Pump.fun is testing AMM, aiming to challenge Raydium’s dominance in Solana’s DeFi space. This move could shift liquidity control, reduce reliance on Raydium, and introduce new rewards for users, sparking speculation about its impact on the ecosystem.

For those unfamiliar, Pump.fun has carved out a unique niche on Solana, letting anyone create a memecoin for less than $2. It’s a breeding ground for viral tokens, with a clever bonding curve mechanism that ramps up prices as market caps climb.

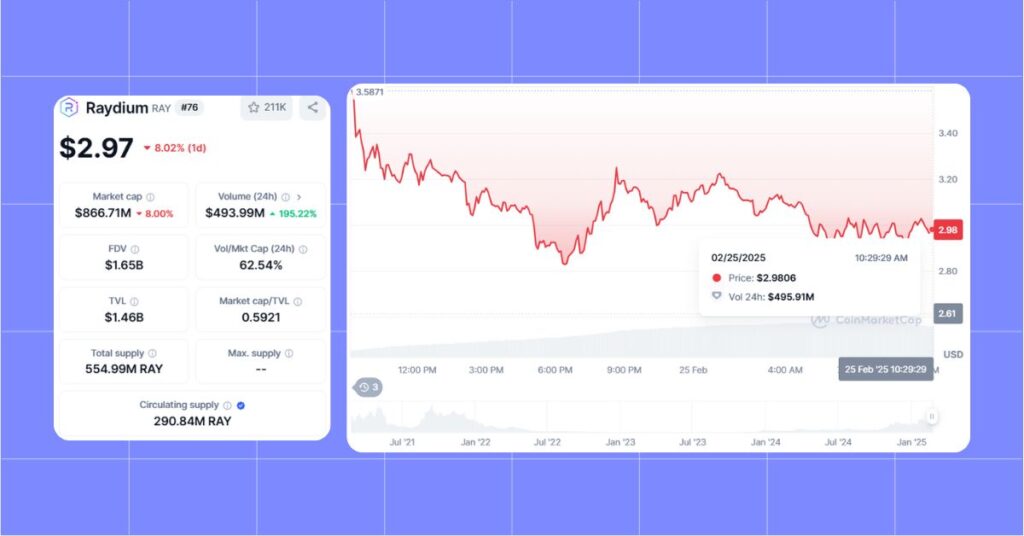

Historically, once a token hits a $69,000 market cap, its liquidity migrates to Raydium, Solana’s leading decentralized exchange (DEX), where it’s burned and traded freely. This symbiotic relationship has fueled Raydium’s growth, contributing to its hefty $500 million in average daily trading volume. But Pump.fun’s latest experiment might just rewrite that playbook.

Here’s where MevX could shine. Its tools, built for Solana’s high-speed blockchain, could give traders an edge in navigating Pump.fun’s like sudden price swings from low liquidity or arbitrage gaps versus Raydium, trading all in seconds. For liquidity providers, MevX might optimize deposit timing, ensuring they ride the waves of Pump.fun’s volatile token launches profitably.

Join MevX here:

Pump.fun is Testing AMM. What does this mean?

The whispers started when sharp-eyed users spotted a new interface at amm.pump.fun, hinting an in-house AMM in the works. Unlike the current setup, where liquidity flows to Raydium, this new system could keep it all under Pump.fun’s roof. Imagine a world where memecoins “graduate” to Pump.fun’s own liquidity pools instead of Raydium’s.

It’s a power move that could redirect trading volume, fees, and control back to the launchpad, potentially slashing Raydium’s slice of the pie. The market’s already reacting Raydium’s native token, RAY, has taken a hit, dropping over 25% in the past day amid the uncertainty.

Why would Pump.fun take this leap? The answer lies in economics and ambition. By running its own AMM, Pump.fun could pocket more transaction fees, currently set at 0.25% on Raydium swaps. Analysts suggest it might even crank that rate higher, doubling revenue if conditions hold. Plus, there’s talk of new reward mechanisms for token holders, adding a layer of incentive that Raydium doesn’t offer. This isn’t just about keeping the lights on, it’s about turning Pump.fun into a full-fledged DeFi powerhouse on Solana, challenging the DEX status quo.

The implications are massive. For Raydium, losing Pump.fun’s token pipeline could dent its dominance, though it’s not down for the count, its support for major markets like SOL-to-stablecoin trades keeps it a heavyweight. For Pump.fun users, an in-house AMM might mean faster trades, tighter ecosystem integration, and maybe even perks like memecoin perpetual or lending if community chatter is any guide. Early tests reportedly feature a token called $CRACK in the experimental pools, hinting at what’s to come.

Pump.fun is testing AMM, and the potential shift in Solana’s DeFi landscape is only just beginning.

But it’s not all smooth sailing. Pump.fun hasn’t officially confirmed the AMM’s rollout, leaving room for skepticism. Building a robust AMM isn’t child’s play, it needs liquidity, security, and trust to rival Raydium’s battle-tested infrastructure. And while Pump.fun’s memecoin factory has churned out hits, it’s also been a hotbed for rug pulls and flops, which could complicate its pivot to a serious DEX contender.

The Solana memecoin scene is at a crossroads. Pump.fun’s AMM gambit could either cement its reign or stumble under its own weight. For now, the testnet trials are fueling heated debates online, with traders and degens alike watching closely. Will this be the moment Pump.fun outgrows its launchpad roots? Or will Raydium weather the storm? One thing’s clear: the battle for Solana’s liquidity crown is heating up, and we’re all along for the ride.

Pump.fun is testing AMM as part of its strategy to shift the balance of liquidity and trading volume on the Solana network. This bold move could disrupt the dominance of Raydium, potentially reshaping the DeFi landscape. While still in its testing phase, the outcome remains uncertain, with both risks and rewards on the horizon for Pump.fun, Raydium, and their users. The race for liquidity supremacy on Solana is intensifying, and all eyes are now on Pump.fun’s next steps.

Stay tuned with MevX, this story’s just getting started.

Share on Social Media: