In this crypto market recap, we dive into the latest developments shaking the cryptocurrency landscape on September 26, 2025.

The market experienced a mild to moderate correction over the past 24 hours, with total capitalization dipping between 0.1% and 4% to around $3.81T-$3.99T USD.

Crypto Market Recap – Overview

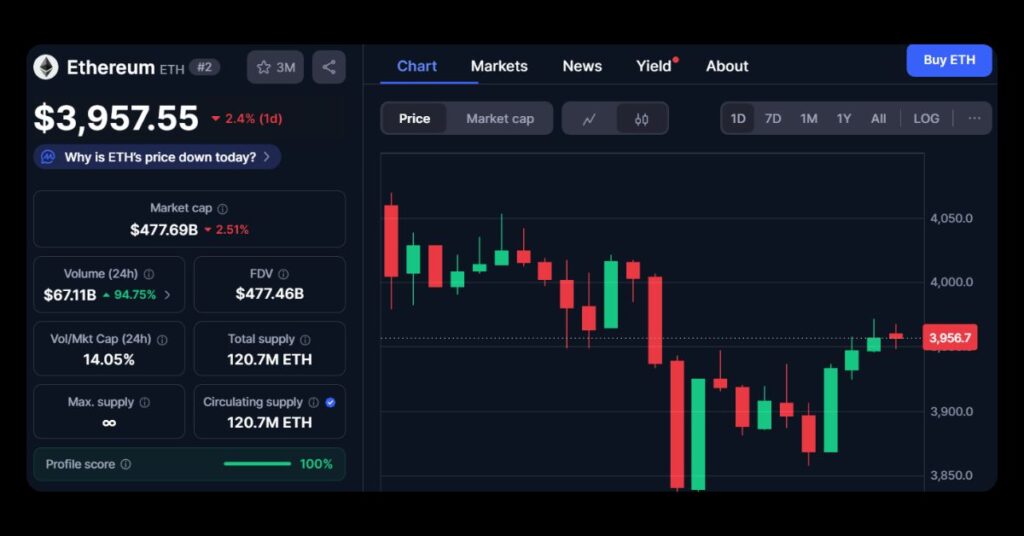

Trading volume held steady at $163B-$233B USD, while Bitcoin (BTC) hovered between $109K-$113K, down 0.79%-3.3%. Ethereum (ETH) saw steeper losses of 3.47%-5.7%, falling below $4K. Altcoins like Solana (SOL) and XRP dropped 6.5%-7% and 5%, respectively.

The Fear & Greed Index at 41 signals neutral sentiment, amid standout gains from tokens like Aster (up 24.8%-495% weekly), SafePal (24.3%), Fluid (26.2%-47.8%), and Zcash.

Key Market Shifts in Crypto Market Recap

- Market Crash and Liquidations:

- The crypto market lost $162B, fueled by over $400M in long liquidations, primarily ETH.

- BTC dipped below $111K and ETH under $4K, driven by U.S. government shutdown fears and ETF outflows.

- ETF Inflows and Approvals:

- Bitcoin spot ETFs saw $241M inflows (cumulative $57.25B), while Ethereum faced $79.36M outflows.

- The SEC approved the Hashdex Nasdaq Crypto Index ETF, including BTC, ETH, XRP, SOL, and XLM, boosting altcoin legitimacy and liquidity.

- Aster Mania Takes Center Stage:

- Aster’s 24-hour volume hit $24B-$29B with $2B TVL, surpassing Hyperliquid.

- Valued at $15B post-Binance endorsement, an airdrop is slated for October 5, challenging major DEXs and fueling DeFi buzz on Solana.

Meme Coin Highlights

- $PRICELESS (priceless): Community-driven token celebrating anticipated Q4 2025 crypto bull market surge.

- $Q4 (The Final Quarter): Meme coin hyping Q4 2025 as explosive quarter for crypto gains.

- $ASTERINU (Aster INU): Community meme token blending cross-chain connectivity with viral internet culture.

- $XPL (Plasma): Stablecoin-focused blockchain innovating with mainnet launch and zero-fee transfers.

- $ELIZABETH (Just Elizabeth Cat): Cat-themed meme coin driven by viral humor and community engagement.

- $PUMP500 (PUMP 500): Meme coin leveraging pump mechanics for rapid speculative community growth.

- $MERIDIAN (MERIDIAN): Emerging meme token riding 2025 narratives for high-volatility gains.

- $ASTER (Aster): Decentralized perpetuals exchange experiencing explosive post-launch market adoption.

- $RUG (mascot of the trenches): Satirical meme coin parodying crypto rug pulls and trench warfare.

- $TROLL (TROLL): Community-driven meme surging on viral hype and cultural predictions.

Regulatory and Innovation Updates

- Stablecoin Launches and Integrations:

- Hyperliquid debuted USDH stablecoin with initial $2M volume; CFTC allows stablecoins as derivatives collateral.

- Stablecoin market cap reached an all-time high of $294.56B. PayPal enabled direct P2P transfers for BTC, ETH, and more, enhancing mainstream adoption.

- European Banking Moves: Nine major EU banks, including ING and UniCredit, plan a MiCA-compliant Euro stablecoin launch in H2 2026, promoting regulated payments autonomy.

- Global Regulations: Australia proposes exchange licensing; U.S. Senate holds a crypto tax hearing on October 1; UAE sets 2027 crypto tax data exchange. These steps aim for clarity but may add short-term pressure.

Institutional Adoption and Tech Advances

- Corporate BTC Buys: Brazil’s OranjeBTC acquired 3.65K BTC ($385M); Jiuzi Holdings allocated $1B to crypto treasury; Thumzup Media plans $10M buyback in BTC/DOGE; MicroStrategy added 850 BTC, signaling long-term confidence.

- Ethereum Progress: Vitalik Buterin unveiled the “Fusaka” update with PeerDAS for scalability; ETH balances hit a 9-year low, hinting at reduced selling pressure.

- Other Innovations: Plasma (XPL) mainnet launched with 25M airdrop; Circle proposed reversible USDC for hack prevention; BNB validators suggest gas fee reductions; Tether eyes $20B raise for $500B valuation.

This crypto market recap underscores a pivotal moment: institutional accumulation persists amid retail caution, with volatility likely until PCE data and Fed decisions. Long-term trends remain bullish on adoption and clearer regulations.

For more timely crypto market recaps and insights, follow our MevX blog today!

Share on Social Media: