On September 24, 2025, Hyperliquid made headlines by launching Hyperliquid Stablecoin USDH, which quickly amassed nearly $2 million in early trading volume.

As Hyperliquid stablecoin USDH goes live, investors and enthusiasts are buzzing about its implications for the broader crypto ecosystem. But what exactly is behind this launch, and why does it matter?

What is Hyperliquid?

Hyperliquid stands out as a leading decentralized exchange (DEX) for perpetual futures, built on its own Layer 1 blockchain with HyperEVM as the execution layer, compatible with Ethereum.

Since its inception, it has dominated the on-chain perps market, capturing over 35% of global activity despite facing stiff competition from rivals like Aster on the BNB Chain.

In July 2025 alone, Hyperliquid processed a staggering $330 billion in trading volume, underscoring its robust infrastructure and appeal to traders seeking high-leverage opportunities.

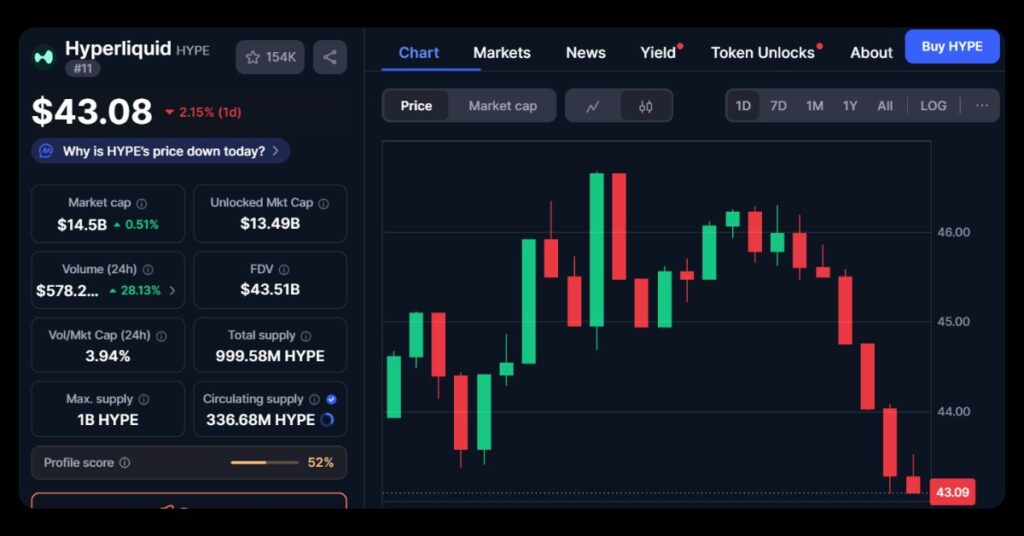

The platform’s native token, HYPE, was airdropped in November 2024, further fueling community engagement. Hyperliquid stablecoin USDH represents a strategic pivot away from reliance on external stablecoins like USDC, which previously accounted for over 90% of its collateral.

By introducing USDH, Hyperliquid aims to enhance internal liquidity, retain profits within its ecosystem, and provide users with a more seamless trading experience.

What Makes Hyperliquid Stablecoin USDH Tick?

USDH is designed as a 1:1 pegged stablecoin to the US dollar, issued by Native Markets and minted directly on HyperEVM.

- Backing Mechanism: Fully collateralized by cash and short-term US Treasury equivalents, managed through Stripe’s Bridge platform for transparency and security.

- Profit Allocation: Yields from reserves are split 50-50, half for buybacks of HYPE tokens, and the other half to fund ecosystem development, keeping value circulating internally rather than leaking to external issuers.

- Differentiation: This model sets USDH apart from fiat-backed peers like USDT or USDC, offering built-in incentives that could redefine stablecoin utility in DeFi.

The launch process was democratic yet contentious. Starting September 5, 2025, Hyperliquid opened governance proposals for issuers, attracting bids from heavyweights like Paxos, Ethena, and Frax Finance.

Native Markets emerged victorious on September 14 with over two-thirds of validator votes, led by figures like Max Fiege (a Hyperliquid investor), Mary-Catherine Lader (ex-Uniswap Labs president), and blockchain researcher Anish Agnihotri.

Critics raised concerns about potential biases, but the selection highlighted Hyperliquid’s commitment to decentralized decision-making.

Launch Day Breakdown: Stats and Early Performance

USDH officially went live on September 24, 2025, with initial trading pairs like USDH/USDC on HyperCore (app.hyperliquid.xyz). The response was immediate and enthusiastic, reflecting strong market interest.

- Early Trading Volume: Surpassed $2.24 million in USDC equivalents within hours, indicating rapid adoption.

- Current Supply Metrics: Total USDH supply at around $24.24 million, with $10.09 million minted on HyperEVM and $8 million available on HyperCore.

- Price Stability: Trading slightly above peg at approximately 1.001 against USDC initially, with minor fluctuations expected for a new asset.

- User Engagement: Over 8 million active addresses holding USDH, showcasing broad participation.

These figures, sourced from usdhstats.com, suggest USDH is off to a solid start, though real-time data may vary.

Future Outlook for Hyperliquid Stablecoin USDH

This launch could bolster Hyperliquid’s competitive edge, especially as it trails Aster in daily revenue ($2.79 million vs. $7.2 million).

By internalizing stablecoin operations, Hyperliquid reduces risks from external dependencies and fosters deeper liquidity. However, challenges remain: as a newcomer, USDH lacks a long track record, and recent governance debates led to a 7% dip in HYPE’s price.

Looking ahead, if adoption grows, USDH might challenge established stablecoins in DeFi, potentially integrating farming opportunities and expanding cross-chain.

In a volatile crypto market, the Hyperliquid stablecoin USDH launch exemplifies innovation amid uncertainty. Will it redefine DeFi stability? Time will tell.

Stay ahead of the curve, follow our MevX blog for more insights on emerging crypto trends!

Share on Social Media: