Main Takeaways

- This article provides the necessary knowledge before getting into copy trading.

- It will guide you on how to find suitable wallets to copy trade

- We also discuss how to master copy trading with MevX

Mastering Copy Trading with MevX

Introduction

In school, it wasn’t always the ones who studied hardest that got the top marks; sometimes, it was the ones who had the right insights—or knew how to copy them. In trading, a similar principle applies: you don’t need to be a market genius to make the best trades; you just need to know where the smart money is moving. With the blockchain’s open ledger, every trade and transaction is recorded, creating a transparent playground for anyone who can spot profitable trends and replicate winning strategies.

Copy trading allows you to identify these top-performing traders, audit their success, and follow their strategies. In this article, we’ll explore how to find profitable wallets, verify their track record, and track their trades effectively. We’ll also introduce MevX, a powerful copy-trading tool that optimizes this entire process, helping you trade like the pros with ease. So, if you’re ready to follow in the footsteps of successful traders, let’s dive in!

What is Copy Trading?

Copy trading involves replicating the trading decisions of seasoned investors, allowing you to benefit from their expertise without needing advanced knowledge. In crypto markets, where volatility is high and decisions must often be made rapidly, copy trading can help individuals earn similar returns as skilled traders by mirroring their portfolios and trades.

How to Pick the Right Wallets

Normally, you would need at least 3-4 tools to successfully find a good wallet. With the MevX trading bot, users are provided with everything, making it easier to find the right wallet with only this trading bot. In this article, we will guide you through 3 methods to find the right wallets with the MevX trading bot.

Top Traders Method:

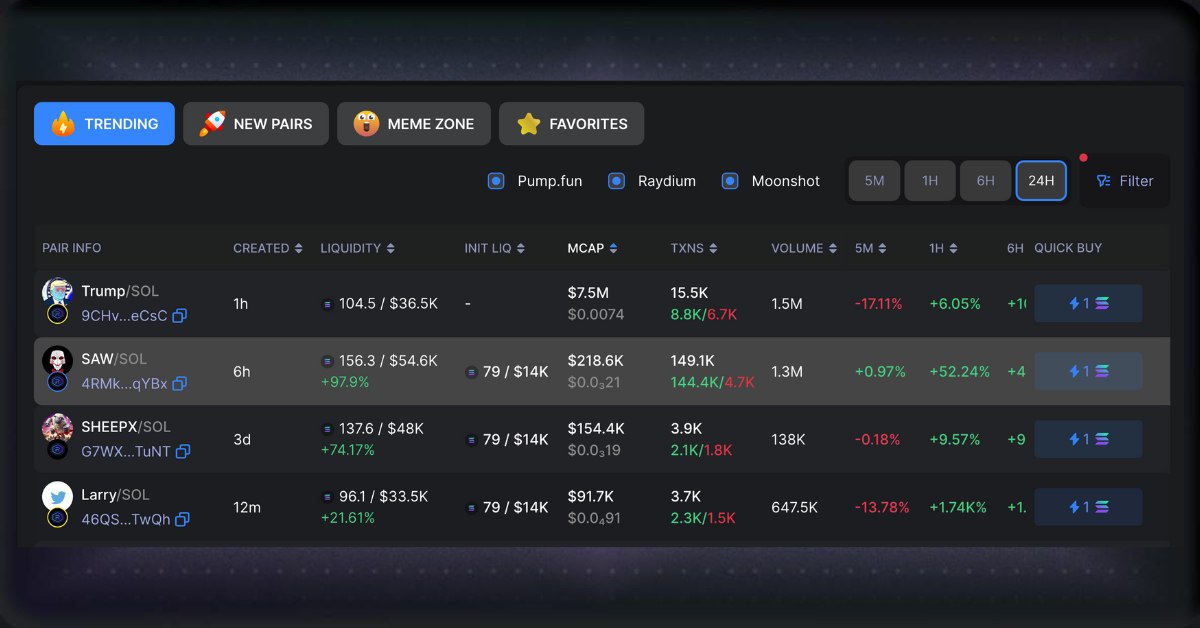

Step 1 – Start with the Trending Coins: On the MevX homepage, check out the Trending section and look for trending coins over the past 24 hours. Look for coins with decent market caps, especially those you recognize. For example, here is JIGSAW, a coin with a $100K market cap and some transactions. You can read our article on How to pick a trending coin for more detail.

SAW in the MevX Trending section

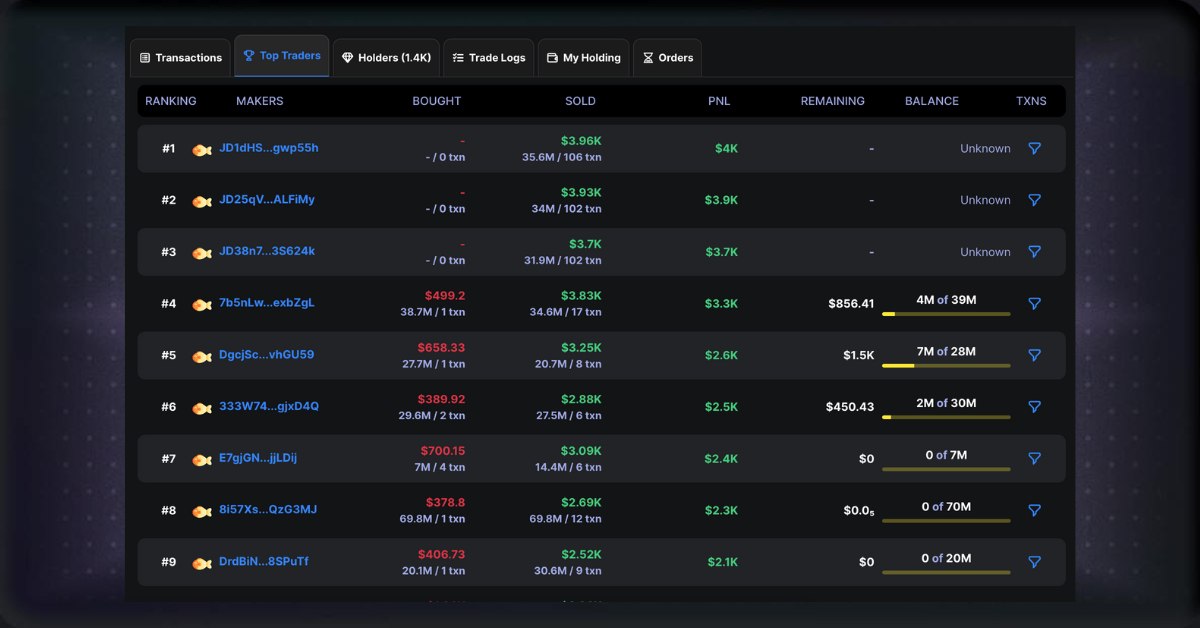

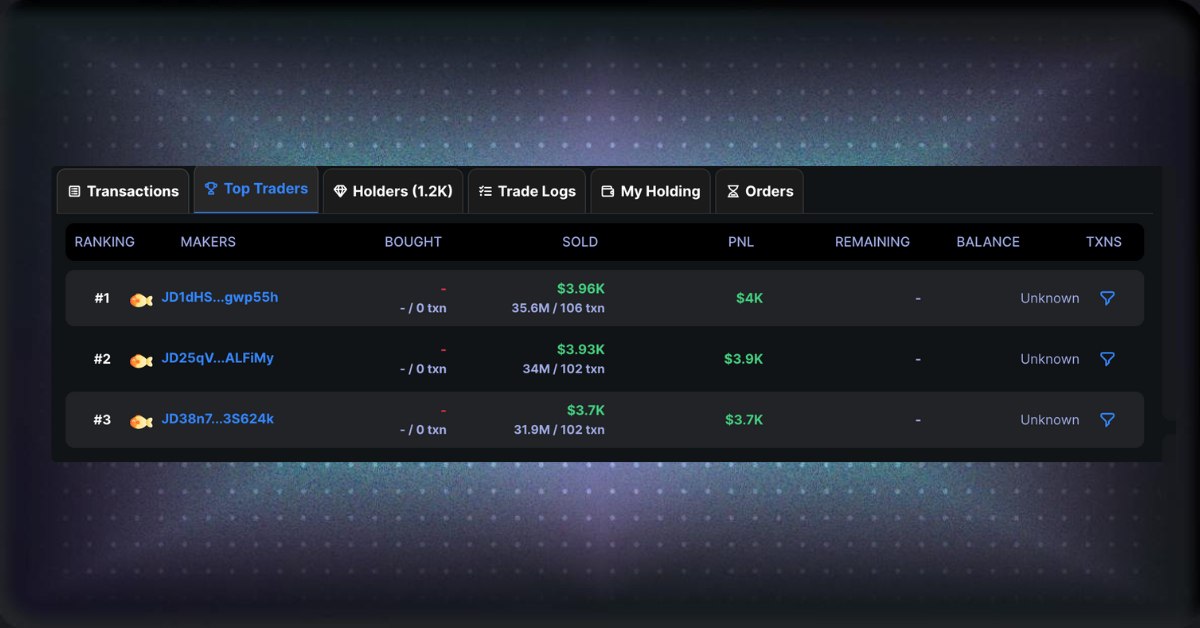

Step 2 – Identify Top Traders: Choose the coin and switch to the “Top Traders” tab to find promising wallets. Look for wallets with realistic transaction amounts, similar to what you might invest, to find options that fit your investment profile.

Top traders tab

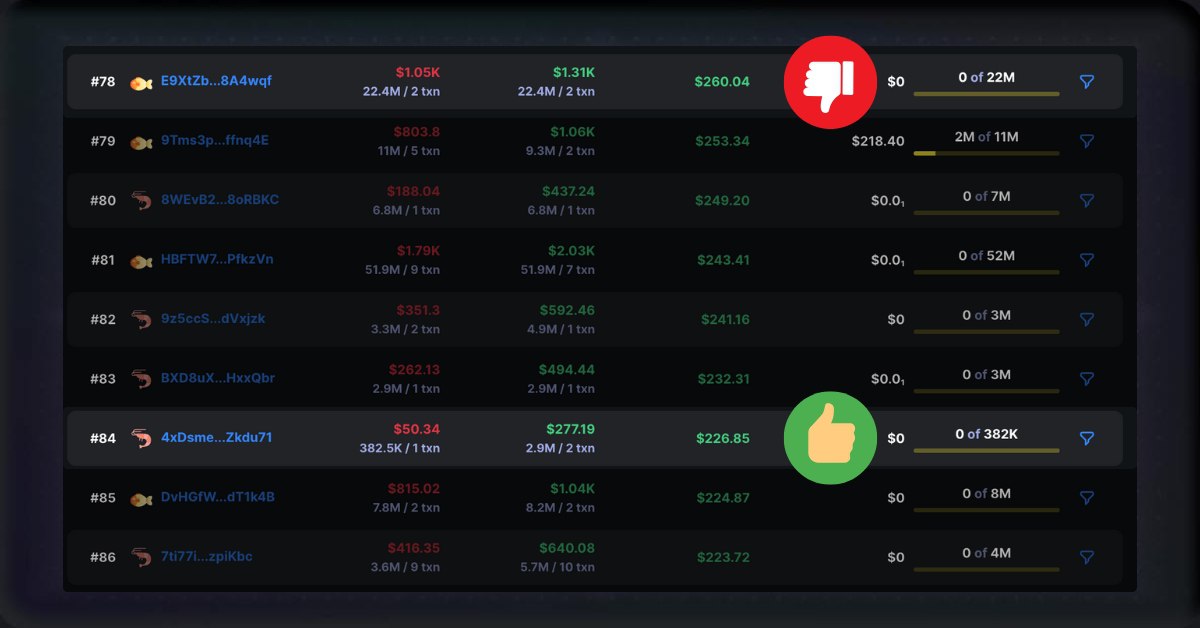

Step 3 – Save Profitable Wallets: Analyze transactions from traders who have successfully turned small investments into significant profits. Copy wallet addresses from these traders and add them to a tracking sheet, like Google Sheets or a similar tool for easy reference.

Example of wallets you should and shouldn’t save

Note: Exclude wallets that only sell and don’t buy, as these are wallets receiving tokens directly from the project team rather than through real trades. This distinction helps in identifying genuine investment activity over developer or insider trades.

Example of wallets that receive tokens from the project team

Top Holders Method

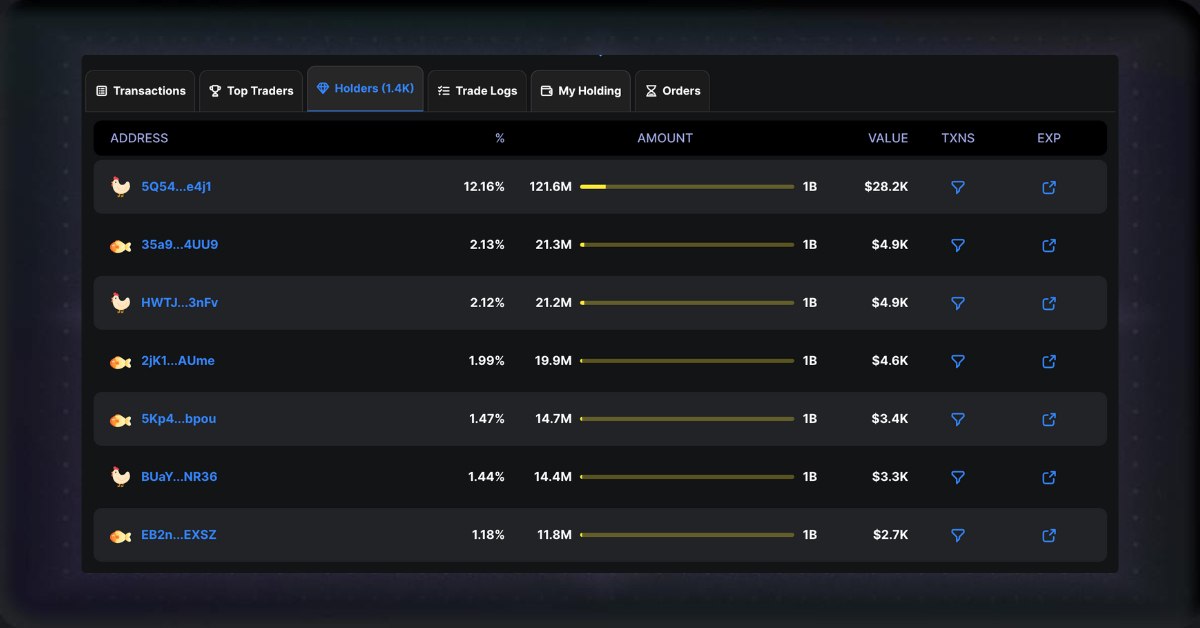

Step 1 – Review Top Holders: Start by navigating to the “Holders” tab for the coin you’re analyzing. Identify individual top holders who have substantial coin amounts in their wallets, which often suggests consistent and potentially profitable trading activity.

Top holders of SAW

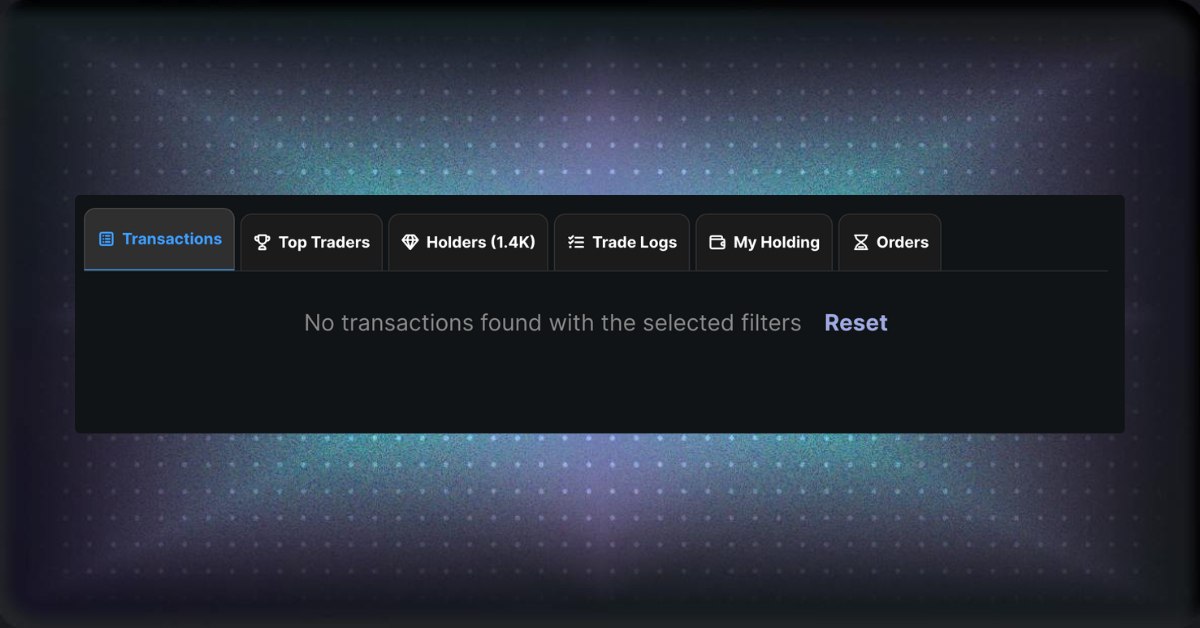

Step 2 – Filter Exchange Wallets: Top holders lists often include exchange wallets, so you’ll want to filter these out. Click on “TXNS” (Transactions) for each wallet. If a wallet does not show buy orders, it’s likely not an individual trader but an exchange or developers, so you can skip it.

Example of an exchange’s wallet

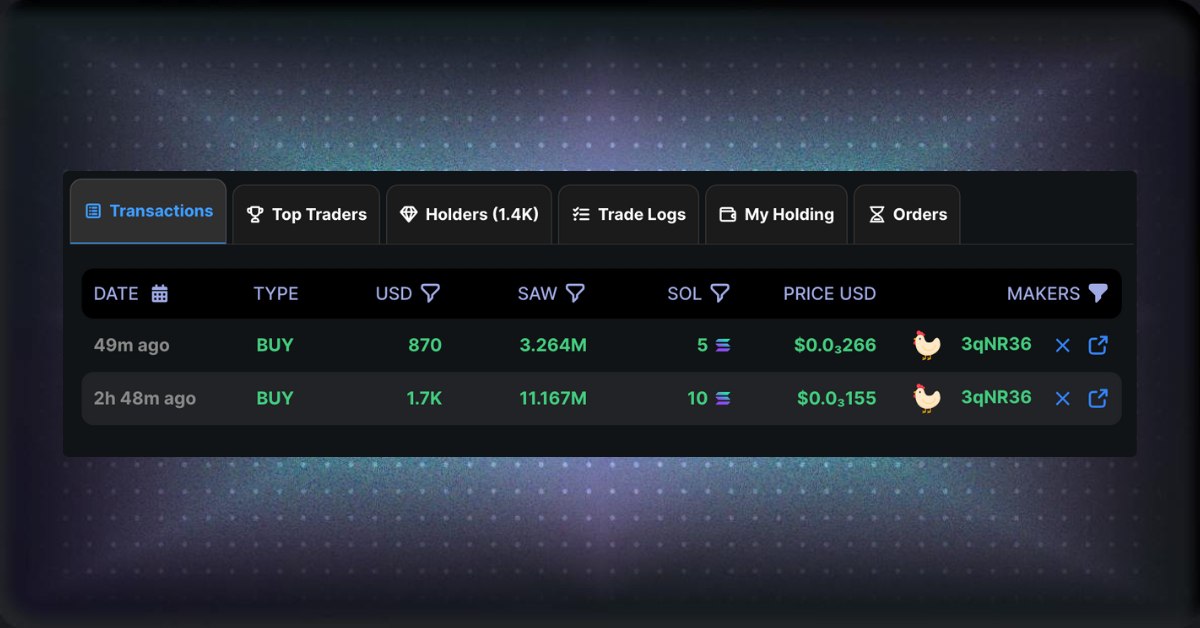

Example of an investor’s wallet

Step 3 – Save The Wallet Addresses: Once you’ve identified the suitable wallets, copy their addresses and add them to your tracking sheet.

Influencer Method

Influencers often buy a token early and promote it, attracting their followers to buy the coin. Then, they will dump their coins right on their followers. If we know their wallet, we can buy right behind them and dump on their followers.

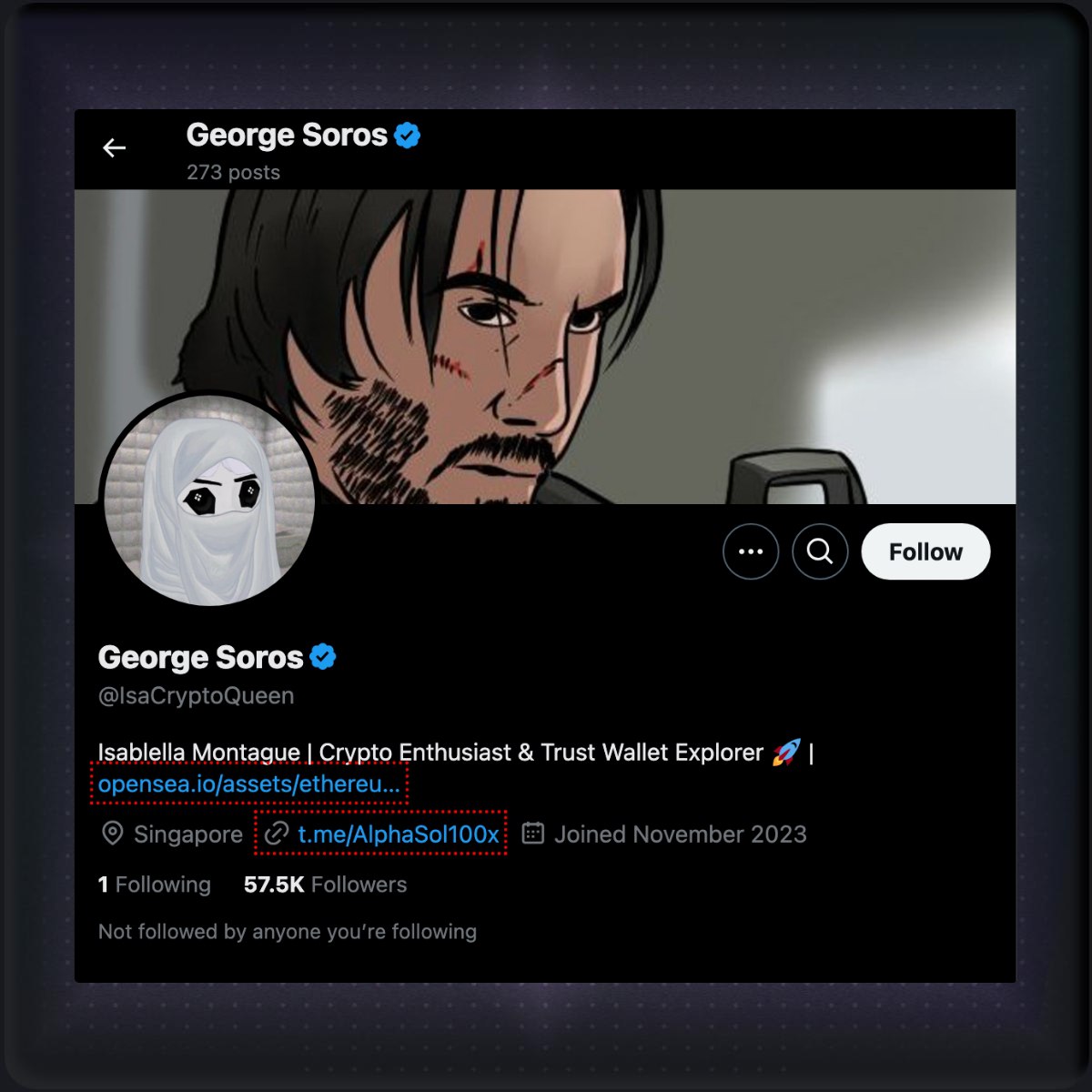

Step 1 – Find Crypto Influencers: To begin, search for crypto influencers on platforms like X (formerly Twitter). Don’t be fooled by blue and gold ticks. Always check for genuine engagement in replies and retweets to gauge authenticity. For instance, let’s look at @IsaCryptoQueen, a smaller influencer known for active crypto discussions.

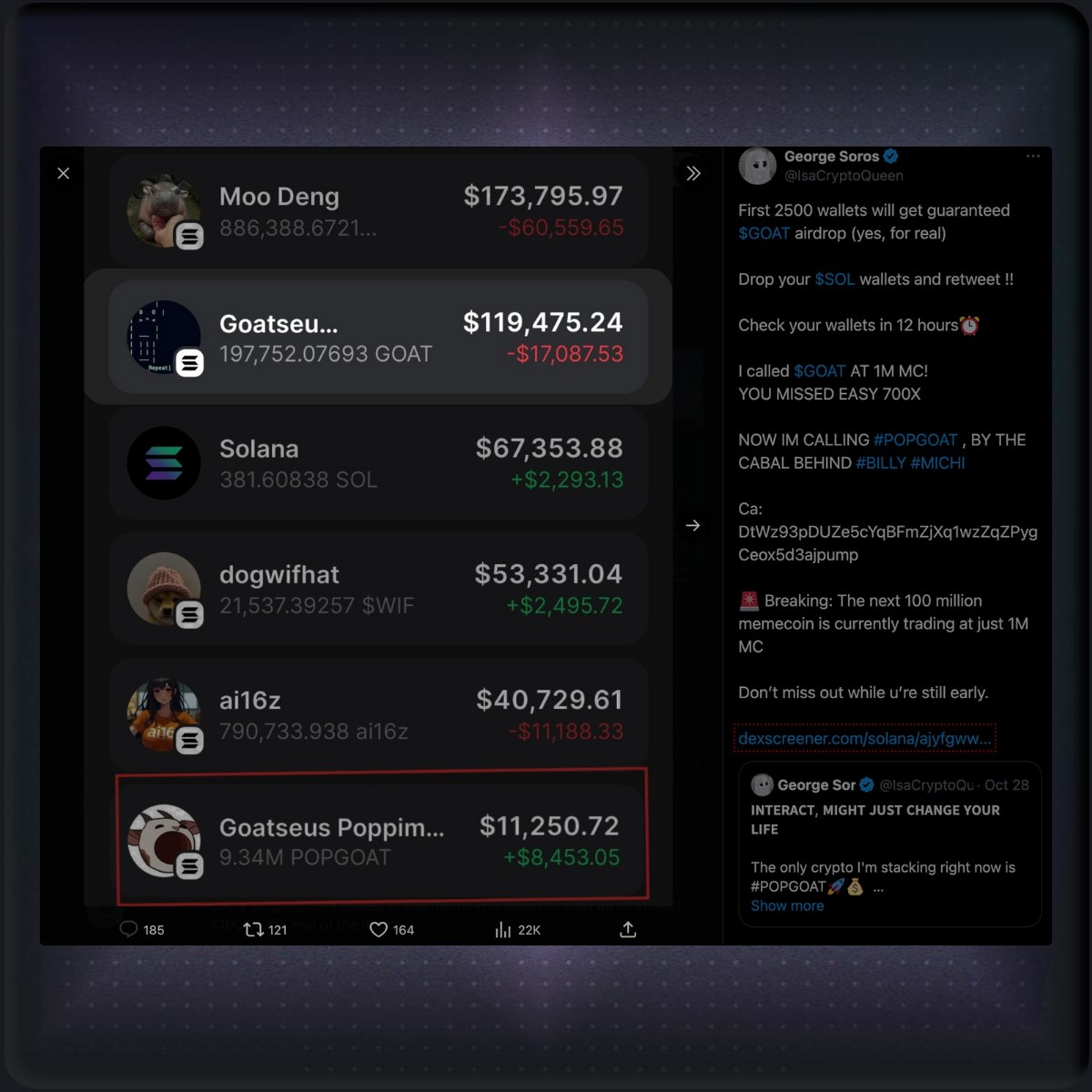

George Soros, or @IsaCryptoQueen

Step 2 – Find Their Wallet: These influencers usually want to hide their wallets. However, with the transparency of crypto, finding them is quite easy. Occasionally, influencers will share wallet details in screenshots or posts. For example, here is a screenshot of his wallet he posted on X:

A screenshot of his holdings

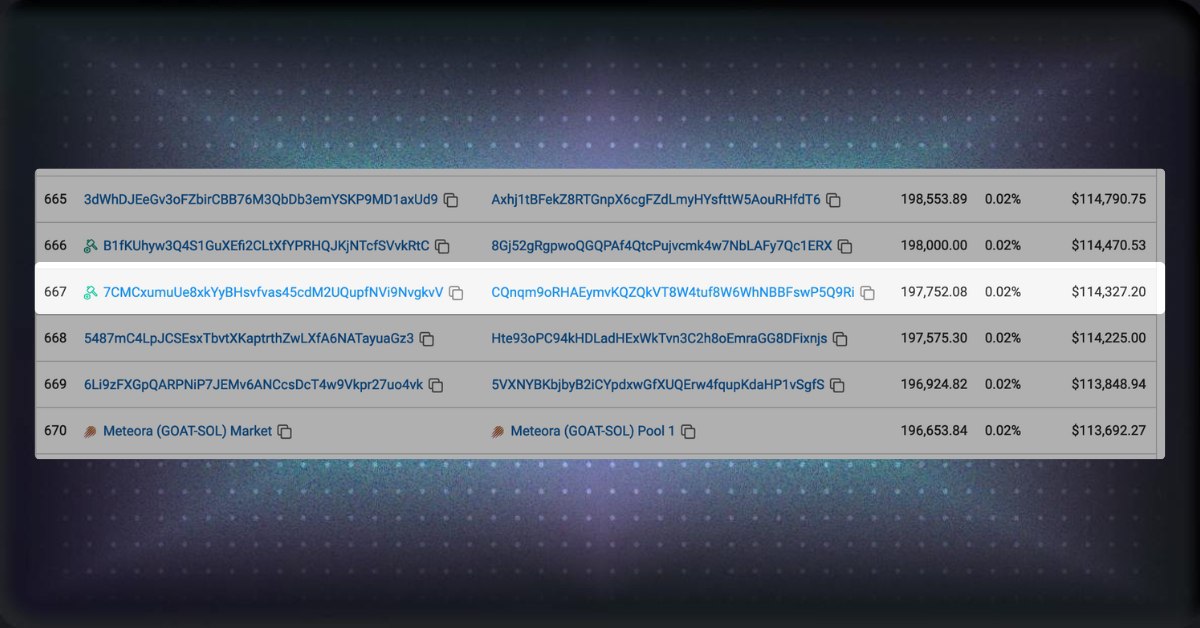

As you can see, he is holding 197,752 GOAT tokens. Using Solscan to find holders of GOAT, we can see a wallet holding the exact amount. This is his wallet.

His wallet on Solscan

Step 3 – Save The Wallet Address: Once identified, save this wallet address at the top of your tracking notes. Influencer wallets can be particularly profitable to follow, as they often buy tokens early, promote them, and later sell once prices rise, making them a prime source of trading opportunities.

Wallet Tracking and Analysis

Once you’ve compiled a list of wallets with promising potential, it’s time to evaluate them for consistent profitability, avoiding those driven by luck alone. To do this, you can use tracking tools like Cello Finance to examine each wallet’s profit and loss (P&L), win rate, and consistency.

Here’s a breakdown of what to look for:

- Win Rate and Consistency: Aim for wallets with a stable performance record, ideally within a win rate range of 50-80%. Wallets with a win rate below 50% are risky, as they’re likely to incur losses over time. On the other hand, wallets with a win rate over 80% could indicate a developer’s wallet, primarily used for selling tokens rather than active investing.

- Profit and Loss (P&L): Use P&L data to check the wallet’s long-term growth pattern. A steady, positive P&L is a good indicator of strategic and consistent trading, whereas high fluctuations may signify luck or volatile market behavior.

- Performance History: Review the wallet’s transaction history to see if the profits result from a few big wins or regular, small gains. Consistent performance usually reflects a solid trading strategy.

Following these guidelines helps ensure that you’re copying wallets backed by reliable strategies rather than sporadic wins. By focusing on data-backed choices, you can reduce the risk of following wallets that may initially appear profitable but lack sustainable results.

How To Manually Copy Trade

Now that you have a list of profitable wallets, this data is a valuable resource for crypto copy trading. Here’s how to make use of it:

Open Tracking Tabs: For each profitable wallet, open a separate Solscan tab to monitor the transactions. Using a separate screen or split windows can make it easier to track multiple wallets simultaneously.

Monitor Transactions in Real Time: Continuously refresh each Solscan tab to catch new trades as they happen. This real-time monitoring helps you act on trades as soon as they’re executed by the original wallet.

Execute Parallel Trades: With your favorite exchange open in another tab, mirror the trades by buying or selling the same token, adjusting for any price delays or slippage. Timing is crucial here—securing a similar price ensures that you benefit from the moves of the wallet you’re copying.

Repeat the Process: Keep monitoring and executing trades following this pattern. However, the manual nature of this approach is time-intensive, and profit margins can be affected by huge delays in trade execution.

While this method can be effective, the constant need for refreshing and timing trades accurately may lead to challenges, especially when competing with high-frequency trading bots.

MevX Copy Trade: A Better Solution

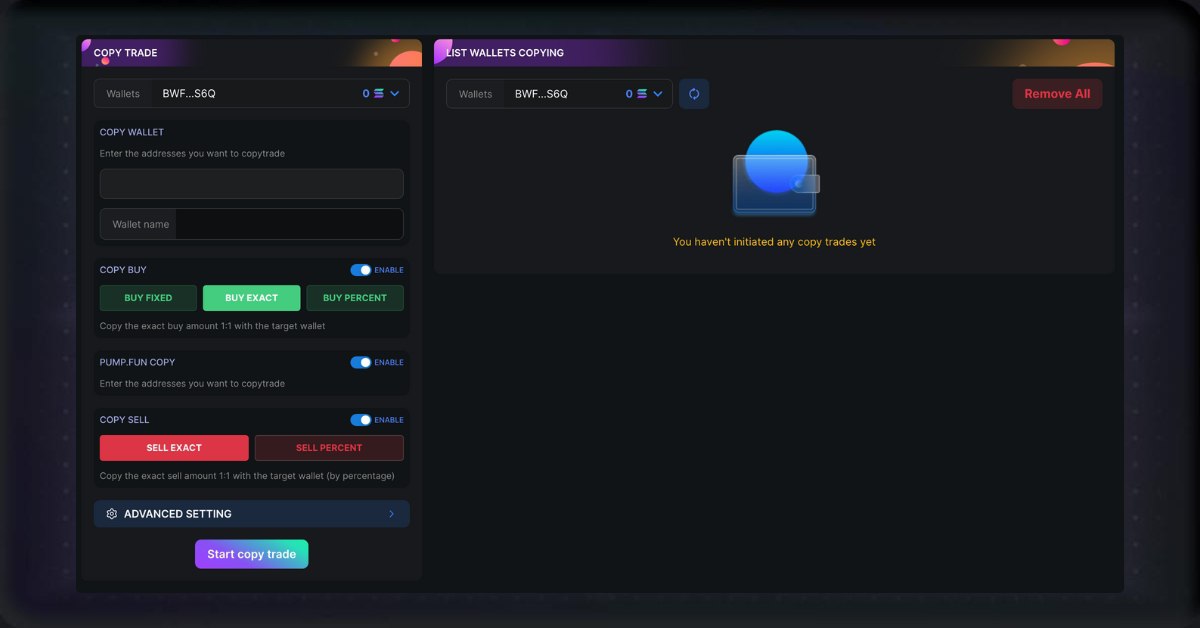

MevX offers a streamlined approach to copy trading, enabling real-time tracking and execution of trades with optimal speed and efficiency.

Interface of MevX Copy Trade

Importance of Speed in Copy Trading

In crypto trading, rapid execution is critical to avoid missed opportunities or losses due to volatility. MevX’s private RPC (Remote Procedure Call) system ensures that trades execute instantly, reducing the risk of slippage and maximizing the returns from each copied transaction.

Advanced Features of MevX Copy Trade

Automation: Once configured, the bot mirrors trades automatically in real-time, eliminating the need for manual input.

Superior Speed with Private RPC: MevX’s private RPC boosts performance, providing unmatched speed and stability by limiting access to only internal users.

- Multi-Wallet Support: MevX allows users to replicate trades across multiple wallets, helping diversify trading strategies and spread risk.

- Copytrade Protection: The MevX Copy Trade feature detects and blocks potentially unsafe or fraudulent tokens. Users can also set specific filters to match their risk preferences.

- Buy at Once Feature: This feature limits token purchases to a single transaction every seven days, preventing excessive buying.

- Customizable Settings: MevX provides adjustable copy trading settings, allowing users to align trades with their risk tolerance and investment goals, offering more flexibility than standard bots.

Optimize the Workflow with MevX

MevX simplifies the copy trading process, allowing users to select specific wallets to follow and set automated strategies based on chosen parameters.

For an effective copy trading setup, use the following recommended configurations:

- Auto Tip: Enable auto tip and set it to 95% or 99%. This will ensure your transactions will be processed first.

- Slippage: For trades with anti-MEV protection, set slippage to 25%; without anti-MEV, adjust to 15%.

These settings can help prevent front-running issues, ensuring smoother trades even in high volatility.

Conclusion

MevX transforms copy trading by automating the process, allowing users to quickly replicate successful trades with precision. Its real-time execution, customizable settings, and robust anti-MEV protection make it a valuable tool for those looking to enhance their crypto trading experience with minimal effort.

Share on Social Media: