Recently, co-founder Vitalik Buterin announced the upcoming Fusaka update, a major hard fork set to revolutionize scalability. Named after the Japanese cities Fuji and Osaka, this Ethereum Fusaka Update promises to address long-standing bottlenecks, particularly through its core feature, PeerDAS (Peer Data Availability Sampling).

But that’s not all, amid this excitement, Ethereum’s ETH balances on centralized exchanges have plummeted to a nine-year low, signaling shifting investor behaviors. Could this be the dawn of a new era for the world’s second-largest cryptocurrency?

What the Ethereum Fusaka Update Means for Scalability

Scheduled for deployment on December 3, 2025, the Ethereum Fusaka Update follows the Pectra upgrade and is hailed by Buterin as Ethereum’s most significant scalability leap yet.

At its heart is PeerDAS, an innovative mechanism designed to handle the growing demand for data availability in Layer 2 (L2) rollups without overwhelming network nodes.

Here’s a breakdown of PeerDAS and its key benefits:

- Efficient Data Sampling: Nodes only need to download small “chunks” of data to verify that over 50% is available, using erasure coding to reconstruct the rest. This avoids the need for full data downloads, making the network more efficient.

- Gradual Blob Expansion: Starting with doubling the current 6 blobs per block to 12, the update prioritizes safety with cautious increases to prevent risks from this novel technology.

- Future-Proofing: Advanced features like cell-level messaging and distributed block building will enable near-limitless scaling, focusing first on L2 improvements before enhancing Layer 1 execution.

- Safety-First Approach: Buterin emphasized rigorous testing, drawing from years of research to ensure stability amid potential blob congestion, which is already nearing capacity.

This Ethereum Fusaka Update could drastically reduce costs and boost speeds for decentralized applications, paving the way for mainstream adoption. Experts view it as a critical step in Ethereum’s roadmap, potentially outshining competitors in scalability wars.

ETH Balances at Historic Lows: A Sign of Confidence?

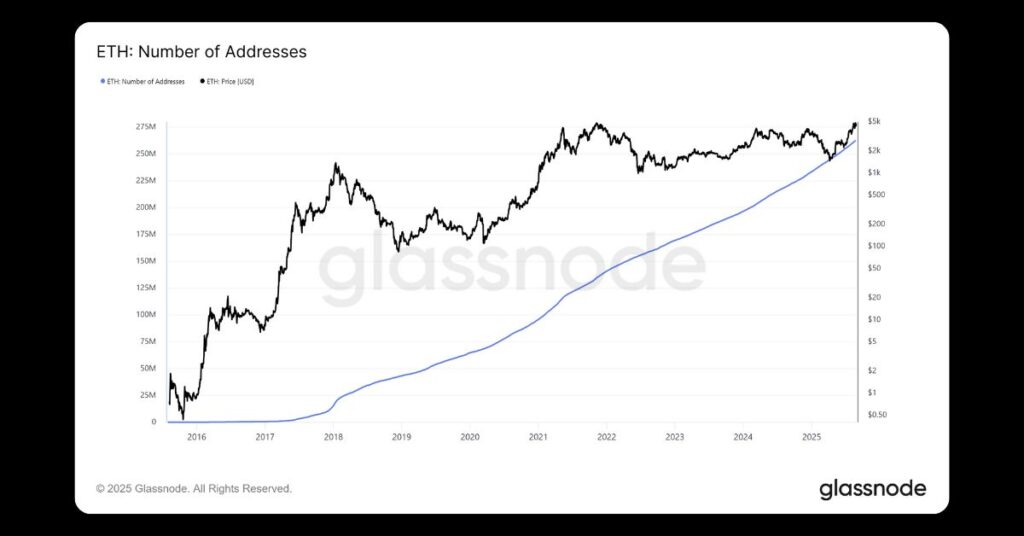

Parallel to the Fusaka buzz, ETH reserves on centralized exchanges have dipped to about 14.8 million tokens, the lowest since July 2016, per Glassnode data. This represents outflows of around 2.7 million ETH (valued at $11.3 billion) in just one month.

Analysts attribute this to institutional accumulation, with entities like ETFs and treasuries hoarding ETH for long-term holds. Long-term holders (LTH) are selling selectively but overall increasing stakes, creating a potential “supply shock” that could drive prices higher if demand surges.

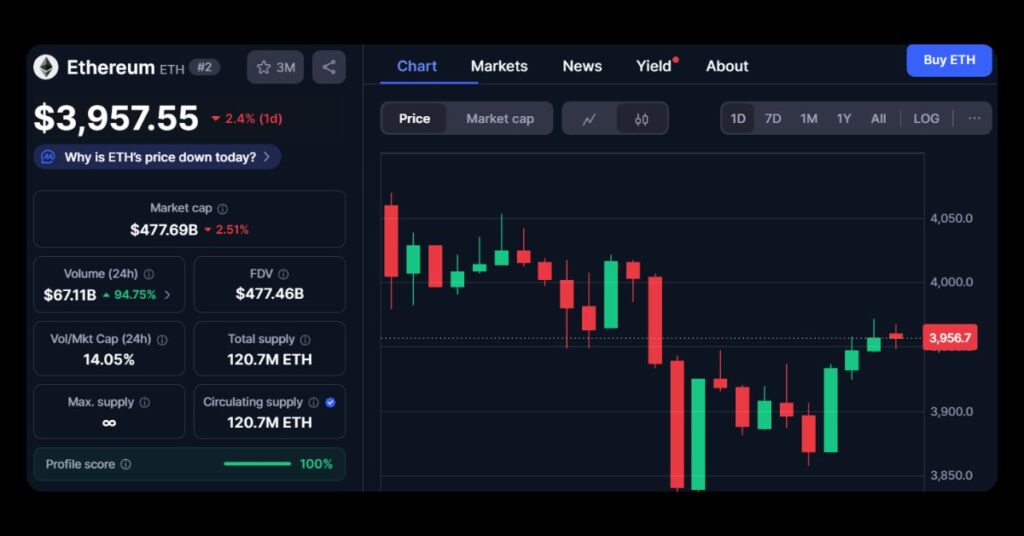

ETH’s price has stabilized above $4,000, with predictions from figures like Tom Lee eyeing $10,000-$15,000 by year-end. This trend reflects growing faith in Ethereum’s future, especially with upgrades like Fusaka on the horizon.

As Ethereum evolves, the Fusaka Update and dwindling ETH balances highlight a maturing ecosystem ready for broader impact. Whether you’re a developer, investor, or crypto enthusiast, these developments underscore the platform’s resilience.

Stay ahead of the curve. Follow our MevX blog for more in-depth crypto insights and updates!

Share on Social Media: