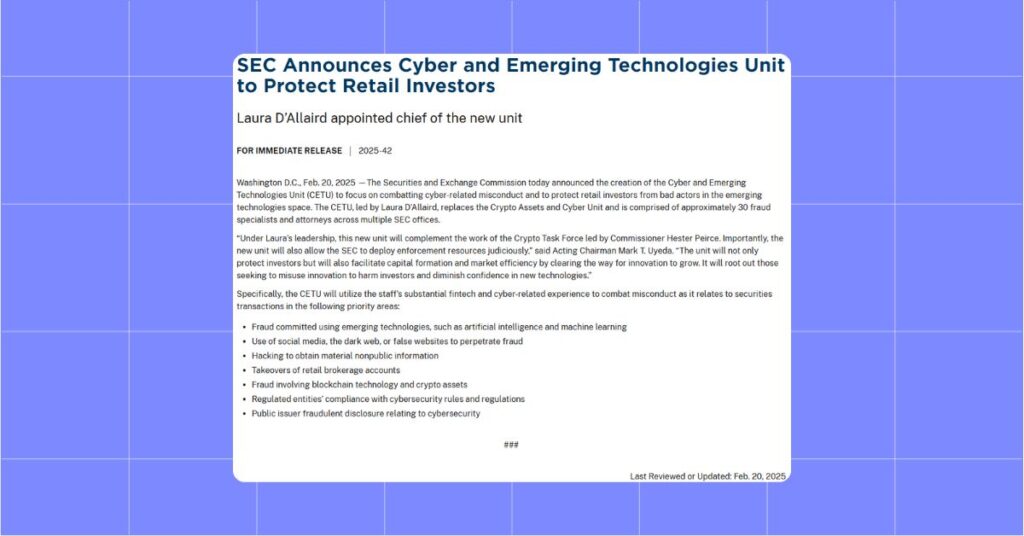

SEC launches Cyber and Emerging Technologies Unit, is it s new era for crypto regulation? On February 20, 2025, the U.S. Securities and Exchange Commission (SEC) made waves in the financial and cryptocurrency communities by announcing the creation of the Cyber and Emerging Technologies Unit (CETU).

This new division, spearheaded by Laura D’Allaird, marks a significant shift in the agency’s approach to regulating cyber-related misconduct and emerging technologies, including the ever-evolving world of digital assets. Replacing the former Crypto Assets and Cyber Unit, the CETU is poised to tackle the unique challenges posed by blockchain technology, decentralized finance (DeFi), and retail investor protection in the crypto space.

With approximately 30 fraud specialists and attorneys on board, this move signals a broader, more proactive stance from the SEC as it navigates the complexities of the digital frontier.

A Step Beyond Crypto Enforcement

The establishment of the CETU comes at a pivotal moment for the cryptocurrency industry, which has long grappled with regulatory uncertainty under the SEC’s watch. Historically, the agency has relied heavily on enforcement actions to police the crypto market, think high-profile cases against Ripple, Terraform Labs, and various unregistered token offerings.

However, the CETU’s broader mandate suggests a potential evolution in strategy. While its predecessor focused narrowly on crypto assets and cybersecurity, the CETU’s inclusion of “emerging technologies” hints at a holistic approach that could encompass artificial intelligence, tokenized assets, and even the metaverse, sectors increasingly intertwined with cryptocurrency innovation.

Acting Chairman Mark T. Uyeda emphasized this shift, stating, “Under Laura’s leadership, this new unit will complement the work of the Crypto Task Force led by Commissioner Hester Peirce. Importantly, the new unit will also allow the SEC to deploy enforcement resources judiciously.” This dual-structure approach, pairing the CETU with the recently launched Crypto Task Force, could indicate a two-pronged effort: enforcement paired with clearer regulatory frameworks.

For crypto enthusiasts, this raises a tantalizing question: Is the SEC finally moving toward a balance between cracking down on bad actors and fostering blockchain innovation?

What It Means for Crypto Investors and Projects

For retail investors, the CETU’s focus on combating cyber-related misconduct is a welcome development. The crypto space has been plagued by hacks, rug pulls, and phishing scams that have cost investors billions. The unit’s emphasis on protecting retail participants could mean more robust investigations into fraudulent ICOs, shady exchanges, and DeFi protocols that exploit unsophisticated users. With cyber threats like smart contract exploits and wallet breaches on the rise, the CETU’s expertise could bolster confidence in a market often seen as the Wild West.

On the flip side, crypto projects and developers might feel a mix of optimism and apprehension. The CETU’s expanded scope could lead to heightened scrutiny of tokenized assets and emerging DeFi platforms, especially those pushing the boundaries of traditional securities laws. However, Uyeda’s comments about “facilitating capital formation and market efficiency” suggest the SEC might be warming to the idea that innovation and regulation can coexist. If the CETU works in tandem with the Crypto Task Force, led by the notably crypto-friendly Commissioner Hester Peirce, often dubbed “Crypto Mom”, we could see a more collaborative regulatory environment emerge, one that offers clearer guidelines rather than retroactive penalties.

The Crypto Community’s Reaction

The crypto world is already buzzing with speculation about what this means for the future. Some see the CETU as a sign that the SEC is adapting to the inevitable mainstreaming of digital assets, especially as institutional players like BlackRock and Fidelity deepen their involvement in Bitcoin ETFs and tokenized securities. Others remain skeptical, viewing it as yet another layer of bureaucratic oversight designed to stifle decentralization. Posts on X reflect this divide, with some users praising the SEC’s pivot toward clarity, while others quip that it’s “too little, too late” after years of enforcement-heavy tactics.

One potential game-changer? The CETU’s focus on emerging technologies could pave the way for regulatory sandboxes, controlled environments where blockchain startups can test innovations without immediate fear of enforcement. Such an approach has worked in jurisdictions like the UK and Singapore, fostering growth while keeping regulators in the loop. If the SEC adopts this model, it could signal a thaw in its historically adversarial relationship with the crypto industry.

SEC Launches Cyber. Is It A New Chapter for Crypto Regulation?

The timing of the CETU’s launch, following Gary Gensler’s departure as SEC Chair on January 20, 2025, adds another layer of intrigue. Gensler’s tenure was marked by aggressive enforcement and a rigid stance on classifying most tokens as securities, often drawing ire from the crypto community. With Acting Chairman Uyeda at the helm and a new unit in play, there’s hope that the SEC might chart a more balanced course. Pairing the CETU’s enforcement muscle with the Crypto Task Force’s mission to craft “comprehensive and clear” guidelines (announced January 21, 2025) could finally give the industry the predictability it’s been clamoring for.

As of today, February 21, 2025, the crypto market stands at a crossroads. The CETU could either become a tool for stifling innovation under the guise of investor protection or a catalyst for legitimizing blockchain technology in the U.S. financial system.

For now, all eyes are on Laura D’Allaird and her team. Will they crack down harder, or will they help build a bridge between regulators and the decentralized dream? The crypto world is watching and holding its breath.

Follow our blog to keep track of the crypto market movements!

Share on Social Media: