The cryptocurrency market is a whirlwind of volatility, innovation, and speculation, with altcoins, cryptocurrencies other than Bitcoin, taking center stage in today’s news (February 26, 2025). From massive hacks to regulatory breakthroughs and bold predictions, the altcoin landscape is proving to be as dynamic as ever. Here’s a deep dive into the biggest stories shaping the altcoin narrative right now.

The Bybit Hack: A $1.5 Billion Blow

One of the most seismic events rocking the crypto world this week is the recent hack of Bybit, a prominent exchange, allegedly perpetrated by North Korean hackers. Reports indicate that a staggering $1.5 billion in cryptocurrency was siphoned off, marking it as one of the largest breaches in the industry’s history. The fallout has been immediate and brutal, altcoin prices, alongside Bitcoin and Ethereum, have plummeted as panicked investors rush to sell. The market cap, now hovering around $3.14 trillion, reflects a 1% dip in just 24 hours, with trading volume spiking as traders scramble to react. This incident has reignited debates about security in decentralized systems and cast a shadow over altcoins, many of which are traded heavily on platforms like Bybit. While the dust settles, the question looms: will this trigger a broader loss of trust, or will it be a fleeting dip ripe for bargain hunters?

See more detail at Bybit hacker – Bybit Suffers $1.4 Billion Hack, The Largest Crypto Attack in History

Uniswap’s Regulatory Win: A Beacon of Hope

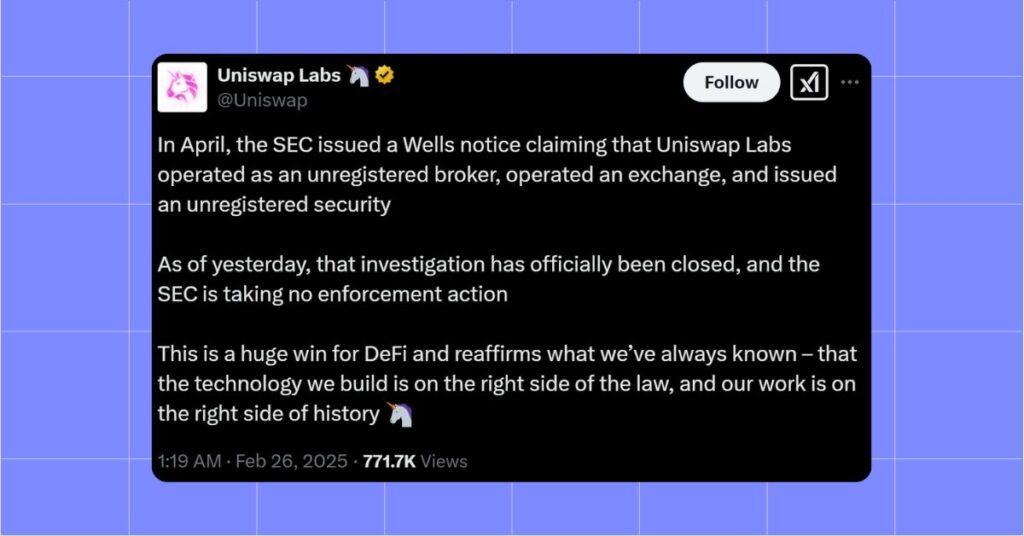

Amid the chaos, a sliver of optimism has emerged for altcoin enthusiasts. The U.S. Securities and Exchange Commission (SEC) has reportedly dropped its investigation into Uniswap, a leading decentralized exchange pivotal to many altcoins’ ecosystems.

This decision, seen as a rare regulatory victory, suggests a potential softening of the SEC’s stance under the current U.S. administration, which has been vocal about fostering crypto innovation. Uniswap’s native token, UNI, and other decentralized finance (DeFi) altcoins could see renewed interest as legal uncertainties fade. For a market battered by hacks and sell-offs, this news offers a counter-narrative: altcoins tied to robust, transparent platforms might just weather the storm better than skeptics predict.

Altcoin Season 2025: Selective Survival

Adding fuel to the speculative fire, CryptoQuant CEO Ki Young Ju has weighed in with a provocative forecast. He argues that 2025 won’t usher in a traditional “altcoin season”, a period where altcoins broadly outpace Bitcoin, but rather a selective surge.

Only altcoins with strong fundamentals, revenue-generating models, and potential ETF consideration will thrive, he suggests. This prognosis aligns with current market trends: while some altcoins like Solana (SOL) and Chainlink (LINK) hold steady thanks to real-world utility, others flounder. Ju’s analysis points to a Darwinian shakeout, where weaker projects could fade into obscurity. For investors, this means a sharper focus on due diligence, picking winners in a crowded field will be more art than luck.

Market Dynamics: Tariffs and Turmoil

The altcoin market isn’t operating in a vacuum. President Trump’s announcement of impending 25% tariffs on Canadian and Mexican imports, reiterated on February 24, has spooked global markets, including crypto. The fear of inflation and economic ripple effects has driven a risk-off sentiment, dragging Bitcoin below $95,000 and Ethereum to $2,500 earlier this week. Altcoins, often more volatile than their bigger siblings, have felt the sting acutely. Yet, trading volumes suggest a silver lining, activity is up, hinting that savvy traders are eyeing the dip as an entry point. This interplay between macroeconomic policy and crypto markets underscores how altcoins are increasingly tethered to broader financial currents, for better or worse.

Robinhood’s Crypto Push: Altcoins on the Move

On a brighter note, Robinhood’s expansion into crypto is making waves. The fintech giant is set to launch crypto products in Singapore this year, building on its recent integration of Coinbase’s Layer 2 Base for Ethereum and USDC withdrawals. This move signals growing mainstream adoption, potentially boosting altcoins tied to Ethereum’s ecosystem. As traditional finance players like Robinhood bridge the gap with crypto, altcoins with practical applications think Polygon (MATIC) or Avalanche (AVAX) could see heightened demand. It’s a reminder that infrastructure and accessibility remain key drivers of altcoin success.

The Road Ahead

Today’s altcoin news paints a picture of a market at a crossroads. The Bybit hack has exposed vulnerabilities, yet Uniswap’s regulatory reprieve and Robinhood’s ambitions hint at resilience and growth potential. Meanwhile, expert predictions like Ju’s suggest a maturing market where quality trumps hype. The takeaway is clear for investors: volatility is a given, but opportunity abounds for those who can navigate the noise. As altcoins jostle for relevance in 2025, the winners may not be the loudest, but the most enduring. Whether you’re eyeing a dip or betting on a breakout, the altcoin saga is far from over, it’s just getting started.

Stay tuned! MevX keeps updating the newest news in the crypto world!

Share on Social Media: