To such increasing interest in crypto trading, using automated tools on Pump.fun helps both new and professional traders improve their strategies. If you are one such trader wishing to optimize efficiency and speed up your trades, a trading bot is a solid solution with features to streamline trading at ease. In this article, we consider how Pump.fun works and go into detail about the strategies you can use with it. Whether you’re just starting with trading or looking for simplification of your strategy, trading bot on Pump.fun can give you that extra edge.

Mastering Pump.fun

What is Pump.fun?

Pump.fun allows for easy creation and trading of memecoins. Typically, these types of tokens are designed to not be real assets other than for a gag and to bring people into the community. This platform utilizes a pricing methodology known as the bonding curve to ensure a balanced but constantly shifting trading environment.

What is Pump.fun?

How Does Pump.fun Work?

Pump.fun works on a very simple and innovative model:

- Choose a Coin: Browse through the list of available meme coins and select any one that catches your interest.

- Buy on the Bonding Curve: Buy the coin on the platform via a bonding curve, a way that ensures that the price is fair among all participants.

- Sell Anytime: You are free to sell your holding at any time, crystallizing your profits or cutting your losses.

- Market Cap Milestone: When enough people buy the coin, it reaches a market capitalization of $69,000.

- Liquidity Deposit: At this milestone, a deposit of $12,000 in liquidity is made to Raydium and burned to add to the coin’s stability and value.

This process not only introduces fairness but also clearly shows a path for how the coin will grow and be sustained.

What Is Pump.fun’s Bonding Curve Mechanism?

The bonding curve model of Pump.fun is one of its strongest points and places the product far away from traditional approaches of token pricing. Here’s how it works:

- Initial Token Supply: At token creation, an initial supply of 800 million tokens is deposited into the bonding curve.

- Price Adjustment: The more users who buy the token, the higher the price-increasing curve, showing exponential growth. The earlier the buyer buys, the cheaper it is.

- Liquidity Provision: At a market capitalization of $69,000, the token adds liquidity to Raydium so that it can be traded on this decentralized exchange. Later, as such memecoins gain traction, they are usually listed on other DEXs, sometimes even to successful CEX listings.

Using MevX Trading Bot

Here is how you can use MevX Trading bot to enhance your profit:

Finding Meme Coin

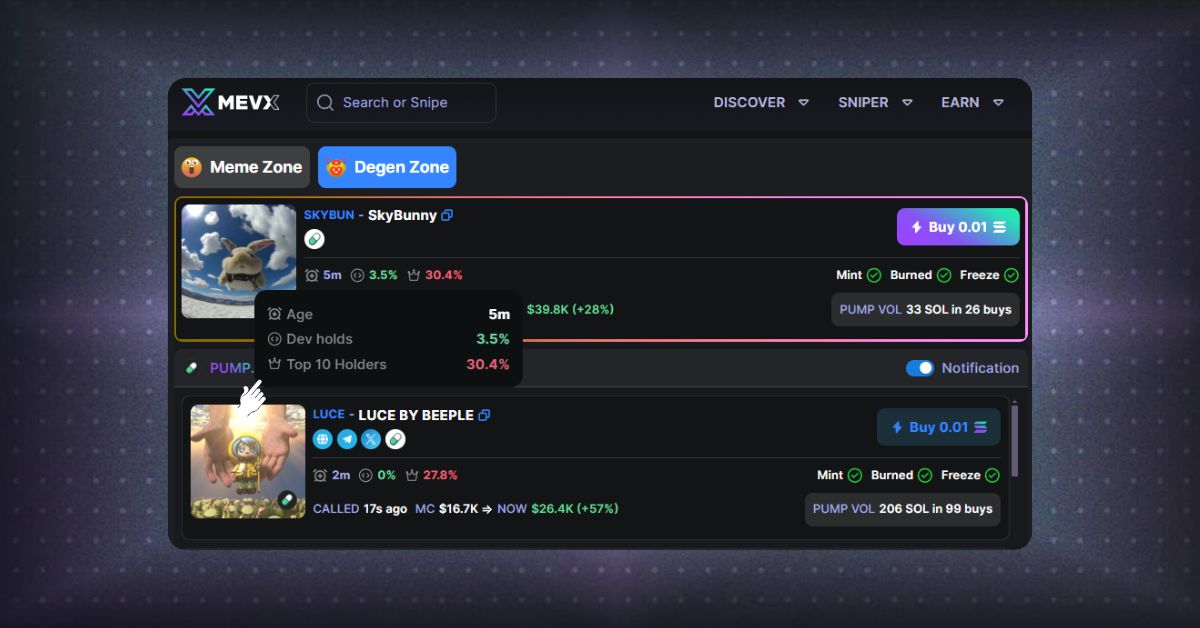

First, deep dive into the project’s purpose and community engagement. Unique concept or trend riding? Many very strong communities give off signals for long-term potential. Factors to consider: age, Dev Hold, Top 10 Holders of a memecoin.

Finding memecoin

Then, look at the liquidity of the coin. Low liquidity can make it hard to enter or exit the trade.

Lastly, verify the background of the development team and whether they are seasoned in their work and transparent. By using this filtration, you will be set to have the most strategic opportunity to identify some very promising meme coins on Pump. fun for future growth and profits.

Using Turbo Sniper

In this case, after some time has elapsed and the market cap of the token has reached a threshold value of 100% on what’s called Bonding Curve Progress, it’ll be re-launched to Solana decentralized exchanges, Raydium.

Using Turbo Sniper

On Raydium, the coin will usually dramatically sink or swim: if the meme is good, if there’s a large and enthusiastic community, and when past the hurdle of numerous snipping bots trying to make money from early volatility, new tokens often bring much profit in.

The important thing as a trader of these memecoins is that you should get in early enough before the promising memecoin hits the Bonding Curve. Then you can use Tubor Sniper to become an early bird who can take promising profit. Remember to set tight stop-loss levels and be very careful with high-risk assets.

What are the key features of Turbo Sniper?

- Ultra-Fast Execution: Turbo Sniper was designed to detect price spikes and dips within milliseconds. This helps in having a near-instant reaction to the trade. The edge in speed is crucial in further volatile markets when there are sudden changes in the market or even news releases; this enables it to capture profits in basically no time.

- Market Volatility Advantage: Turbo Sniper capitalizes on high volatility, making it effective in capturing profit from a rapid price rise before the market shifts. This feature is designed for the fast-moving crypto environment where minutes count.

- User Control in High-Risk Scenarios: Turbo Sniper emphasizes that when it comes to high-risk assets, caution is paramount. The system does, however, permit stop-loss and recommends smaller position sizes for traders who would wish to reduce the potential for greater losses when the market turns against them.

Risk Management:

- Stop-Loss and Take-Profit Thresholds: The ability to set stop-loss and take-profit thresholds allows users to limit potential losses and automatically lock in profits. This is very important when managing the unpredictability of rapid market movements.

- Position Sizing Recommendations: Always advise beginners to open smaller trade sizes to reduce risk exposure while getting familiar with the functions of Turbo Sniper.

Setting Up a Trading Bot: The Ultimate Trading Bot for Profitable Trading at Pump.fun

While Pump.fun gives a function of memecoin listing, it’s often not enough to get a profitable memecoin trading strategy. A strategy for trading actually needs super-fast execution and flexibility in settings of fees, especially in case of exiting the positions before the bonding curve impacts the price. That’s why traders need a supportive bot like MevX.

Click to Set up MevX Trading Bot

Although several web-based interfaces currently enable memecoin trading via DEXes, MevX is the most established and reliable option. It provides the rapid execution and customization essential for effective trading.

Explore more MevX features

Why should you use a trading bot?

In Pump.fun’s fast-moving memecoin market, a trading bot can boost profitability, consistency, and risk control.

- Speed: Bots execute trades in milliseconds, crucial for capitalizing on quick price changes in Pump.fun’s volatile market.

- 24/7 Trading: Bots operate around the clock, capturing opportunities even outside typical trading hours.

- Precision and Control: Automated execution reduces human error and emotional decisions, while customizable strategies like stop-loss and position sizing help manage risk.

- Scalability: Bots can handle multiple trades at once, making it easier to manage a diversified portfolio.

- Real-Time Market Analysis: Bots continuously monitor market data and adjust instantly to changing conditions.

Conclusion

Take advantage of Pump.fun is essential for crypto traders, moreover understanding a feature like the Turbo Sniper also enhances your trading strategy with speed and precision. While the MevX trading bot provides significant advantages such as automation, reduced emotional trading, and risk management, it also requires careful handling to avoid potential downsides, like unexpected market movements impacting quick trades. By understanding Pump.fun’s functionality and using trading bots wisely, you can harness the power of automation to improve your trading outcomes.

Disclaimer: The content of this article is provided for informational purposes only and should not be considered investment advice, financial advice, or any other type of professional advice.

Share on Social Media: