The $LIBRA token became a global sensation and then a cautionary tale – in early 2025 after Argentine President Javier Milei’s social media endorsement. What followed was a rapid rise, insider profiteering, and a devastating crash, exposing the risks of cryptocurrency scams and meme coins. This timeline details every key moment, from creation to fallout, to help you understand the complete timeline of the LIBRA drama and its implications for the crypto market.

Why This Matters for Crypto Investors

The $LIBRA drama highlights the volatility of cryptocurrencies, the dangers of meme coins, and the impact of influential endorsements. Whether you’re a crypto trader, investor, or simply curious about blockchain and digital assets, this timeline provides critical insights into how quickly scams can unfold in the decentralized world.

The Complete Timeline of the LIBRA Drama: Key Events and Dates

The timeline of the LIBRA drama is quite complicated, making it difficult to follow. Therefore, we aim to simplify the series of events in timestamps to fully inform our readers of the incident. Please note that the timestamps are in Argentine time.

February 14, 2025

6:30 p.m. – Creation of the $LIBRA Token

- The “Viva la Libertad project” website goes live, offering vague details about using $LIBRA to fund Argentine entrepreneurs.

- Developers create the $LIBRA token on the Fix Float platform, known for anonymity and frequent use by scammers.

- All $LIBRA tokens are immediately distributed to 12 different wallets to avoid suspicion of a scam.

6:55 p.m. – Liquidity Pool Setup

- Five minutes before President Milei’s post, the development team establishes a liquidity pool, allowing investors to buy and sell $LIBRA.

- This step simulates market activity and attracts buyers.

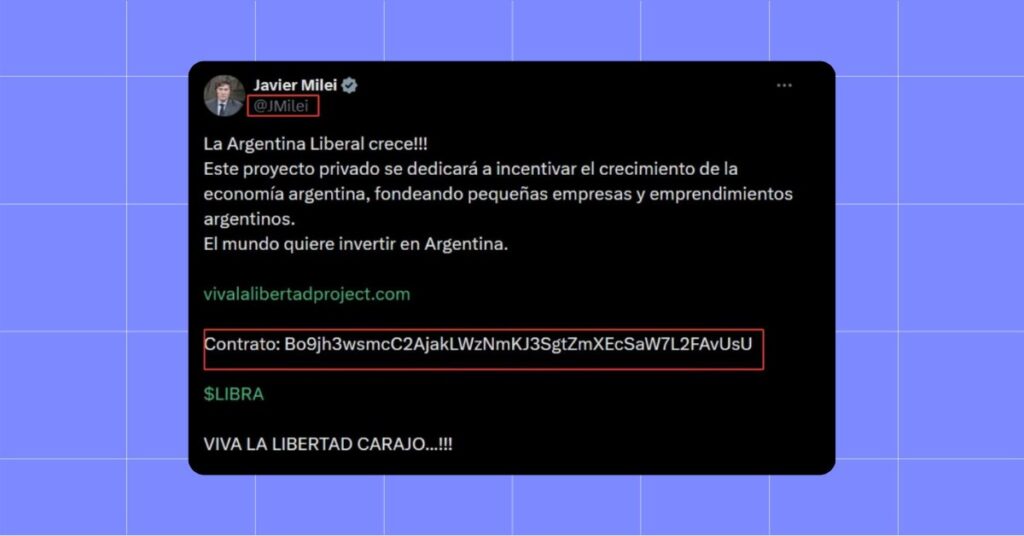

7:00 p.m. – Milei’s Endorsement on X

- Javier Milei posts on X, promoting $LIBRA and sharing its contract address.

- Within 45 minutes, $LIBRA’s price skyrockets from $0.216 to $5.54.

- Trading volume reaches $1.5 billion, and market cap hits $4.5 billion.

- 84% of tokens are held by three wallets linked to the development team.

7:37 p.m. – First Major Profit

- The first buyer, who purchased $LIBRA at the time of Milei’s post, sells most of their holdings 37 minutes later, making a net profit of $6.5 million.

7:40 p.m. – 8:40 p.m. – The Crash Begins

- Developers and early buyers start selling, causing a 70% price drop from $4.74 to $1.44 over the next hour.

- Crypto analysts confirm most sellers were part of the development team.

February 15, 2025

12:38 a.m. – Milei Deletes Post

- More than five hours after his initial post, Milei deletes his X promotion of $LIBRA.

- He states, “I wasn’t informed of the fine details of the project and, after learning, decided not to continue spreading it.”

- The deletion triggers the final collapse of $LIBRA’s value.

February 15–16, 2025 – Aftermath and Investor Losses

Over 75% of $LIBRA investors lose money. Argentine crypto expert Fernando Molina reports:

- 62.8% of wallets lost between $1 and $1,000.

- 8.7% lost between $1,000 and $10,000.

- 2.9% lost between $10,000 and $100,000.

Only a small fraction profited, with the biggest winner making $8.5 million and the biggest loser dropping $5.25 million.

February 17, 2025

Hayden Davis’s Revelations

- Hayden Davis, CEO of the $LIBRA project appears in interviews, including with Coffeezilla, admitting he held $110 million from the $LIBRA scheme.

- He reveals that the teams behind $LIBRA and $MELANIA (another controversial token) are the same.

- The same day, Milei reposts a controversial tutorial on how to buy $LIBRA on X, causing a temporary price surge from $0.35 to $0.75 before crashing back to $0.43.

- Davis claims some influencers were compensated for losses (e.g., DeFi Noy received $5 million in USDC).

February 18, 2025

Milei’s TV Defense

- Milei appears on television, denying he promoted $LIBRA and claiming he only shared information out of goodwill.

- He argues that few Argentines were affected (estimating 45 local investors) and that most losses were from China and the U.S.

- He insists investors were professional traders who understood risks.

- This interview destroys any chance for a $LIBRA recovery.

February 19, 2025

Despite the crash, $LIBRA still has a market cap of over $272 million, with a price of $0.27.

The Meme Coin Dilemma

The $LIBRA drama is not just another crypto failure—it’s a harsh wake-up call. A staggering 99% of tokens linked to political figures or celebrities turn out to be rug-pulls or pump-and-dump scams, leaving traders devastated while developers walk away with millions.

“How many more times must investors be deceived before meme coins are abandoned entirely?” is the question in many minds right now. This event has shattered confidence in the space, proving that traders are nothing more than disposable cash cows for the architects of these schemes. Is this truly the end of meme coins? If the only real winners are the developers and insiders, what purpose do these tokens even serve beyond enriching the few at the expense of the many? The $LIBRA drama has left an ugly stain on the crypto world—one that may never be wiped clean.

The Timeline of the LIBRA Drama serves as a grim reminder of the dangers lurking within the cryptocurrency market. It exposes the harsh reality that most memecoins are designed not to create wealth for the community, but to funnel money into the pockets of their creators. As the Timeline of the LIBRA Drama unfolds, it shows traders chasing dreams of instant riches while the masterminds behind these projects cash out and vanish.

The question remains: will the crypto community finally learn from the Timeline of the LIBRA Drama, or is history doomed to repeat itself? The answer may determine the future of decentralized finance.

Find out more latest news on the MevX Blog!

Share on Social Media: