Meme Coins Tutorial introduces you to the fast-paced world of meme coins, a high-risk, high-reward corner of cryptocurrency. Born from internet humor and cultural trends, these coins have become a serious trading avenue. Whether you’re new to crypto or an experienced trader, this guide will help you set up, understand strategies, and navigate the risks to trade meme coins confidently in 2024.

What Are Meme Coins?

Meme coins are a class of cryptocurrencies that trace their creation back to internet memes or other viral phenomena. Intrinsically, they have no value or technological use case but only a derived value from community-driven hype and relevance to the culture. Examples include Dogecoin and Shiba Inu, which proved even humor could be a financial opportunity.

Meme Coins Tutorials: How To Start Trading Meme Coins

To start trading meme coins effectively, follow these steps:

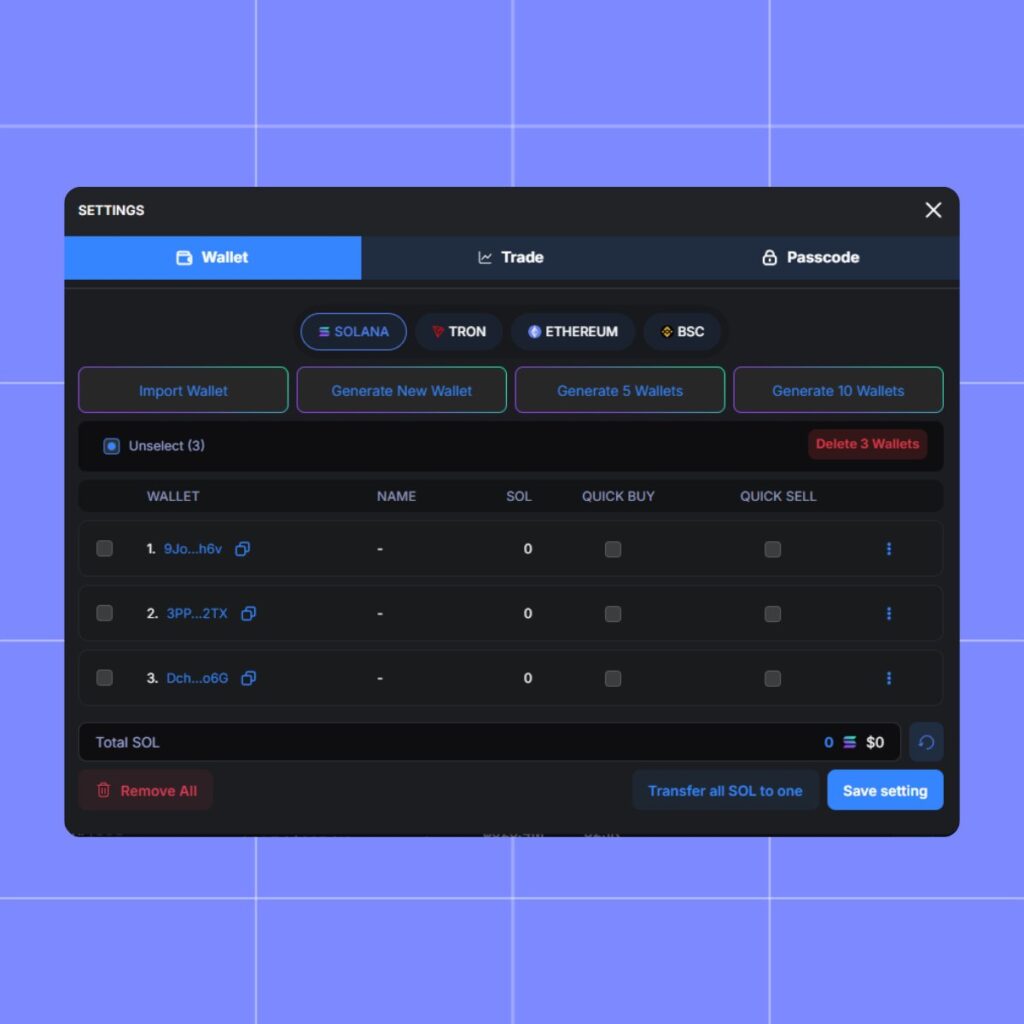

1. Set Up a Dedicated Wallet

Create a fresh cryptocurrency wallet exclusively for meme coin trading. The best blockchain for meme coins, currently, is Solana. We recommend you check out our guide on How to set up a Solana wallet.

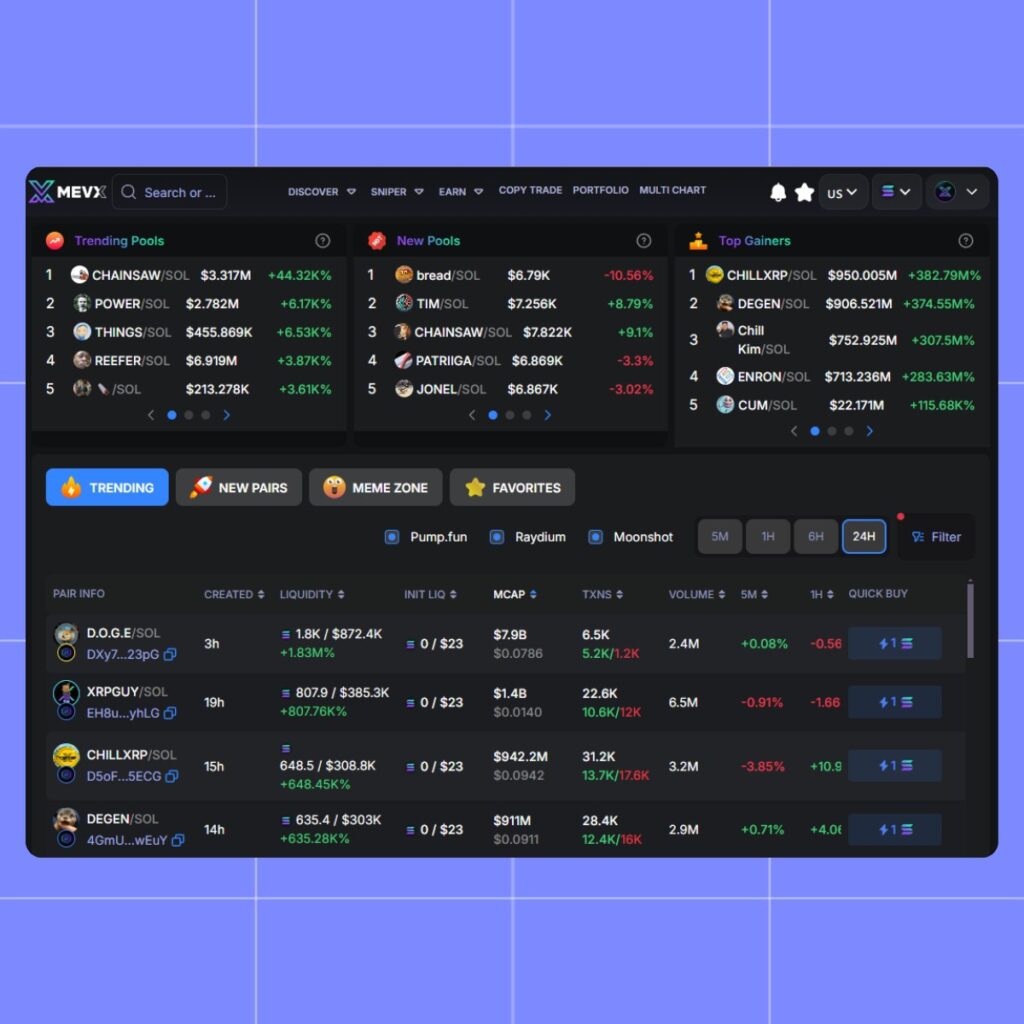

2. Choose the Right Trading Platform

There are many platforms specialized in meme coins trading. However, the only platform that supports multiple chains at incredibly high speed and with cheap fees is MevX. Check out our MevX Login article to begin your journey.

How Much Should You Invest?

Trading meme coins is inherently risky, so always invest an amount you can afford to lose.

- Key Rule: Allocate funds for learning rather than expecting guaranteed returns.

- Be Prepared: Losses are common, so focus on the experience and fun. Gains will follow with smart strategies.

Managing Investments in Meme Coins

1. Sizing Your Buys

Adopt a structured approach to limit exposure:

- Spend 1–5% of your bankroll per coin. Spending too much on a single coin increases your exposure to potential losses, especially in a high-risk market like meme coins.

- For example, with 100 SOL, spend:

- 1 SOL for low confidence.

- 3 SOL for medium confidence.

- 5 SOL for high confidence.

Tools like MevX can help customize these allocations easily.

2. Avoid Overtrading

- Such overtrading behavior would be initiated by just the thought of FOMO or even panic if prices are falling in cases like meme coins, which usually inspire investors with emotional feelings. Such overtrading actions can surely end in rapid profit erosion and avoidable losses.

- Avoid reacting to every market swing. Stick to your strategy to prevent losses.

Timing Your Buys: The Art of Entry

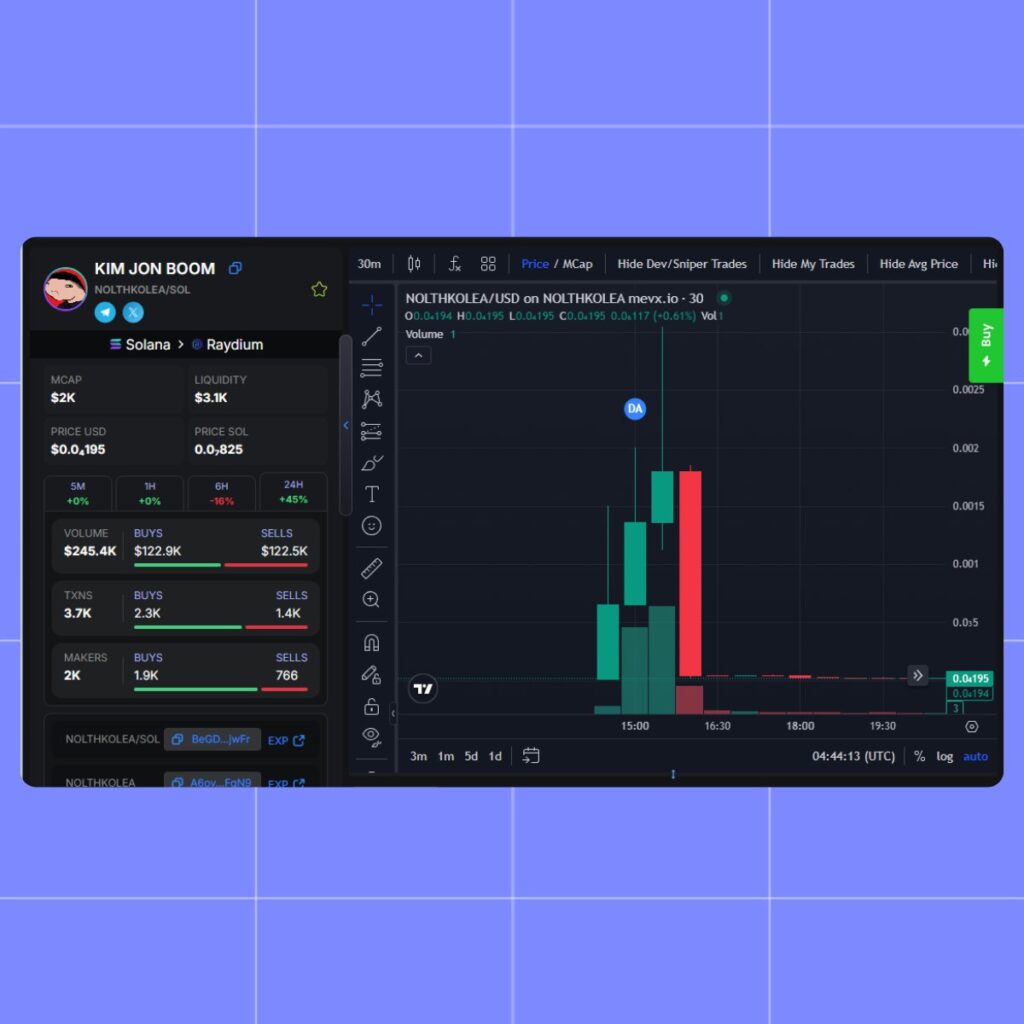

Market Cap Considerations

- Low Market Cap (<$50k): Offers higher risk but the potential for rapid 3x–5x returns. Best suited for short-term trades.

- High Market Cap (> $1M): More stable but with lower immediate growth potential. Ideal for longer-term holds.

Avoid Chasing Green Candles

Buying during a pump can lead to losses. Patience pays off; wait for better opportunities.

Rug Pulls: Understanding the Risks

Rug pulls are common in meme coins trading. This occurs when developers remove liquidity from the pool, leading to significant losses for investors. Here’s how to mitigate them:

- Liquidity Lock Less Than 100%: This means the developers cannot withdraw liquidity. Tools like MevX provide this information directly.

- Realistic Analysis: Scrutinize developer activity and project hype.

- Common Red Flags: Anonymous developers, vague roadmaps, and unrealistic promises.

How to Sell Meme Coins: Exiting the Market

Selling meme coins can be as tricky as buying them. Follow these tips in our meme coins tutorial:

- Take Profits Early: Aim to recover your initial investment when the coin’s value doubles (2x) or triples (3x). This ensures that any remaining holdings are effectively “house money,” reducing stress and emotional attachment to the trade.

- Sell in Chunks: Selling your holdings in portions rather than all at once is a practical strategy for maximizing returns while minimizing negative impacts on the market price.

General Tips for Meme Coin Beginners

- Always Another Opportunity: Never sweat the losses; new coins come up every day.

- Avoid Get-Rich-Quick Thinking: Focus on steady, informed decision-making.

- Community Engagement: Join the telegram groups and Twitter groups to learn.

Advanced Insights for Meme Coin Trading

- Simplicity Wins: Memes are usually easy to understand and make plenty of sense. Complex or very narrowly niched concepts cannot rally the greater community.

- Utilize the Right Tools: Specific tools, such as MevX, made life easier with real-time market data, deep analytics, and customizable trading options.

- Be Chronically Online: Timely participation is a competitive advantage.

- Avoid Derivative Memes: Originals tend to outperform copycats. You should always research if the coin is the original version to invest in.

Common Meme Coin Terminology

Familiarize yourself with these key terms:

- Trenches: Low market cap trading while engaging in community chats.

- Dev: The coin’s developer.

- MC: Market cap.

- Jeet: Selling a coin abruptly.

- KOL: Key opinion leader in crypto spaces.

- MEV Bot: A bot that front-runs trades for profit.

Conclusion

Trading meme coins requires strategy and knowledge of their community and culture. Websites like MevX make it all so much easier, while disciplined budgeting and smart timing minimize the risks. Though meme coins can return some incredible dividends, none of them are completely free from hiccups. Take this meme coins tutorial as your map through the minefield of this amazing, yet very, very unpredictable market in 2024.

Start small, read up, and above all else, have fun.

Share on Social Media: