded the martial law declaration six hours later in a Cabinet meeting, making grace in defeat by acknowledging that the National Assembly had defeated the declaration overwhelmingly. “I will accept the National Assembly’s request and lift it,” Yoon said. The about-face brought relief to the country and to financial markets that had been steeling themselves for prolonged turbulence.

Under South Korean law, martial law must be lifted if a parliamentary majority opposes it. The swift resolution of this political crisis demonstrated the strength of South Korea’s democratic institutions.

Following the announcement, the cryptocurrency market began to recover. The White House, which had earlier expressed “serious concern” about the situation, welcomed the decision to lift martial law.

Context and Broader Implications

The vibrant crypto ecosystem in South Korea has often been a bellwether for market trends. Just a day before the political turmoil, the nation’s retail trading volumes reached their second highest level of the year, buoyed by strong momentum in altcoins. This environment of heightened activity and speculation made the market particularly sensitive to the shock of a political crisis.

The episode of martial law has, however, caused a price dip in the short term. In fact, its impact on the greater cryptocurrency market remains to be seen. Political instability erodes investor confidence, particularly in areas like South Korea, where regulatory uncertainty around cryptocurrencies is already a large factor.

Lessons for Crypto Markets

The events in South Korea highlight the interconnected nature of politics and markets. As one of the world’s most active crypto-trading nations, any significant policy or political development in South Korea can have ripple effects across global markets.

This incident also underscores the importance of infrastructure resilience for crypto exchanges. Platforms like Upbit and Bithumb faced challenges in handling the surge in activity, pointing to a need for robust systems capable of managing unexpected spikes in trading volume.

Conclusion

The sudden announcement and subsequent rollback of martial law in South Korea brings into striking view the volatility inherent in crypto markets, which is present in larger global geopolitics. Resilient it proved to be, but the market did indicate that traders and investors needed to be alert.

This underscored the crucial balance between governance, laws, and market stability in South Korea. Indeed, once this country’s crypto market overcomes this political shock, it will become the focus of global attention due to its dynamic vitality and vulnerability to external shocks.

Share on Social Media: