The crypto world has opened wider avenues for investment and innovation in the financial world. Great opportunities, on the other hand, often present great risks, particularly in terms of fraud. The most notorious scheme that happens around the crypto world is when developers of a cryptocurrency project abandon it after having attracted a pool of investors, thereby leaving them with worthless tokens. This article looks at how to use MevX as a rug pull checker to protect your investments from scams.

What Is a Rug Pull?

A rug pull is a type of scam where developers of a certain cryptocurrency project lure investors into buying their tokens, only to pull out all liquidity from the pool or otherwise dump their tokens for cash. Usually, this leaves investors with huge losses.

How To Avoid Rug Pull With MevX

Analyzing tokens and projects requires extensive research, many times having to use several tools to avoid rug pulls. With the MevX trading bot, users will have an all-in-one suite of necessary tools combined into one platform to make recognizing safe investments easier. The MevX makes it easy to detect vulnerabilities, thus allowing users to independently evaluate projects without having to consult too many resources. We will take a closer look at how easy it is to avoid rug pulls using MevX.

Step 1: Find The Token On MevX

You can either search for the token or paste the contract address on the search bar of MevX.

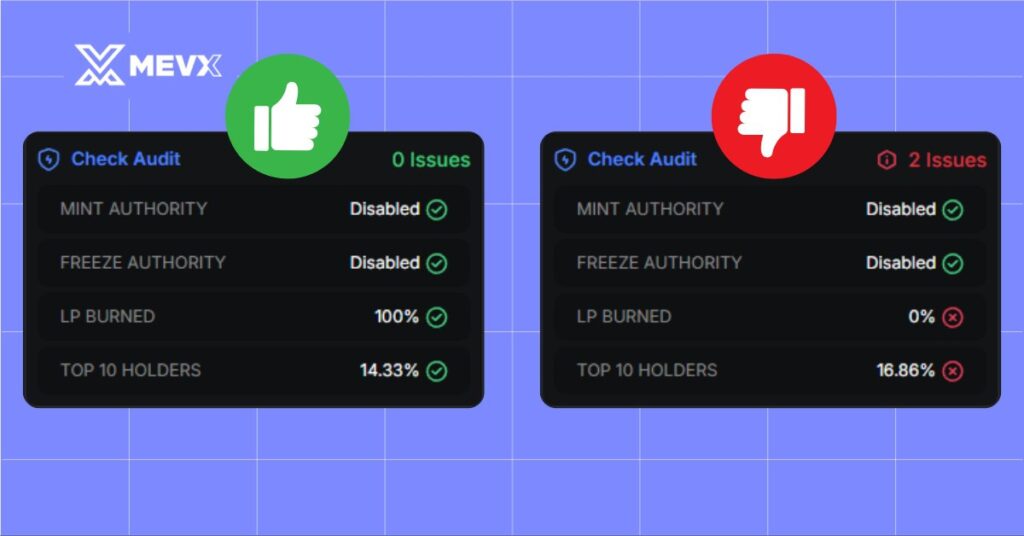

Step 2: Look For MevX’s Certified 4 Checks

With the verification of 4 Checks, MevX makes sure that investors invest in truly reliable projects. Each check was created to lower the chance of risk, really making your investments safe.

- Mint Auth Disabled: If disabling the mint authority is not done, then one can create unlimited tokens; it would simply mean a very obvious dilution of the existing tokens.

- Freezable Disabled: This, if enabled, would let the token creator block trades or completely freeze their tokens, thereby exposing their investors to a 100% loss by not allowing sales.

- Liquidity Burned: In the absence of liquidity locks or burns, the project developers may withdraw the liquidity, hence preventing investors from selling the tokens and probably incurring losses.

- Top 10 Holders Distribution: Projects where the top 10 holders own more than 16% of the total supply are in a state where manipulation could easily occur, consequently exposing other investors to a great deal of risk.

The minute either one of those features is taken away or compromised, it’s a total warning sign.

Step 3: Check Market Performance

Evaluating a token’s market performance is vital for assessing its stability and potential growth. To achieve precise results, set the data display to a 6-hour timeframe on MevX. Use the following criteria for a detailed analysis:

- Market Cap

- What to Look For: A higher market cap indicates greater stability and less susceptibility to market volatility.

- Why It Matters: Tokens with larger market caps are generally more established and less prone to dramatic price swings.

- Liquidity

- What to Look For: Liquidity pools holding more than $50,000.

- Why It Matters: Healthy liquidity ensures smoother trading and reduces the risk of significant price fluctuations during transactions.

- Trading Volume

- MevX employs a color-coded bar to accompany the numbers, where green indicates buy activity and red indicates sell activity

- What to Look For:

- A balanced 6-hour trading volume, ideally slightly green-oriented.

- Why It Matters: Overly dominant green volumes mean the token is getting pumped and is about to get dumped. In contrast, the overly dominant red volumes mean the token already got dumped.

- Transactions (TXNS)

- What to Look For: A balanced ratio of buy and sell orders in the transaction history.

- Red Flag: Like trading volume, if buy orders completely dominate the chart, it could signal a pump-and-dump scheme where a sudden sell-off is imminent.

By checking these metrics, you can identify tokens with strong market performance and avoid projects with a high risk of instability or manipulation.

Step 4: Check The Chart

The price chart is a valuable tool for evaluating a token’s growth and market behavior. Here’s what to look for:

What to Look For:

- A steady overall upward trend, with a few natural dips reflecting healthy market fluctuations.

Red Flag:

- Sudden, sharp price spikes followed by rapid declines could indicate pump-and-dump schemes or artificial manipulation.

Analyzing the chart helps you gauge the token’s stability and avoid projects with suspicious activity.

Step 5: Check Social Media and Websites

Evaluating a project’s online presence is essential to understanding its credibility and community support. MevX enlists the social media and websites related to the project so you can easily access those. Here’s what to look for:

Social Media Activity:

- A vibrant, active community on platforms like Telegram, X (formerly Twitter), or Discord is a good sign of a genuine, community-driven project.

- Look for consistent engagement, meaningful discussions, and responses from the project team.

Project Website:

- A well-maintained website with clear information about the token’s purpose, roadmap, and team can boost confidence.

- Missing or unclear details about the project’s goals and structure are cause for concern.

Red Flags:

- Lack of activity abandoned accounts, or interactions dominated by bots.

- Sudden spikes in social media engagement are often used to artificially hype the token.

- The websites cannot be accessed.

Conclusion

The turbulent crypto world requires eternal vigilance and the right tools of the trade to keep losses at bay and potentially lucrative. Among the many such threats, rug pulls still lead the pack. Still, it is very much possible to evade them, given one knows the right approach. That is where MevX comes in—a complete suite for token and project analysis on a very intuitive platform.

With this guide, including the employment of MevX’s Certified 4 Checks, one can review the performance against the market, study the price chart, scrutinize social media and website activity concerning the project in question, and thereby pick out legitimate projects in which to secure an investment. In the ever-shifting world of cryptocurrency, MevX equips investors with knowledge, confidence in decision-making, and the unmasking of scam projects.

Share on Social Media: