In the ever-evolving cryptocurrency ecosystem, the pursuit of passive income has become a strategic goal for many investors. Amid the various methods to grow digital assets, BNB staking stands out as a reliable and lucrative option. This guide takes you through the ins and outs of staking Binance Coin (BNB), from understanding its mechanics to strategies that can help you maximize your returns.

What is BNB Staking?

Staking is a mechanism that allows cryptocurrency holders to lock up their assets, enabling them to participate in blockchain operations like validating transactions. In return, participants earn rewards—creating a steady income stream. Although Binance Coin (BNB) is primarily associated with the Binance Chain and BNB Smart Chain’s Proof-of-Stake Authority (PoSA) model, staking options have broadened thanks to advancements like Delegated Proof-of-Stake (DPoS).

How Does BNB Staking Work?

While BNB does not natively operate on a traditional Proof-of-Stake (PoS) model, third-party platforms and services have innovated ways to offer staking. These include liquid staking and pooled staking options, where participants delegate their tokens to validators or a stake through custodial platforms that handle technicalities on their behalf. This democratization of staking ensures that even those without technical expertise can benefit.

Why Should You Stake BNB?

1. Earn Passive Income:

Staking BNB creates a consistent income stream without requiring active trading or constant market monitoring. This “set-it-and-forget-it” approach is perfect for investors looking to grow their portfolios with minimal effort.

2. Strengthen Blockchain Security:

Your staked BNB helps maintain the efficiency and security of the Binance ecosystem. By staking, you contribute to the network’s decentralization and integrity.

3. Achieve High Returns:

Many staking platforms offer Annual Percentage Yields (APY) ranging from competitive to exceptionally high rates. Depending on the platform and terms, these returns can significantly amplify your initial investment.

4. Lower Risk Alternative to Trading:

Crypto trading can be volatile, with rapid market fluctuations leading to potential losses. Staking provides a stable and predictable income source, making it a less risky option for long-term holders.

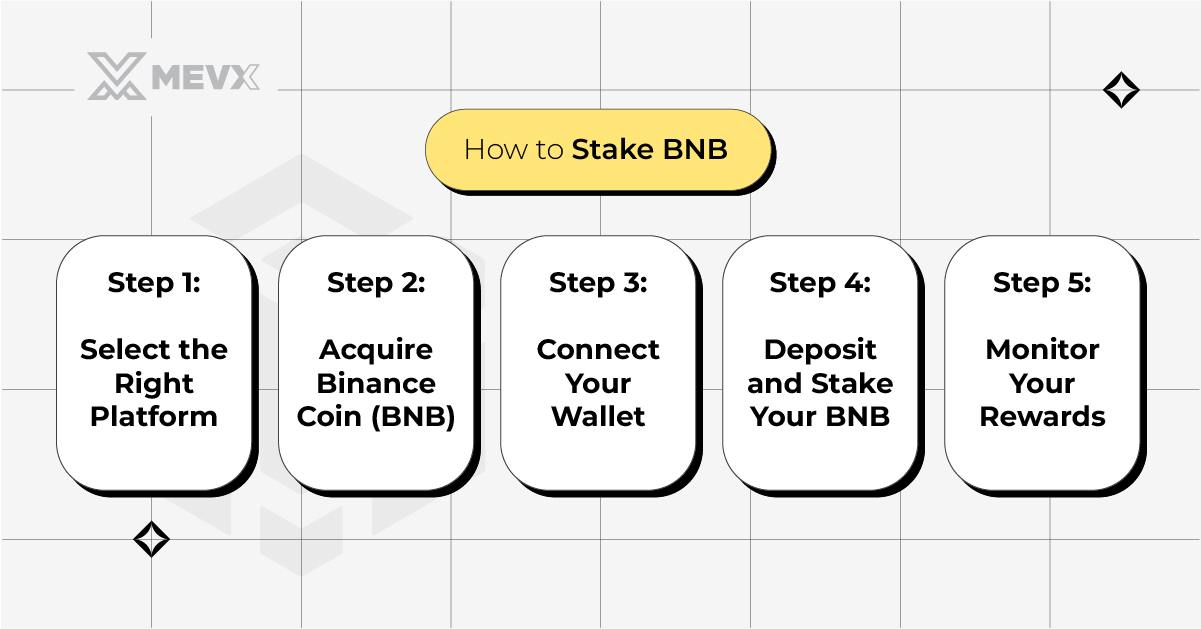

How to Stake BNB

The following basic steps show how to stake BNB effectively

Step 1: Select the Right Platform

Choosing a reliable staking platform is crucial for ensuring security and maximizing rewards. Here are some popular platforms:

- Binance: The most direct option for staking BNB, offering flexible terms and competitive APY rates.

- Ankr: Known for liquid staking, it lets you earn rewards while maintaining the liquidity of your staked assets.

- Trust Wallet: A decentralized and mobile-friendly option for staking directly from your wallet.

- Stader Labs: A growing platform offering innovative staking solutions, including auto-compounding rewards.

When selecting a platform, evaluate factors like reputation, user experience, fees, and customer support.

Step 2: Acquire Binance Coin (BNB)

To start staking, you’ll need BNB tokens. Purchase them from reputable exchanges like Binance, Coinbase, or Kraken. If you already own BNB, transfer it to a secure wallet compatible with your chosen staking platform.

Step 3: Connect Your Wallet

Most platforms require you to link your crypto wallet. Popular wallets like BNB Chain Wallet, MetaMask, Trust Wallet, and Ledger are widely supported. During this process:

- Double-check platform URLs to avoid phishing sites.

- Follow the connection prompts carefully to ensure a secure link between your wallet and the platform.

To set up your wallet, see Setting Up a Wallet for BNB Chain: A Step-by-Step Guide

Step 4: Deposit and Stake Your BNB

Transfer the required amount of BNB from your wallet to the staking platform. Once deposited:

- Navigate to the staking section and select BNB.

- Review the staking terms, including APY, lock-up periods, and potential withdrawal penalties.

- Confirm the transaction to initiate staking.

Step 5: Monitor Your Rewards

Regularly check your staking dashboard for updates on rewards and performance. Some platforms, like Binance and Ankr, offer tools for tracking rewards in real time. Staying engaged allows you to reinvest or adjust your staking strategy as needed.

Maximizing Your BNB Staking Rewards

- Diversify Your Staking Portfolio: Spreading your investments across multiple cryptocurrencies and platforms can mitigate risks while unlocking varied earning opportunities. For instance, you might complement BNB staking with Ethereum, Cardano, or Polkadot staking.

- Reinvest Your Earnings: Compounding is a powerful tool for growing your crypto assets. By reinvesting your staking rewards, you can increase your overall stake, which leads to higher future rewards. Some platforms even offer auto-compounding features to streamline this process.

- Leverage Flexible Staking Options: Many platforms provide both short-term and long-term staking options. Short-term plans offer quick access to funds but lower returns, while long-term plans generally offer higher APY rates. Align your choice with your financial goals and liquidity needs.

- Stay Informed About Market Trends: Keeping up with market news and network updates can give you an edge. For example, staking during low network participation periods can increase your rewards.

Maximizing Earnings with Staking, Launchpool, and Launchpad

While staking provides a reliable income stream, Binance takes it further with Binance Launchpool and Binance Launchpad, two exclusive platforms designed to enhance your crypto investment experience.

Binance Launchpool

This platform allows users to stake BNB and other assets to farm new cryptocurrency tokens. Launchpool is a perfect complement to staking, enabling users to diversify their portfolios with minimal risk.

- Farm New Tokens: Stake your BNB to earn rewards in the form of tokens from new projects.

- No Lock-Up Required: You can withdraw your tokens at any time.

- Early Access: Launchpool participants often get tokens before they’re listed on major exchanges.

Binance Launchpad

Binance Launchpad offers users the chance to participate in token sales for new blockchain projects. With BNB, you can gain early access to tokens from projects carefully vetted by Binance.

- Invest in the Future: Buy tokens at their initial offering price.

- Exclusive Opportunities: Many projects launched on Launchpad have seen exponential growth.

- Use Your BNB Wisely: The amount of BNB you hold often determines your allocation for these token sales.

By combining staking, Launchpool, and Launchpad, BNB holders can build a diversified portfolio and participate in some of the most promising opportunities in the crypto space.

For more information, explore Unlocking Crypto Potential With Binance Launchpad and Launchpool

Managing Risks in BNB Staking

Minimizing risks is crucial for successful BNB staking. Follow these strategies to protect your assets and maximize returns.

- Secure Your Wallet and Private Keys: Use wallets with robust security features and never share your private keys or recovery phrases. Enable two-factor authentication (2FA) for added protection.

- Thoroughly Vet Platforms: Research the reputation, security measures, and terms of the platform before committing your assets. Avoid platforms with unclear policies or unrealistic reward promises.

- Diversify Strategically: Don’t put all your eggs in one basket. By diversifying your stakes, you reduce exposure to platform-specific or token-specific risks.

- Be Cautious of Scams: Verify URLs, avoid suspicious links, and always use official websites or apps to access staking services.

Understanding APY and Staking Rewards

What is APY?

Annual Percentage Yield (APY) reflects the annualized return on an investment, including compounding effects. Factors influencing APY in BNB staking include:

- Lock-Up Periods: Longer durations often yield higher APY.

- Network Activity: Rewards may fluctuate based on the number of stakers and network performance.

- Market Dynamics: Supply-demand economics of BNB can affect the overall returns.

How to Maximize APY

Participate during high network activity but low competition periods. Additionally, consider platforms with dynamic reward structures to capitalize on favorable conditions.

Conclusion: Make the Most of Your BNB Holdings

Staking BNB is not only a profitable investment strategy but also a meaningful contribution to the blockchain ecosystem. Whether you’re a crypto novice or a seasoned trader, staking offers an accessible way to earn consistent rewards while minimizing risks.

With platforms like Binance, Ankr, and Stader Labs leading the way, there’s never been a better time to explore the potential of BNB staking. Start staking today and watch your crypto portfolio grow—one reward at a time!

Share on Social Media: