Main Takeaways

- This article covers how an investor gets a x153 return from this investment.

- The timeline of transactions and his trading strategy are also discussed.

- We also mention the lesson learned from this study case.

A case study on x153 return

Introduction

It is no longer a surprise when hearing someone has turned into a millionaire by trading meme coins. These coins offer unimaginable returns in a short time and have become a popular investment choice among many young investors. The winners in this market usually share their massive profits but not how to achieve them.

In this article, we explore how an individual investor can multiply his funds by 153 times. By examining his process, we hope to have an overview of his strategy and provide valuable insights for our readers.

The Meme Coin in Focus: Goatseus Maximus

Goatseus Maximus ($GOAT) emerged as a unique meme coin in the crypto space, known for blending internet culture, artificial intelligence, and decentralized finance in an unusual and provocative way.

Introduction to Goatseus Maximus

Launched amidst a surge of interest in meme coins, Goatseus Maximus garnered attention quickly. The project was championed by Terminal of Truths (TT), an AI agent infamous for its unfiltered internet-style posts, and it attracted additional credibility due to involvement from tech figures like Marc Andreessen, who fueled intrigue with financial backing.

Following its launch, Goatseus Maximus took off rapidly, driven by high levels of community activity and the AI-generated content promoted by Terminal of Truths. Within days, its market capitalization surpassed $600 million at one point. The unique marketing style—cryptic, irreverent, and NSFW—resonated with parts of the internet-savvy audience, turning the coin into an internet sensation and marking its place within the meme coin community.

The Wallet We Will Discuss

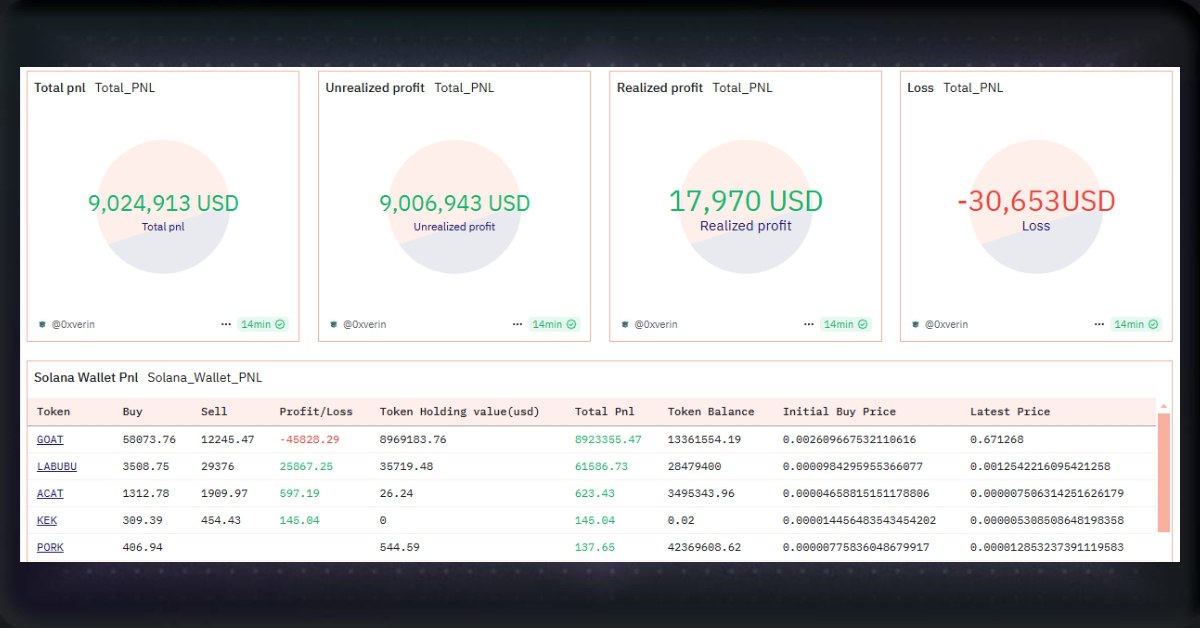

The wallet 4Jpef1sPVwFaQmWhDVaoHcY66nmSmbLd2fXgVW59wJqL is a prominent example of strategic success in meme coin trading. It became known for its tactical moves within the meme coin market, most notably with the coin Goatseus Maximus, where it capitalized on early price momentum and took profit at opportune moments.

The x153 Moment: Buying and Selling Timeline

October 11, 2024:

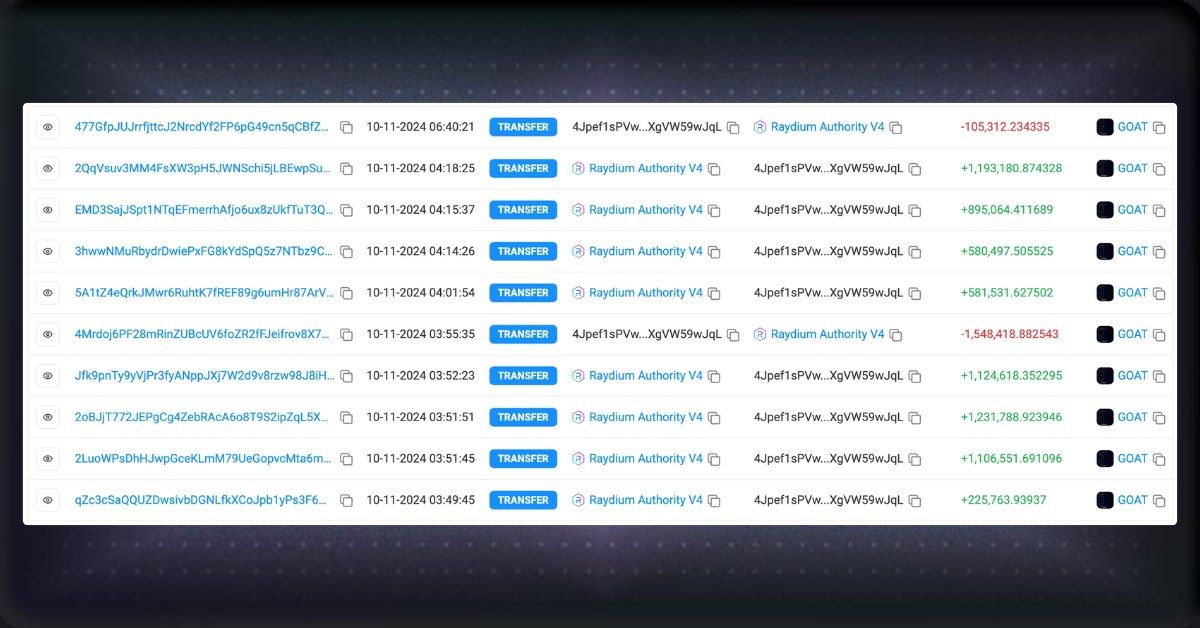

Between 03:30:09 and 04:18:25 UTC, this investor bought in bulk 15.4 million GOAT tokens while prices ranged from $0.0024 to $0.006. The average entry price settled around $0.0026. This initial buy positioned him to potentially gain 230% if the price were to reach $0.006. Although a strong outcome for most investors, this wallet recognized Goatseus Maximus’s momentum and potential beyond this point, even as it had already surged by 3,300% by the time of purchase.

In this period, at 03:55:35, the investor placed a sell order for 1.5 million GOAT tokens. We believe this order is to convert assets back into SOL, possibly to cover transaction fees rather than secure profit. The reason is he sold them at $0.003—a close margin compared to the buy price. Moreover, just minutes later, he made a repurchase of 580,000 tokens.

Transactions on October 11, 2024

October 13, 2024:

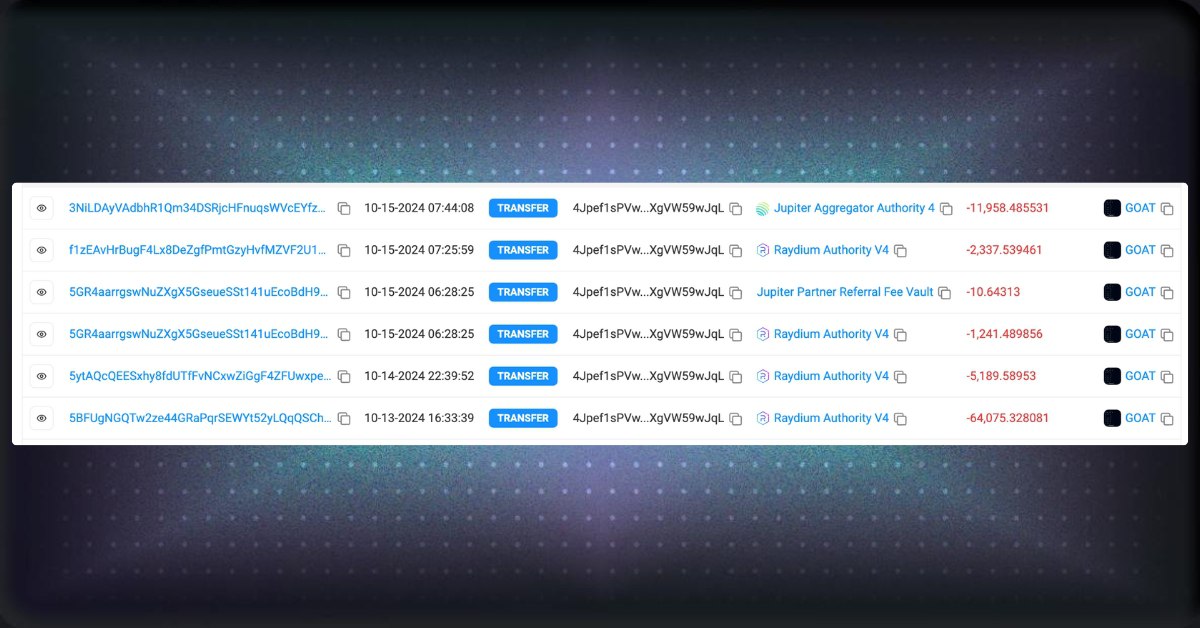

Later, at 06:33:39 on October 13, Goatseus Maximus reached $0.089, multiplying his initial funds by 14x. He then sold 64,075 tokens for $5,702 as his first major profit-taking move.

October 14, 2024:

As the coin continued to rise, he sold 5,189 tokens at $0.167 on October 14 at 22:39:52 UTC, netting $866. Over time, he sold a total of 15,537 tokens at $0.13 for around $2,000 and held onto the remaining amount.

Transactions between October 13 and 15, 2024

October 30, 2024:

When this article was written, Goatseus Maximus was valued at $0.67. His 13.36 million GOAT tokens hold an impressive worth of $8.9 million—a 153x return on his initial investment of $58,073, showcasing a highly strategic approach in meme coin trading.

His $58,073 turned into $8.9M

Strategy Used by the Wallet Owner

According to his trading behaviors, we believe he is a risk-taker and a huge meme coin enthusiast. His strategy revolves around his correct evaluation of the token’s potential.

Potential Evaluation

This investor appears to have a keen sense for spotting meme coins with high potential, focusing on those that show unique growth factors or promising momentum in the market. His initial purchase of Goatseus Maximus, even after the token had already surged by over 3,300%, shows a calculated bet on the coin’s ability to achieve even greater highs. Rather than relying solely on luck, he assesses each token’s potential based on its current momentum and his insights into market sentiment, looking for indicators that suggest further upward movement.

If you don’t have enough experience to find similar meme coins with high potential, you can visit the MevX trading bot website and seek the trending section. This section provides you with tokens that are experiencing great momentum, ensuring you can catch up with the surge.

Patience and Timing

Exemplifying patience, the investor holds his assets through considerable price fluctuations instead of making quick trades to capitalize on minor gains. For instance, rather than selling immediately after a surge, he allows the token’s value to increase significantly, indicating a well-thought-out strategy. This patience reflects a willingness to wait for more substantial returns rather than reacting impulsively to minor price changes, maximizing the potential growth of his investment.

Avoiding FOMO and Panic Selling

One notable aspect of his strategy is his ability to sidestep FOMO and panic selling, which are common pitfalls in the meme coin market. By refraining from emotional buying or selling, he avoids joining hype-driven rallies too early or exiting his position in response to temporary dips. His composure during periods of volatility suggests a disciplined mindset that keeps emotions in check, likely contributing to his long-term gains.

Taking Partial Profits

Rather than selling off his holdings all at once, he opts for a gradual, staggered approach. By taking partial profits at different price points, he secures returns incrementally while still holding onto a majority of his position, allowing him to benefit from continued gains if the token’s value rises further. This approach balances risk and reward, enabling him to capitalize on short-term spikes without sacrificing the opportunity for longer-term profits.

Lessons Learned from This Wallet’s Strategy

This wallet’s approach offers several key insights into meme coin investment.

Seizing Potential Even After Initial Gains: If you believe a coin has untapped potential, it may be worth investing even if the price has already surged. Just as a coin needs to reach 10x before it can hit 100x, high potential can justify entering even after substantial gains. We have covered an effective strategy in our article on how to trade trending meme coins.

Taking Partial Profits Instead of Full Exits: A common approach in meme coin investing is not to sell everything at once when you reach a profit. Selling gradually allows for capturing some returns while keeping exposure to potential further price increases.

Setting Ambitious Targets: Meme coins can have unpredictable yet explosive growth. For risk-takers, aiming for higher returns can be worthwhile—rather than panic-selling early, holding on through fluctuations could lead to substantial rewards if the market aligns.

How MevX Can Enhance Similar Strategies

The case study on Goatseus Maximus ($GOAT) demonstrates the strategic mindset required for high-return opportunities within meme coins, where both timing and disciplined profit-taking are essential.

For investors following this approach, the MevX trading bot offers a robust tool to streamline and strengthen these strategies, particularly in volatile meme coin markets.

- Timely Entries and Exits: In the case study, the wallet owner’s success was largely driven by timely entries and exits during rapid price movements. With MevX, investors can set automated buy and sell orders, capturing ideal price points in response to fluctuating market conditions.

- Slippage Control: As meme coin prices tend to swing widely, slippage control is also key. MevX’s private RPC system is optimized for speed, which minimizes the risk of executing trades at less favorable prices. With its private RPC, MevX ensures your transactions are processed with the fastest speed in the market.

- Gradual Profit Taking: Another critical lesson from the case study was to secure profit gradually. The MevX bot allows users to automate this by setting incremental sell points at target price levels. This feature lets traders manage risk effectively by locking in gains periodically without having to constantly monitor the market.

Conclusion

In summary, this wallet owner’s strategies offer valuable lessons in meme coin success, from assessing potential despite previous gains to taking profits in portions and setting ambitious targets. Success in this volatile space requires not only confidence but also a disciplined approach to timing, patience, and incremental profit-taking.

Disclaimer: The content of this article is provided for informational purposes only and should not be considered investment advice, financial advice, or any other type of professional advice.

Share on Social Media: