The decentralized finance (DeFi) space has been rocked by yet another high-profile security breach, this time targeting Infini Earn Funds, a platform promising lucrative yields for crypto investors. In a devastating turn of events, Infini loses over $49.5 million due to a private key compromise, underscoring the persistent vulnerabilities in the rapidly evolving world of blockchain-based finance.

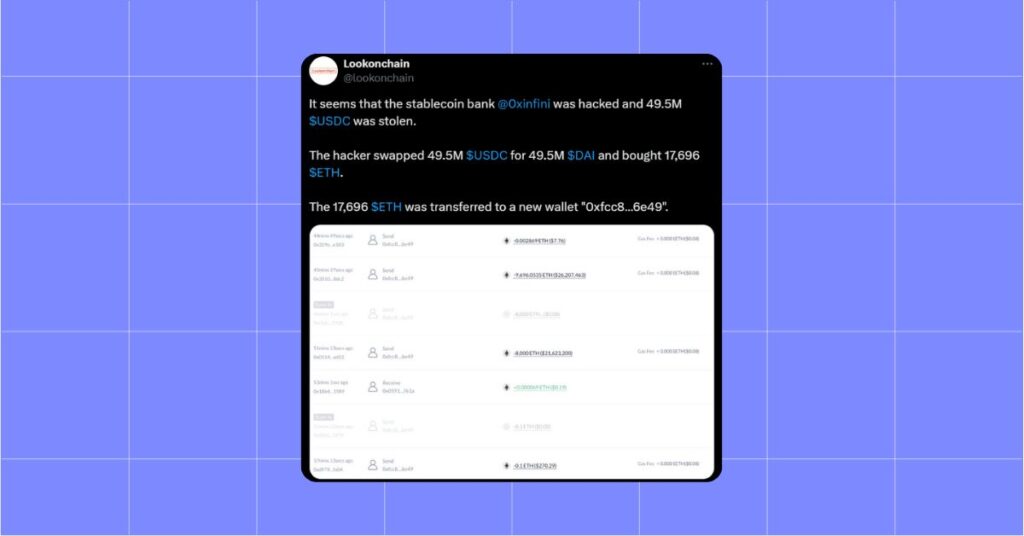

The private key breach, which unfolded earlier this week, saw an attacker siphon off funds from Infini’s vault, primarily in USDC, a stablecoin pegged to the U.S. dollar. Blockchain security firms like PeckShield and Beosin Alert quickly traced the exploit, revealing that the stolen haul was converted into roughly 17,696 ETH (Ethereum’s native cryptocurrency) before being transferred to an external wallet. The sheer scale of the theft has sent shockwaves through the crypto community, already reeling from a similar $1.46 billion hack targeting the Bybit exchange just days prior.

What makes this incident particularly alarming is the root cause: a private key breach tied to human error rather than a sophisticated smart contract exploit. According to reports, Infini’s founder, identified only as Christian, has taken full responsibility, admitting that the attack stemmed from a failure to properly revoke admin privileges from a former contributor. This individual, who retained access to critical systems, exploited their authority after a delay of over 100 days, catching the platform off guard. The oversight highlights a glaring truth, even in a decentralized ecosystem, the human element remains a significant point of failure.

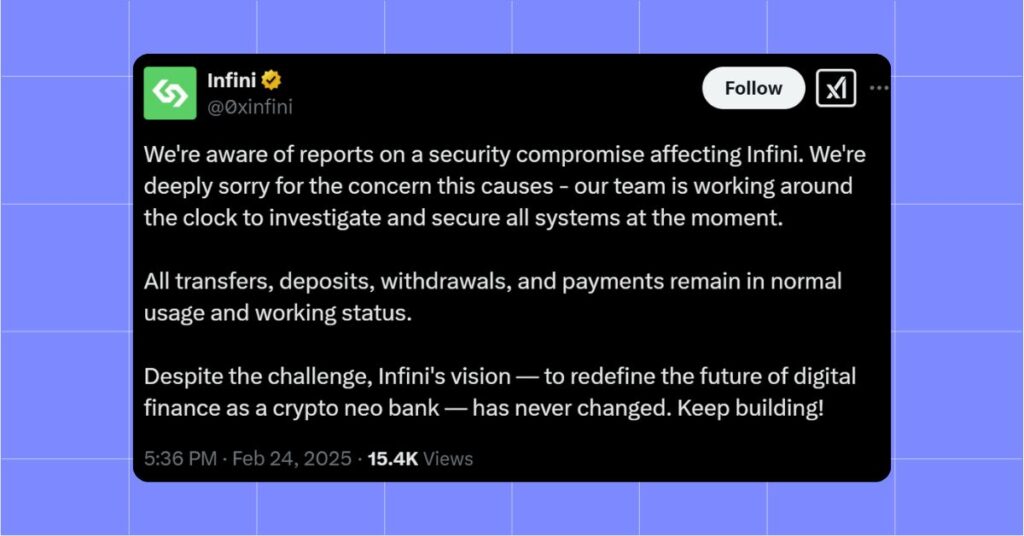

Christian has since addressed the community, promising full compensation for affected users and asserting that Infini holds sufficient liquidity to cover the $49.5 million loss. While this commitment offers some reassurance, it does little to quell the broader concerns about DeFi security. Private keys, the cryptographic linchpins of blockchain systems, are notoriously difficult to manage securely. A single misstep, whether through negligence, phishing, or insider threats can lead to catastrophic losses, as Infini’s users have now learned the hard way.

The fallout from the breach is still unfolding. Blockchain analysts are actively tracking the stolen funds, with some suggesting that the attacker may attempt to launder the ETH through mixers or decentralized exchanges. Authorities have been notified, though the pseudonymous nature of crypto transactions often complicates recovery efforts. For Infini, the immediate priority is restoring trust. The team has vowed to implement stricter security protocols, including multi-signature wallets and third-party audits, to prevent a repeat incident.

Infini Loses Over $49 Million. What’s the lesson?

This private key breach arrives at a precarious moment for DeFi. With billions of dollars locked in protocols worldwide, the sector has become a prime target for hackers. The Bybit hack earlier this month, coupled with Infini’s loss, brings the total stolen from major platforms in February alone to nearly $1.5 billion. These incidents fuel skepticism among regulators and traditional investors, who question whether DeFi can ever truly deliver on its promise of financial freedom without robust safeguards.

For the average user, the Infini Earn Funds breach is a stark reminder to exercise caution. Before entrusting funds to any platform, research its security practices, team transparency, and audit history. Diversifying investments and using hardware wallets for personal holdings can also mitigate risk. Meanwhile, the broader DeFi community must confront the elephant in the room: until private key management and contract authority are foolproof, these multimillion-dollar breaches will remain a recurring nightmare.

Infini’s pledge to make users whole is a step in the right direction, but the damage to its reputation, and the industry’s credibility, may take far longer to repair. As the dust settles, one thing is clear: in the Wild West of DeFi, security isn’t just a feature, it’s a necessity.

MevX users, in particular, should be extra vigilant given the interconnected nature of DeFi platforms and the potential for similar vulnerabilities. Follow us, we are here for you!

Share on Social Media: