In the volatile world of cryptocurrencies, Ethereum managed to shine last week, Ethereum outperformed both Bitcoin and Solana. This performance can be attributed to various factors, from network activity and institutional interest to market sentiment and technical upgrades. Here’s a deep dive into why Ethereum stood out in the crypto market over the past week.

Institutional Interest and Stablecoin Inflows

One of the key drivers behind Ethereum’s recent outperformance was the significant inflow of stablecoins into its ecosystem. Over the last week, Ethereum saw an increase of $1.1 billion in stablecoin supply, suggesting a robust influx of capital into the network. This is in stark contrast to Solana, which experienced a decrease of $772 million in stablecoin supply. The growth in stablecoins on Ethereum indicates not only liquidity but also confidence from institutional investors who see Ethereum as a platform for real-world asset (RWA) tokenization, where it holds an 85% market dominance.

Ethereum Outperformed Price Performance and Market Dynamics

In terms of price action, Ethereum’s performance against Bitcoin was notable. The ETH/BTC ratio increased by 4.5% last week, signaling that Ethereum was gaining ground relative to Bitcoin. Bitcoin, while still the king of cryptocurrency in terms of market cap, was trading below $98K, showing less dynamism compared to Ethereum’s movements. Meanwhile, Solana faced a 6% decline in its SOL/ETH ratio, indicating a relative underperformance against Ethereum. This could be partly attributed to concerns over upcoming token unlocks for Solana, potentially diluting the value of existing SOL.

Network Activity and Revenue Generation

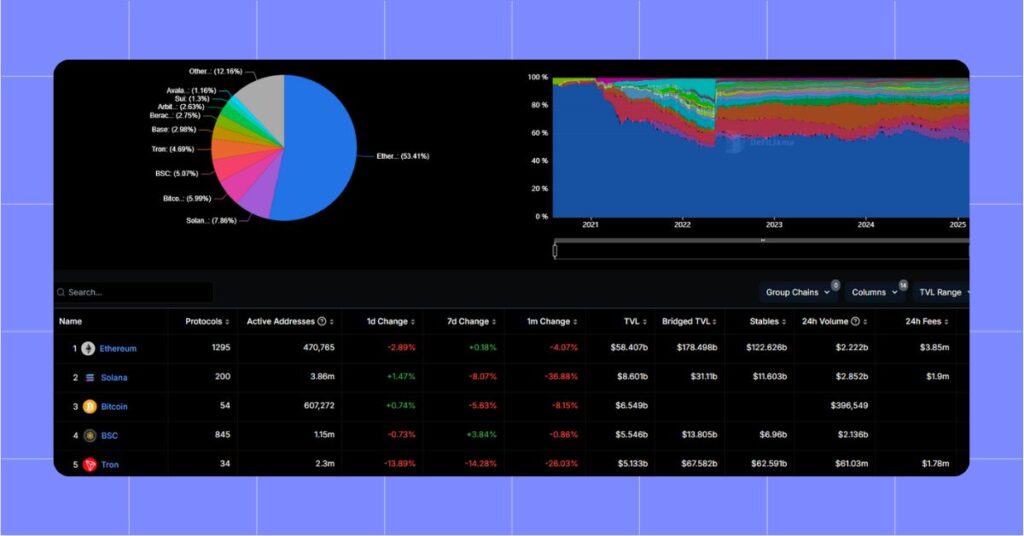

Ethereum’s network activity has been a beacon of its resilience and utility. Despite the broader market’s volatility, Ethereum’s application revenue, although down by 31% week-on-week, still stood at a significant $19.9 million, capturing a 12% share of the market. In contrast, Solana, while leading in revenue with $109.5 million, saw a sharp 45% decrease. This disparity in revenue decline rates suggests Ethereum’s revenue streams are more stable or less sensitive to market downturns.

The increase in Ethereum’s gas limit and the ongoing adoption of Layer 2 scaling solutions have contributed to more efficient transactions, possibly encouraging more activity and thus revenue. The network’s ability to handle high-value transactions and smart contracts, especially in DeFi and NFT sectors, continues to draw users and developers to Ethereum.

Community Sentiment and Technical Developments

Community sentiment, as reflected on social media platforms like X (formerly Twitter), has leaned positively towards Ethereum. There’s a growing narrative of Ethereum’s stability and its critical role in the DeFi space. Conversely, Solana has been facing some criticism, with some community members labeling it a “scam chain” due to its high token unlocks and past network issues, which might have influenced its performance last week.

Additionally, Ethereum’s upgrades, like the post-Dencun increase in gas limits, suggest ongoing improvements that could enhance scalability and user experience. These technical developments are critical in maintaining and growing Ethereum’s user base and developer community.

Real-World Asset Tokenization and DeFi Dominance

Ethereum’s lead in RWA tokenization is another pillar supporting its recent outperformance. The platform’s infrastructure for complex smart contracts and its established ecosystem for DeFi applications give it a substantial edge. With over half of the global DeFi TVL, Ethereum’s dominance in this sector is undeniable. The influx of institutional capital into Ethereum for tokenizing real-world assets further solidifies its position as not just a speculative asset but a utility-driven blockchain.

The Rise of Meme Coins on Ethereum

A remarkable phenomenon contributing to Ethereum’s growth is the proliferation of meme coins within its ecosystem. Meme coins, often inspired by internet culture and humor, have gained substantial traction, attracting both retail and institutional investors. In 2024, the meme coin market capitalization soared from $20 billion in January to $120 billion in December, marking a 500% growth. Ethereum hosts major meme coins like Shiba Inu (SHIB), Pepe (PEPE), Mog Coin (MOG), and Turbo (TURBO), which have seen explosive growth due to their viral appeal and strong community engagement. For instance, PEPE reached over a $1 billion market cap within weeks of its launch, outperforming other meme coins in early adoption. The deflationary tokenomics and strategic branding of these coins have made them standout assets within the Ethereum network.

Recently, the emergence of the meme coin HULEZHI has stirred up the meme coin community on Ethereum, helping Ethereum maintain its top position among blockchain networks according to DeFiLlama. MevX has analyzed this meme coin in the article “Escaping the Digital Matrix With HULEZHI Crypto Rebellion.” You can check out the article to gain a deeper understanding of the HULEZHI phenomenon and its impact on the crypto community.

HULEZHI gained attention when an anonymous developer, known as “hulezhi,” burned 500 ETH (approximately $1.65 million) in protest against what he called “technological tyranny.” This act sparked significant controversy and led to the creation of related meme coins on other blockchain networks.

This event has highlighted Ethereum’s importance in the development and circulation of meme coins while showcasing how individual actions can influence the broader crypto community.

Conclusion

Last week’s outperformance of Ethereum over Bitcoin and Solana can be attributed to a combination of factors: increased institutional interest, stablecoin inflows, more stable revenue generation, positive community sentiment, technical upgrades, and its dominant position in DeFi and RWA tokenization. While Solana showed impressive revenue figures, its volatility and upcoming token unlocks might have deterred some investors. Bitcoin, known for its stability, did not capture the same level of activity or speculative interest that Ethereum did in the last week.

As the crypto market continues to evolve, Ethereum’s performance last week underscores its resilience and the ongoing trust in its ecosystem by both retail and institutional investors. However, in the fast-paced world of cryptocurrencies, these dynamics can shift rapidly, making continuous observation and analysis crucial for understanding future trends.

Check out all blockchains with our blog now!

Share on Social Media: