In a development that will redefine analysis on-chain, MevX brings a new, robust feature—transaction hash filters—right into its trading chart. With its “Read the Chain, Play the Game!” mantra, its new feature enables investors to see and analyze blockchain transactions in an entirely new manner, unlocking new avenues to unprecedented insights into player behavior and marketplace trends.

Identifying Market Players: MevX’s “Zoo” of Investors

Recognizing that different traders operate with varying levels of capital and influence, MevX has categorized investors into five distinct archetypes with its transaction hash filters, each represented by an animal:

- Worms ($10 – $250 transactions): These are the small-scale traders, often new to the market or engaging in low-risk transactions.

- Lobsters ($250 – $1K transactions): A step above worms, lobsters have more market confidence but still approach trading cautiously.

- Sharks ($1K – $5K transactions): Sharks are more strategic and can influence smaller players through their calculated trades.

- Dolphins ($5K – $10K transactions): These traders possess the capital to significantly impact market trends.

- Whales (Over $10K transactions): The most powerful players, whales make high-value trades that can cause major price swings.

By identifying and tracking these investor categories, MevX empowers traders to anticipate market movements and make informed decisions based on the behavior of key participants.

Enhanced Trading Insights with MevX’s New Filters

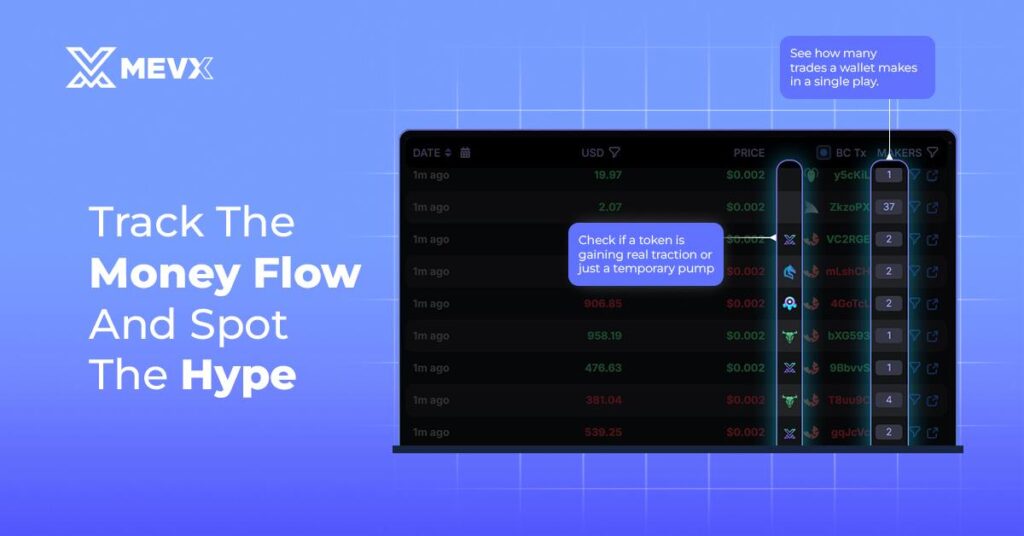

The transaction hash filters offer a range of new analytical capabilities, enabling traders to:

- Monitor Transaction Frequency: By assessing how frequently specific wallets engage in transactions, traders can deduce whether a player is accumulating, distributing, or testing market waters.

- Anticipate Large-Scale Moves: Observing the actions of sharks, dolphins, and whales provides foresight into potential market shifts, allowing traders to adjust their strategies accordingly.

- Evaluate Token Momentum: The tool differentiates between tokens gaining genuine traction versus those experiencing short-lived hype, reducing the risks of investing in unsustainable trends.

- Analyze Platform Preferences: Understanding which platforms high-volume traders use can reveal insights into liquidity trends and emerging market opportunities.

Redefining DeFi Trading Intelligence

With the introduction of transaction hash filters, MevX continues its mission to democratize blockchain data, providing traders at all levels with the tools to navigate the fast-paced world of decentralized finance (DeFi). Whether you’re a new entrant cautiously testing the market as a “worm” or a seasoned “whale” executing large trades, these new features provide the transparency and intelligence needed to stay ahead.

By transforming complex blockchain narratives into actionable insights, MevX ensures that traders can truly “Read the Chain, Play the Game!” with confidence and strategic precision.

Share on Social Media: