May 5-11, 2025 was an exhilarating week in cryptocurrency as meme coins ignited a trail of excitement with their price hikes and pop culture driven narratives. In the article below, we delve into hot trends, high market activity, and record-breaking moments that dominated the week and give tips to enthusiasts and investors.

Meme Coin Weekly Recap: May 5-11, 2025

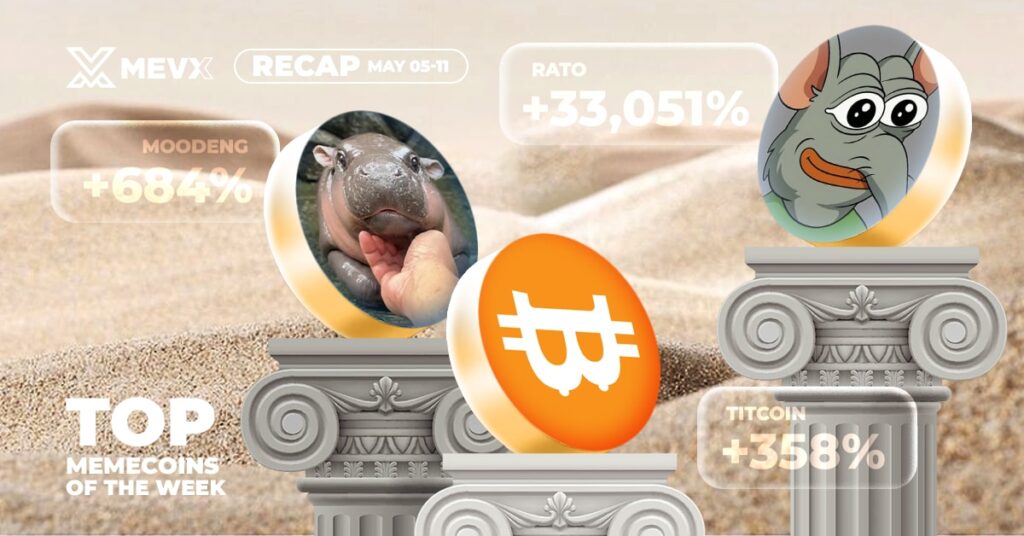

Meme coins led the way, with new tokens associated with the election of Pope Leo XIV and Elon Musk’s Gork sparking wild trading, including Tungtungtung Sahur, Rato the Rat, and Titcoin.

Tungtungtung Sahur ($TUNG) Skyrockets

Tungtungtung Sahur ($TUNG) was the breakaway star, surging higher by over 150% to a market cap of $50 million on $25 million in volume over 24 hours. Live X and out-of-the-box branding ignited a stratospheric ride to the upside to cement its reputation as best performing asset of the week and a meme coin madness poster child.

Rato the Rat ($RATO) Steals the Show

Rato the Rat ($RATO), a token created by Pepe the Frog creator Matt Furie, moved from a $10 million to a $30 million market cap on the strength of $15 million in volume. Viral X posts and collector mania mirrored Pepe’s cultural relevance, and $RATO was a token on a meme coin investor’s watchlist.

Bull ($BULL) Rides the Wave

Market symbol of bullishly inclined sentiment $BULL surged by 80% to a market cap of $20 million on a $20 million trade volume. Its straightforward tale appealed to investors boarding the Bitcoin rally wagon and was a favorite among speculation traders.

Big Meme Coins Surge in Volume

Pepe ($PEPE), Pnut ($PNUT), and Moo Deng ($MOODENG) saw epic volume spikes, which could presage a meme coin season. $PEPE rose 80% to a market cap of $5.8 billion on volume of $14.2 million, $PNUT doubled to $297 million on volume of $17.6 million, and $MOODENG moved up 285% to $137.9 million on volume of $21.6 million on FOMO and social media attention.

Pope Leo XIV Meme Coins Spark Debate

The Pope Leo XIV election also ignited a meme coin mania and had a number of the tokens pump up to as much as 200% and record a combined volume of $10 million in trades. They were roundly criticized on X for capitalizing on a dicey moment and the morality of meme coin storytelling.

Cthulu ($CTHULU) Channels Vitalik’s Mystique

Cthulu ($CTHULU), fueled initially by Lovecraftian horror and Vitalik Buterin, surged 200% to a $15 million market cap on $8 million volume. The bizarre blend of Ethereum fandom and terror was a success among X users and fueled its skyward trajectory.

Titcoin ($TITCOIN) Stages a Comeback

Titcoin ($TITCOIN), an experienced meme coin, rallied 50% to its all-time high and reached a $25 million market cap and $12 million volume. Its recovery highlighted renewed interest in experienced meme coins in a bull market environment.

Gork Tokens Soar with Musk’s Interaction

Gork parody account-associated meme tokens surged after Elon Musk’s engagement. One token, New XAI Gork ($GORK), surged 300% to a market capitalization of $40 million with a volume of $30 million. Elon Musk’s X handle changed to “Gorklon Rust” and a tweet engaging with @gork fueled feverish speculation despite Gork not representing a duly noted project by xAI. The surge pushed some associated tokens up to as much as a 7,100% gain as Musk’s influence was on full display, but X posts cautioned against potential scammers and noted $GORK’s tangential relation to xAI.

Niche Meme Coins Gain Momentum

Some meme coins did stir up a buzz, like Partyhats ($HATS), a meme token tied to RuneScape’s legendary party caps, which doubled to a $10 million market cap on $5 million volume. Chill House ($CHILLHOUSE), a merge of Chill Guy and Housecoin, rose 120% to $8 million on $6 million volume. Diddy ($DIDDY) and Hood Mr. Beast ($MRLEAST) also gained traction and established market caps of $5 million and $7 million, respectively.

Other Notable News: May 5-11, 2025

The crypto space was abuzz with revolutionary events in the time period, ranging from institutions to regulatory news and surprises. Below are the main events of the period.

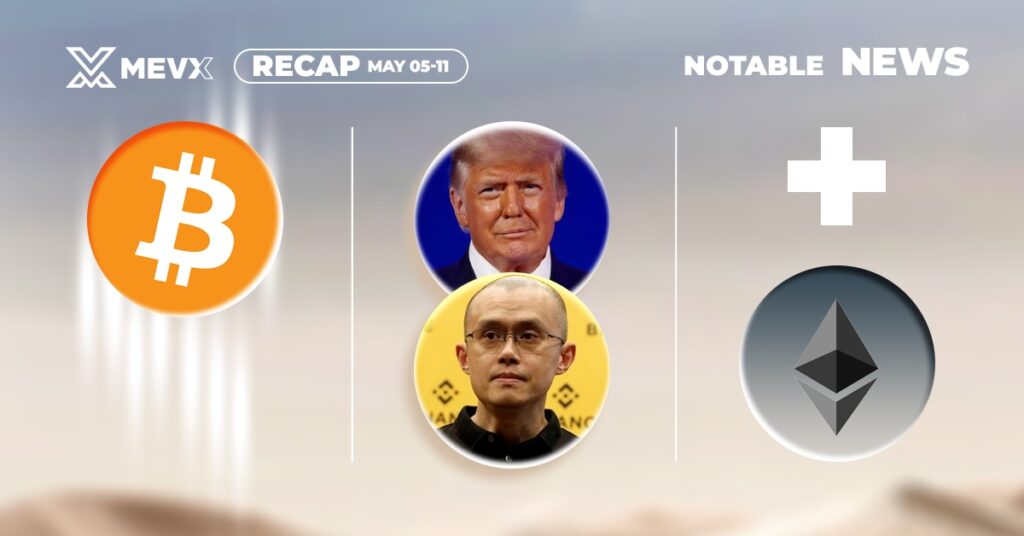

Bitcoin Reaches $104,700

Bitcoin hit $104,700 near its all-time high of $110,000 on the back of institutional buying and positive market attitude, on a volume of $20 billion in 24 hours. The benchmark drove the trend among altcoins and meme coins alike.

BlackRock Bolsters Ethereum ETF with Staking

BlackRock announced staking exposure in its Ethereum ETF, a first in institutional onboarding of cryptocurrency. The product would attract investors seeking passive income, propelling Ethereum’s price to $1,850 by 5% and amplifying its popularity among mainstream investors.

Ethereum Prepares for Pectra Upgrade

Ethereum’s upcoming Pectra upgrade, focused on improving scalability and security, generated positive sentiment. The anticipation fueled increased staking activity and price stability, positioning ETH for potential further growth.

CZ’s Pardon Request Sparks Speculation

The ex-CEO Changpeng Zhao (CZ) of the crypto exchange firm Binance requested a pardon from President Trump amidst controversy surrounding leniency in regulation. The operations and reputation of Binance hang on the decision’s fate. X posts on social media had equal parts optimism and scepticism.

Federal Reserve Holds Rates Steady

The Federal Reserve’s decision to maintain interest rates steady provided a solid setting to financial markets, supporting risk assets like cryptocurrencies. The setting calmed investors and contributed to the upbeat momentum of the week.

Stablecoins Poised to Lead in 2025

Stablecoins were forecasted by experts to take over the cryptocurrency market by the year 2025 on the back of increasing usage in payments and settlements. The forecast had emphasized their central role in connecting traditional and decentralized finance.

Zerebro Founder Found Alive

Zerebro founder Jeffy Yu, previously reported missing, was found alive, boosting confidence in the project. The news triggered a 10% price increase for Zerebro’s token, with $3 million in trading volume.

Binance Backs Dood Airdrop

Binance supported an airdrop on the launch of Doodles as it brought NFTs to its ecosystem. The project boosted the token of Doodles by 15%, volume reaching $5 million and indicating more synergy between cryptocurrencies and NFTs.

Chainlink Launches Rewards Program

Chainlink introduced a rewards program to promote ecosystem participation, propelling $LINK from 8 to $15 on a volume of $10 million. The program is intended to grow the size of Chainlink’s oracle network and make it more reliable for DeFi applications.

ETH-BTC MVRV Analysis Signals Opportunity

ETH-BTC MVRV calculation tracked Ethereum undervaluation relative to Bitcoin and signaled ETH price appreciation potential. It was fueled by $8 billion ETH volume trades reflecting investor optimism surrounding Ethereum’s fate.

Conclusion

The week of May 5-11, 2025, was a vivid showcase of the crypto market’s dynamism, with meme coins like Tungtungtung Sahur, Rato the Rat, and Gork-related tokens leading with explosive gains, fueled by X-driven hype and cultural relevance. Bitcoin’s $104,700 surge and Ethereum’s institutional and technological advancements underscored the sector’s growing maturity. However, ethical concerns around event-based meme coins and regulatory uncertainties, such as CZ’s pardon request, highlighted inherent risks. As stablecoins gear up to lead in 2025, investors must navigate this vibrant landscape with informed caution, balancing speculative opportunities with strategic diligence.

Share on Social Media: