In today’s crypto market recap, the cryptocurrency landscape shows mild volatility amid macroeconomic pressures. Bitcoin (BTC) hovered between $113,000 and $114,000, dipping 1-2% in the last 24 hours, while Ether (ETH) surged 5-6% before correcting.

Key Regulatory Developments in Crypto Market Recap

The total crypto market cap stands at around $4.1 trillion, with BTC dominance at 56%, signaling capital concentration in major assets.

The Fear & Greed Index lingers in “Fear” territory (25-30), influenced by upcoming events like Fed Chair Jerome Powell’s Jackson Hole speech and FOMC minutes.

Bitcoin ETF outflows reached $100-200 million, adding downward pressure, yet analysts eye buying opportunities at $107,000-$110,000 support.

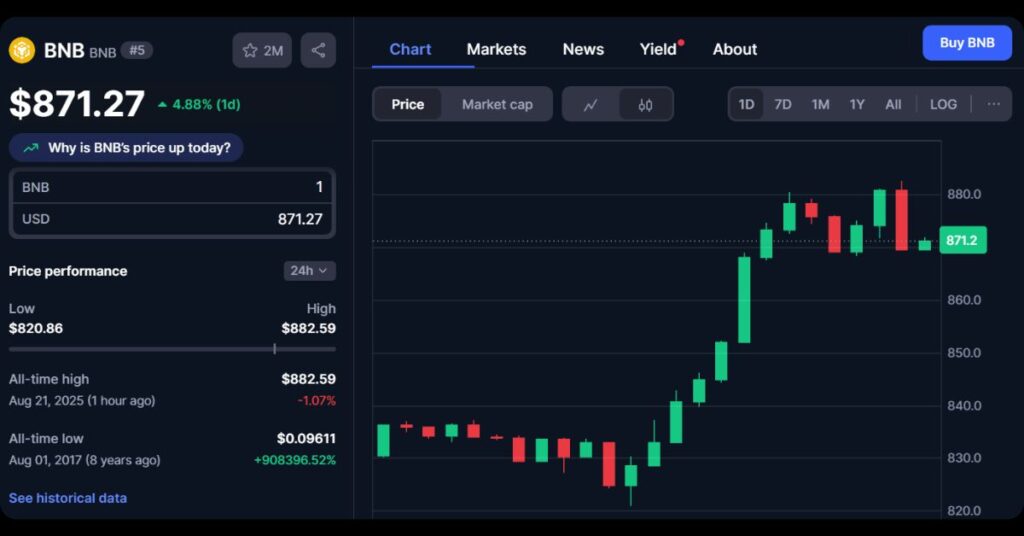

Liquidations exceeded $460 million, mostly long positions, with altcoins like XRP and Solana risking 20-25% drops, while BNB hit a new high of $873.

Regulatory shifts are reshaping the crypto market recap narrative:

- China’s Potential Stablecoin Approval: Beijing may greenlight a CNY-pegged stablecoin to internationalize its currency, marking a policy pivot.

- Brazil’s Bitcoin Reserve Debate: A public hearing discusses adding BTC to national reserves, though central bank officials oppose it.

- U.S. Fed’s Crypto-Friendly Stance: Fed Atlanta President Raphael Bostic urges banks to serve crypto without fear of penalties, emphasizing fintech opportunities. Advocacy groups push for swift stablecoin legislation to avoid lagging behind the UK and Japan.

- UK Sanctions on Russian Crypto Networks: Targeting Kyrgyzstan-based entities aiding Russia in evading Western sanctions.

Meme Coin Highlights

- $YZY (YZY/YZY): Experienced explosive growth, reaching $3 billion market cap, fueled by celebrity endorsements and community hype.

- $HOLYPUMP (Holy Pump): Narrative revolves around divine intervention in crypto pumps, blending religious memes with speculative trading excitement.

- $LIGHT (Light): Achieved consistent growth through viral marketing, expanding holder base, and integrating into Solana’s DeFi ecosystem.

- $DARK (DARK): Saw substantial market cap increase, driven by dark humor themes and strategic listings on major DEX platforms.

- $TROLL (TROLL): Demonstrated remarkable resilience, surging over 170,000% with strong community engagement and influencer support.

- $Kanye (Kanye Hayden West): Centers on celebrity culture parody, mocking fame while attracting fans through satirical Kanye-inspired storytelling.

- $bork (Binance gork): Playful dog meme narrative emphasizing fun, community bonding, and rebellion against traditional finance norms.

- $THUNDER (THUNDER): Evokes powerful storm themes, symbolizing rapid price surges and electrifying market disruption potential.

- $EMMY (Emmy): Narrative highlights award-show glamour parody, celebrating crypto wins with humorous red-carpet style events.

- $YZY (YZY): Recorded impressive valuation spikes, growing from microcap to millions via Kanye West association and viral promotions.

- $LYN (Lyn): Maintained a steady upward trajectory, benefiting from cross-chain expansions and dedicated holder loyalty programs.

- $ORGANIC (ORGANIC): Focuses on eco-friendly farming satire, promoting natural growth metaphors in volatile crypto markets.

- $SINS (SINS): Explores redemption themes through confession-style community interactions, blending guilt with profitable trading jokes.

- $PMP (PMP): Narrative mocks the pharmaceutical industry, using pill metaphors for quick gains in meme coin speculation.

- $imperfect (imperfect): Gained traction by embracing flaws, fostering inclusive community growth, and anti-perfectionist crypto culture.

Institutional Investments Driving Crypto Market Momentum

Institutional activity bolsters the crypto market recap:

- Winklevoss Twins’ $21M BTC Donation: Supporting a pro-Trump PAC to promote crypto-friendly policies, potentially boosting BTC to $200,000 by year-end.

- Corporate BTC Accumulations: MicroStrategy added 430 BTC ($51.4M), totaling 629,376 BTC; Japan’s Metaplanet bought 775 BTC ($93M), reaching 18,888 BTC.

- Nubank’s Bitcoin ETF Launch: Brazil’s digital bank introduces a BTC futures-based ETF on B3 exchange.

- Volkswagen Accepts Crypto Payments: In Singapore, including BTC, ETH, USDT, and USDC for vehicles and services.

Market Forecasts and Technological Innovations

Optimistic projections highlight the crypto market recap:

- Coinbase CEO’s Bold BTC Prediction: Brian Armstrong forecasts BTC hitting $1 million, driven by AI integration and favorable regulations.

- Harvard Economist’s Reversal: Acknowledges error in predicting BTC’s collapse to $100, now viewing it as stable.

- Stablecoin Growth Outlook: U.S. Treasury sees them reaching $2 trillion, becoming major Treasury bond buyers; Goldman Sachs predicts trillions in market size.

On the tech front:

- 0G Labs Praised by Forbes: For solving blockchain scalability with AI without compromising decentralization.

- Binance’s Beacon Network: A rapid-response system against crypto crimes, detecting issues in minutes.

- Tokenization Advances: SkyBridge tokenizes $300M on Avalanche; xStocks expands Nvidia/Tesla stocks on Tron.

Overall, while macro factors weigh on prices, regulatory progress and institutional inflows signal potential recovery if the Fed cuts rates.

Stay updated with the latest crypto news by following our MevX blog for daily insights and analysis!

Share on Social Media: