TLDR:

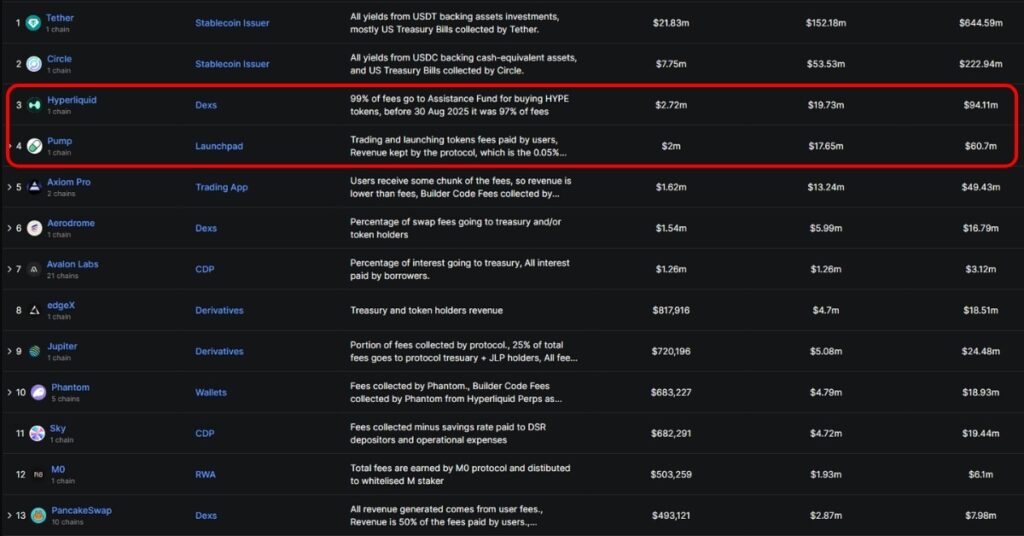

- Market: Hyperliquid’s HYPE token surged to an all-time high (ATH) of $59.29 with a market cap close to $19.5B based on $13.63B volume of 24-hour perpetuals and $2.75M protocol revenue, beating out pump.fun’s $2M.

- Narrative: Hyperliquid is currently dominating pump.fun in 2025, with its daily revenue of $2.75M exceeding pump.fun’s $2M fueled by robust perpetuals trading and directional expansion like integration of USDH and USDC.

Hyperliquid is stealing the spotlight in 2025 with its native token HYPE hitting a new all-time high of $59.29 on September 18, 2025, and a market value of nearly $19.5B. DefiLlama data as per BlockBeats news on September 19 reveals that Hyperliquid’s protocol revenue hit a staggering $2.75M in the past 24 hours and led pump.fun’s $2M and took the second spot after Tether ($21.83M) and Circle ($7.75M). With $13.63B in perpetuals volume for 24 hours and $335.56B in 30 days, Hyperliquid’s Layer 1 perpetual DEX, with up to a 50x advantage, clearly overpowers pump.fun’s memecoin focus.

The $HYPE narrative is based on such outperformance, led by Hyperliquid’s hegemony over perpetuals trading, beating pump.fun’s $2M revenue with a 50% differential. Strategic action such as Native Markets’ winning of the bidding for USDH and Circle’s USDC integration through HyperEVM continue to stretch the lead. Arthur Hayes, BitMEX founder, hailed it “All-time Hype,” predicting a 126x potential if stablecoin revenue scales from $1.2B to $258B annually. Hyperliquid’s $110.11M August revenue—double pump.fun’s peak days—supports a $1.4B HYPE buyback of 31.06M tokens. Investors should track revenue trends and trading volume, keeping an eye on Hyperliquid’s lead over pump.fun.

Read more crypto narratives on the MevX Blog!

Share on Social Media: