Ethereum has emerged as the largest blockchain platform for decentralized applications (dApps) and smart contracts, second in market capitalization only to Bitcoin. Understanding gas fees is a critical component of using Ethereum; these are costs users pay for the processing and validation of transactions on the network. Familiarizing yourself with gas fees will be important, as they can greatly impact the cost and efficiency of any Ethereum transaction.

Ethereum Gas Fees

What Are Gas Fees on Ethereum?

Ethereum gas fees indicate a price for the ability to conduct transactions or to execute the smart contract. Payment is settled in Ether (ETH), the native cryptocurrency of Ethereum, and determined by the amount of computational work required for an operation to be performed. The more complex the operation will be, the more gas it will require, and, accordingly, the more expensive the transaction will be.

The two major components of gas fees are gas units and gas price. Gas units tell the quantity required for a certain work to be done, while the gas price tells how much one pays per measured in gwei, where 1 gwei is the elemental form for 0.000000001 ETH. For example, a normal transfer of ETH, which normally requires 21,000 gas units at a rate of 20 gwei, will cost something close to 0.00042 ETH. This, however, can go up or down due to network congestion.

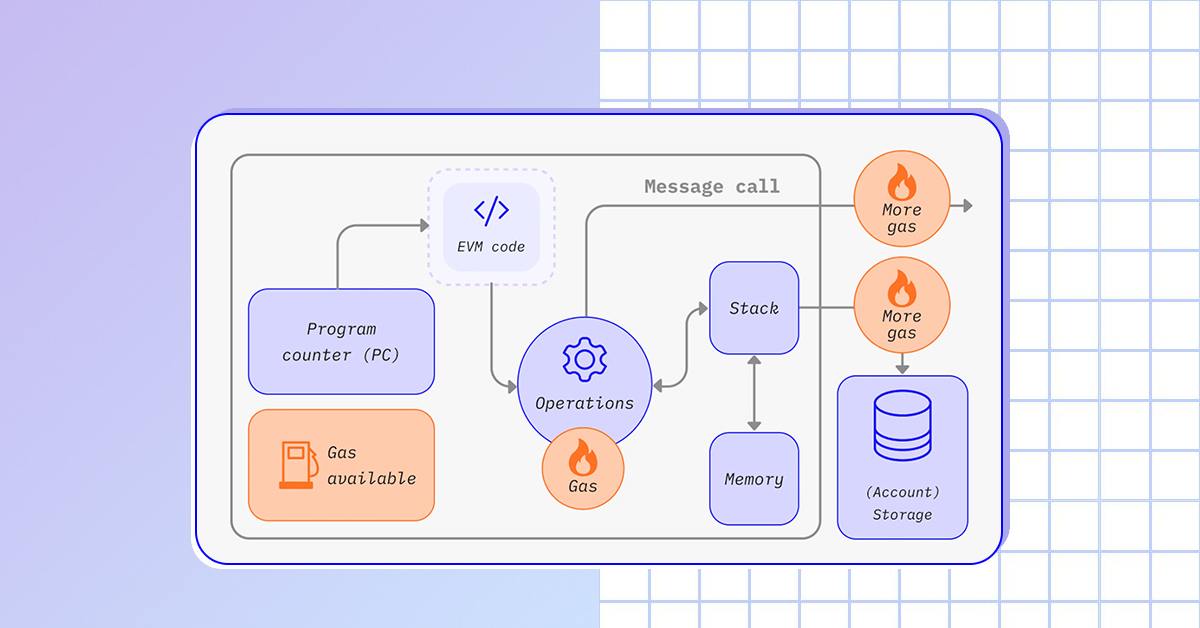

How Gas Fees Work on Ethereum (Source: Ethereum)

How to Calculate Gas Fees for Transactions

To calculate the cost of an Ethereum transaction:

- Determine Gas Limit (e.g., 21,000 for a basic ETH transfer).

- Choose a Gas Price: Gas prices fluctuate with network demand, generally measured in Gwei.

- Calculate Transaction Fee: Use the formula:

Transaction Fee = Gas Limit × Gas Price

For example, if a transaction has a gas limit of 21,000 units and a gas price of 50 Gwei:

Transaction Fee = 21,000 × 50 = 1,050,000 Gwei = 0.00105 ETH

EIP-1559 and Its Effect on Gas Fees

The London Hard Fork introduced EIP-1559, which was a whole adjustment of the Ethereum gas fee into a dynamic base fee that continues to shift with the demand on the network. While it is still possible to tip miners so they prioritize one’s transactions, in EIP-1559, there is greater predictability of the fees and, consequently, an easier estimation of the cost of a transaction and avoidance of spikes during periods of high activity on the network.

Key Components of Ethereum Gas Fees

Three main factors come into play that determine the Ethereum gas fees:

- Gas Price: The price you are willing to pay for one unit of gas, often given in gwei. It varies depending on network demand.

- Gas Limit: The maximum gas one is willing to use for a certain transaction. The amount of gas to set over any generic transaction is 21,000 units.

- Transaction Cost: The total cost is a product between the gas price and the limit. Assume using the same example, that the price of gas is 20 gwei and that the gas limit is 21,000 units, meaning one would be facing 0.00042 ETH for the cost.

Common Ethereum Transactions and Gas Costs

The cost of gas varies according to the type of transaction:

- ETH Transfer: A simple wallet-to-wallet ETH transfer, it requires about 21,000 gas units. So at the rate of 20 gwei, it comes to approximately 0.00042 ETH.

- Execution of Smart Contracts: Depending on the operation one is running, more complex operations executed on dApps like some DeFi applications can take as high as 100,000 units of gas and sometimes even more.

- ERC-20 Token Transfers: Transfers of ERC-20 tokens are more gas-expensive than a simple ETH transfer, with a typical gas of 45,000 to 65,000 gas units.

All of these costs can be influenced by network congestion. During periods of high activity, such as surges in NFT trading or popular token launches, gas fees can spike, making transactions more costly.

Tools for Monitoring Ethereum Gas Fees

Certain platforms are using real-time data to help with Ethereum gas fee monitoring and cost optimization.

Transaction gas price estimator (Source: Etherscan)

- Etherscan Gas Tracker: It is a tool that will give detailed information on the current gas price, such as low, average, and high gas prices, in addition to an estimate by transaction type.

- Blocknative Gas Estimator: Very helpful since it gives the current prices and trends, which can allow the user to decide on when to start the transaction.

- Milk Road: Offers a graphical view of gas prices to enable users to plan when it is the best time to operate transactions based on low activity for lower transaction costs.

Factors Affecting Gas Fees

- Network Demand: With high demand, the prices of gas are bound to go up since users compete to be included in a transaction.

- Transaction Complexity: The usage of smart contracts or dApps requires more computational resources and therefore gas for such operations costs more.

- EIP-1559’s Influence: EIP-1559 has improved this as the base fee mechanism introduced automatically adjusts fees according to network congestion.

How Ethereum 2.0 Aims to Reduce Gas Fees

Ethereum 2.0 (Eth2) is focused on upgrading the network by migrating away from Proof of Work (PoW) into Proof of Stake (PoS), greatly improving scalability and reducing network costs. Eth2 introduces several new features: the Beacon Chain, The Merge, and Sharding. Combined, these enable a potential increase in the throughput of transactions while also lowering the fees paid on transactions to less than $0.001.

Layer-2 Scaling Solutions and Their Impact on Gas Fees

Layer-2 solutions are networks built atop Ethereum that offer faster and cheaper transaction times. For instance, Optimistic Rollups batch transactions off-chain, where the load is taken off Ethereum, whereas ZK-Rollups bundle transactions with zero-knowledge proofs that verify the transaction off-chain before sending it to Ethereum.

Some of the popular Layer-2 networks include:

- Optimism and Arbitrum – Optimistic Rollups

- zkSync and Loopring – ZK-Rollups

The latter can reduce the cost to as low as a few cents by using layer-2 networks and can significantly improve the cost efficiency of Ethereum for users.

Practical Tips to Reduce Gas Fees

- Gas Price Monitoring: Platforms like Etherscan provide real-time and historical gas information that will help you decide on the best time to send your transaction.

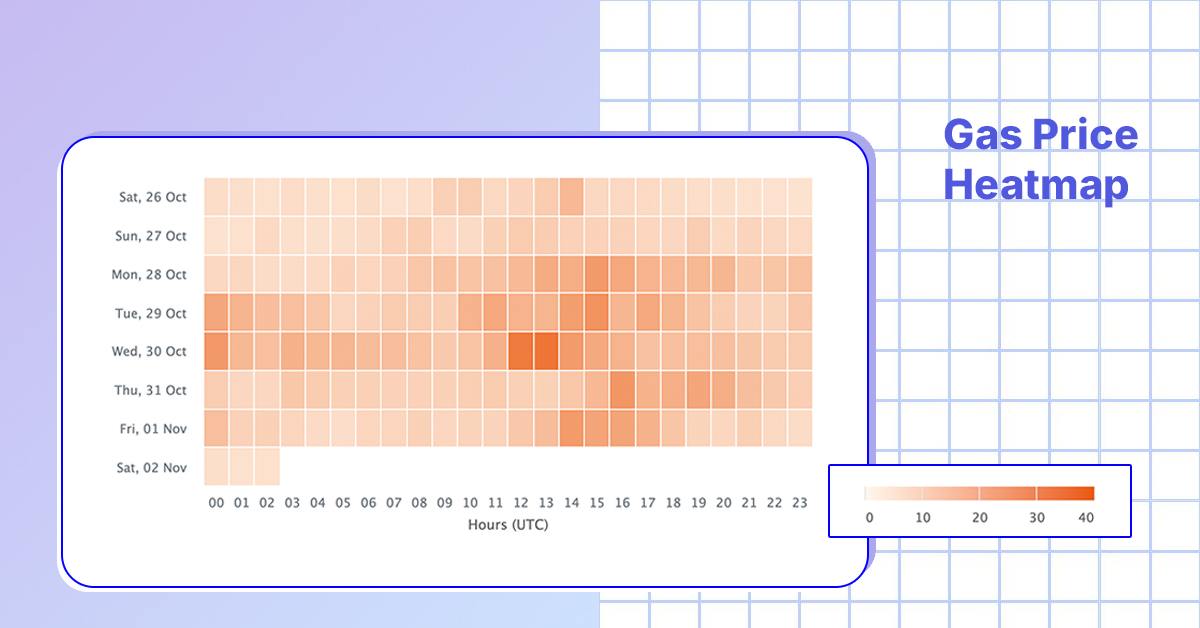

- Time Your Transactions: Generally speaking, gas is less expensive if bought at off-peak hours, anytime on the weekends, or early in the morning in the U.S.

- Layer-2 Solutions Implementation: It will be easy to shift traffic to cost-effective gas prices and higher velocities with Layer-2 scaling solutions such as Arbitrum and zkSync.

Conclusion

Understanding Ethereum gas fees and how they work is essential for maximizing the efficiency of your transactions. While Eth2 and upgrades like the Dencun upgrade will continue to improve scalability and reduce fees, Layer-2 solutions already offer effective ways to keep transaction costs manageable. By monitoring gas prices, timing transactions wisely, and exploring Layer-2 alternatives, Ethereum users can navigate the network more cost-effectively and make the most of their cryptocurrency experience.

Share on Social Media: