TLDR:

- Market: Aster ($ASTER) reached a $700M market cap ATH and $3B+ perp daily volume and is able to keep pace with Hyperliquid’s TVL.

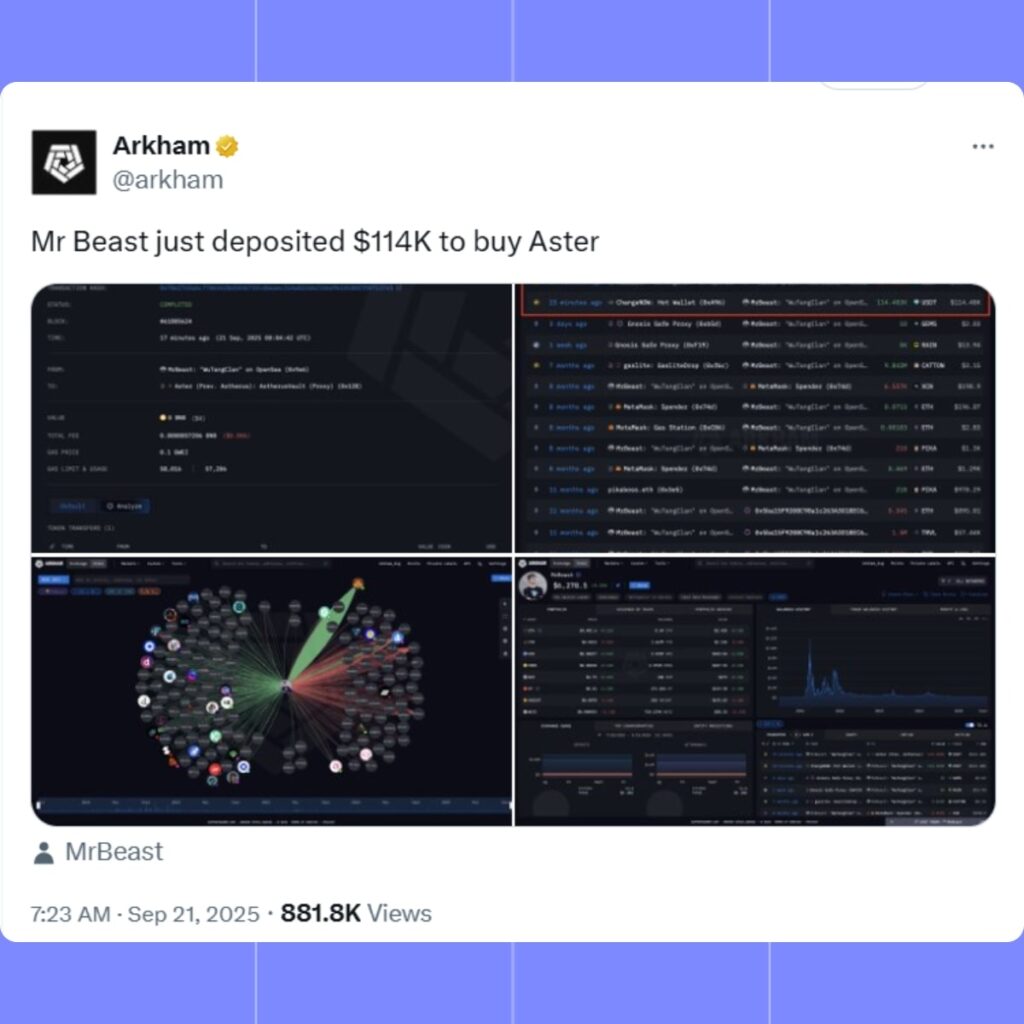

- Narrative: $ASTER’s meteoric ascent, in relation to the reported $114K purchase by MrBeast and validation by CZ, experienced a sudden demise in the reported $20K loss exit, prompting competition vs. Hyperliquid.

In September 2025, perpetual’s DEX token on BNB Chain and Arbitrum, Aster ($ASTER), launched sneakily on 17 September and reached a $700M market cap on 21 September following a 2,100% rally to $1.97 and is currently trading at ~$1.40. Supported by CZ’s YZi Labs, it competes against Hyperliquid, leading sovereign-chain perps, and while Hyperliquid’s $13.63B in daily volume leads Aster’s $3B+, Aster’s low-cost, cross-chain appeal and CZ’s reputation threaten to topple Hyperliquid’s supremacy, as both set their sights on the $100B+ DeFi derivatives market.

The $ASTER narrative exploded when Arkham flagged MrBeast’s “WuTangClan” wallet depositing $114K (5.57M $ASTER at $0.20) on September 21, sparking a 1,800% pump. CZ’s emojis and YZi Labs’ involvement, plus whale “Cooker Flips” turning $1.24M into $6.7M, fueled FOMO. But on September 21-22, on-chain data suggested MrBeast sold at $1.65, locking a $20K loss from $94K proceeds, per X posts from @0xEthanDG and @anilsingta. MrBeast denied it—“Not my wallet, never doing a meme coin”—amid 2024 pump-and-dump allegations ($23M profit). CZ’s other investments, like ASTER and past Binance ventures, amplify his DeFi influence.

Aster’s $3B+ perp volume holds strong, but the dip to $1.40 (down 30% from ATH) sparked “top signal” memes. Hyperliquid’s edge lies in its $110.11M monthly revenue and USDC integration, yet Aster’s CZ-backed momentum keeps it competitive. Investors should watch volume and MrBeast’s next move—real loss or not, this saga’s a crypto rollercoaster.

Read more crypto narratives on the MevX Blog!

Share on Social Media: