Staking on Ethereum has gained considerable momentum since the network recently made its transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). Through the transition, ETH holders are now able to actively contribute to the security of the network through the process of staking their assets so they may validate transactions, support the network, and get rewards. This article will take a closer look at ways one can stake Ethereum, describing each staking method and the pros or cons that come with each approach.

Ethereum Staking

What is Ethereum Staking?

Ethereum staking is the process of locking up ETH as part of a contribution to the security of the network and the process of validating blockchain transactions. Through staking, holders of ETH become validators, or those participants in the network who are responsible for proposing and verifying blocks in return for rewards. The Ethereum protocol enforces strict penalties against malicious behavior by validators to ensure that they act honestly, such as attempting to change transaction data or double-spend. This system not only protects the security of the network but incentivizes validators with rewards proportionally to the amount staked.

Why Stake Ethereum?

The most active key elements to support Ethereum network security, decentralization, and further sustainability are staking. Validators participating in staking lock Ethereum against possible attack vectors, make it reliable, and finally “green.” Here is why the process of staking is so valuable:

- Network Security: ETH staking provides a barrier to attacks since it would be prohibitively expensive for an attacker to accumulate the majority share of the network’s validating power.

- Earning Passive Rewards: Stakers receive rewards in ETH. These rewards are proportional to the increase in the number of stakers, network activities, or the amount they stake.

- Ecological Benefits: PoS is much less power-consuming than PoW, hence aligning with Ethereum’s goal of being eco-friendly.

However, staking comes with a great deal of consideration. Validators stand to incur penalties for going offline, misconfiguring their setup, or acting dishonestly. These penalties include losing part or all of their staked ETH in extreme cases, ensuring only committed validators participate.

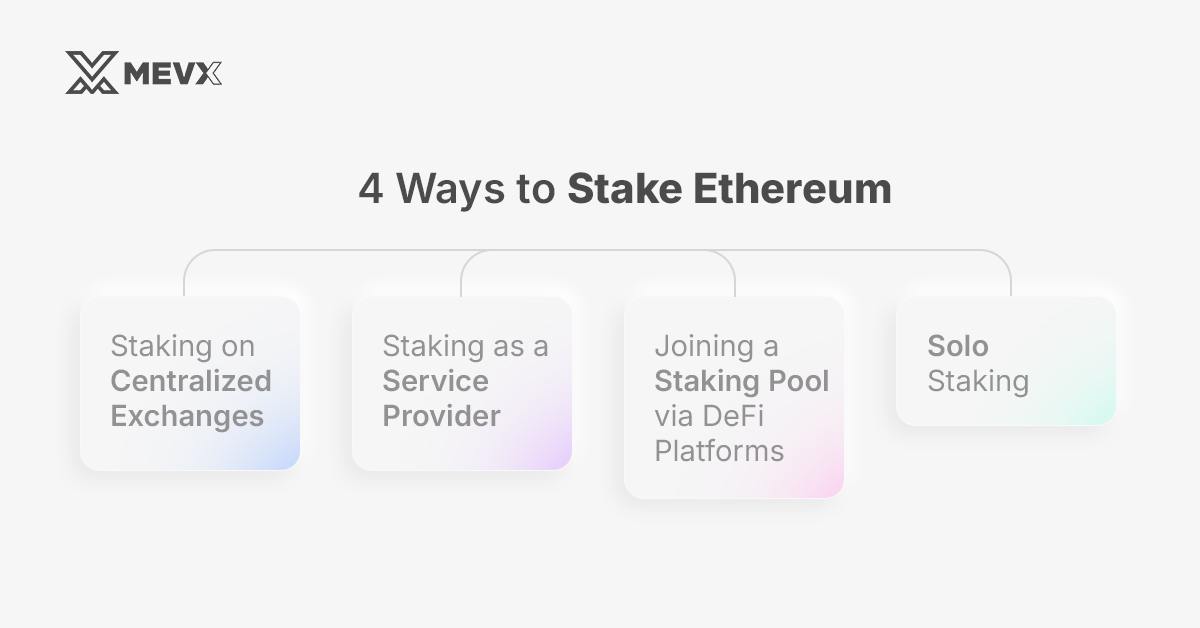

4 Ways to Stake Ethereum

Each of the staking procedures differs in some way from others regarding accessibility, control, and technical requirements. This is what makes Ethereum staking so versatile. Let’s have a look at each of these options in more detail.

Ways to stake Ethereum

1. Staking on Centralized Exchanges

Staking on centralized exchanges is generally the easiest and fastest way for new users to stake ETH. Major exchanges, like Binance, Coinbase, and Kraken, offer staking services whereby a user may delegate their ETH to the service for staking, while the platform takes care of the technical aspects related to maintenance.

a. Requirements: Account in a centralized exchange; ETH balance on the exchange.

b. How to:

- Create an account at the exchange and log in or activate your account (if required).

- Deposit or directly buy ETH on the exchange.

- Navigate to the staking section of the platform and select ETH staking.

- Input the amount of ETH you want to stake and confirm.

- Earn rewards as the exchange stakes for you.

c. Pros:

- Convenience: Extremely minimal technical requirements; the exchange handles everything.

- Ease of Use: Excellent for total newbies or those who want pretty hands-off staking.

d. Cons:

- Lower Rewards: Rewards are shared with centralized platforms that take a cut of the staking reward.

- Custodial Risks: ETH kept on exchanges is at risk in terms of security and regulatory scrutiny. For a user to be able to use these services, the platform will have to be trusted with custody of his ETH.

2. Using a Staking-as-a-Service Provider (Non-Custodial Wallet Delegation)

Those who do not want to use an exchange can stake their ETH directly through staking-as-a-service providers, whereby they can retain their private keys. These service providers generally integrate via popular non-custodial wallets such as MetaMask or Ledger and abstract all the technical requirements for staking.

a. Requirements: A non-custodial wallet, e.g., MetaMask, Ledger; balance of ETH.

b. How to:

- Select a staking provider compatible with your wallet.

- Connect your wallet to the provider’s platform and enable staking delegation.

- Follow the step-by-step process for delegating your ETH to the provider’s validator nodes.

- Monitor rewards directly within your wallet interface.

c. Pros:

- Greater Control: Users retain custody of private keys, enhancing security.

- Easy Setup: No technical maintenance; node management is outsourced to the providers.

d. Cons:

- Lower Returns: Service fees decrease the net rewards.

- Trust in Provider: Users might rely on the provider to operate honestly and efficiently.

3. Joining a Staking Pool via DeFi Platforms

Decentralized finance (DeFi) platforms like Lido and Rocket Pool offer staking pools, which decrease the minimum entry requirement by introducing staking pools and adding flexibility through liquid staking. Liquid staking is a concept whereby even though your ETH is locked into staking, you receive ERC20 tokens representing your staked ETH that you can then use in any DeFi activities.

a. Requirements: A compatible non-custodial wallet to connect to the DeFi platform.

b. How to:

- Choose a DeFi platform offering Ethereum staking pools, such as Lido or Rocket Pool.

- Connect your wallet to the platform.

- Deposit ETH into the staking pool shared with other stakers.

- Receive liquid staking tokens (like stETH issued by Lido) representing your staked ETH, allowing you to trade or invest while earning staking rewards.

c. Pros:

- Low Minimum Deposits: Suitable for users with less than 32 ETH.

- Liquidity: Liquid staking tokens allow flexibility for other investments.

d. Cons:

- Protocol Risk: Staking pools are based on the security of the DeFi platform.

- Potential Lower Returns: Pool fees may reduce staking rewards.

4. Running a Validator Node (Solo Staking)

Running a validator node provides total control and yields the highest rewards. It requires a minimum of 32 ETH to be staked and hardware capable of reliably processing transactions.

a. Requirements: 32 ETH, a computer with reliable internet, and technical knowledge.

b. How to:

- Set up a powerful computer with a minimum of 16GB RAM, or higher, and storage; preferably SSD, 2TB or more.

- Install the necessary software: Download the Ethereum client software from vendors like Geth, and run a validator setup.

- Generate validator keys and set up your node.

- Maintain uptime by monitoring logs, updating software, and keeping the hardware online to avoid penalties.

c. Pros:

- Highest Rewards: The reward for solo staking is the highest.

- Full Control: Nobody else is involved; you are responsible for your ETH and node.

d. Cons:

- High Technical Barriers: It requires knowledge of technical stuff and good hardware.

- Penalty Risks: Unproductive events or misconfiguration that result in a ban or reduction.

Key Benefits of Ethereum Staking

Ethereum staking offers numerous advantages to participants, including:

- Passive Income Generation: Income will be rewarded to the participants who stake ETH without active trading.

- Network Security: Validators are part of the network security and decentralization mechanisms.

- Governance Power: Through staking, an individual can vote on proposals that concern the future of the network’s development and upgrades.

- Ecological Sustainability: The PoS model is more environment-friendly compared to the PoW.

- Capital Appreciation: The staked ETH might appreciate as Ethereum matures.

Potential Risks of Ethereum Staking

Staking ETH is not without its dangers, and these also need to be considered with caution:

- Market Volatility: All the price fluctuations of ETH may have an impact on the value of the staked assets.

- Liquidity Constraints: The staking could lock ETH up for extended periods, especially in solo staking.

- Technical Risks: The solo stakers themselves are expected to maintain their hardware up and running to avoid penalties.

- Penalties: Validator going offline or trying any malicious action, slashing is a real threat.

Choosing the Right Staking Method

When deciding how to stake ETH, consider the following factors:

- Deposit Requirements: This ranges from 32 ETH on solo staking to flexible amounts in staking pools.

- Technical Skills: The most technically challenging is solo staking, while exchange staking is easily done even by beginners.

- Staking Fees: These change across different platforms, which, in turn, change the net returns.

- Liquidity Needs: Liquid staking through DeFi platforms is much more flexible than locking your staked assets.

- Platform Security: Make sure the security of the chosen platform is reliable enough to keep your ETH safe.

Conclusion

Ethereum staking allows anyone to actively participate in securing the network and earning rewards. From the centralized exchanges, staking-as-a-service, and DeFi pools to operating a validator node, each methodology has its own advantages and risks. Ultimately, the right choice depends on one’s ETH holdings, technical expertise, and risk tolerance. By staking Ethereum, you are not only earning passive income but also baking the future growth and security of the Ethereum Network.

Share on Social Media: