The period September 1 to 7, 2025, witnessed memecoins capturing the crypto space in the midst of a $3.9-$4 trillion market cap. Bitcoin held steady at $110,000-$112,000, Ethereum fell to $4,300-$4,377, and Solana reached $213 with $11.76 billion DeFi TVL. Solana’s frenzied activities in the domain of memecoins, with Pump.fun launches as a driving force, integrated nostalgia, parody, and real-world assets or RWA storylines, and volatility were created through Trump-connected projects and institutional entries. This summary presents noteworthy memecoins, trends, and events for traders and enthusiasts.

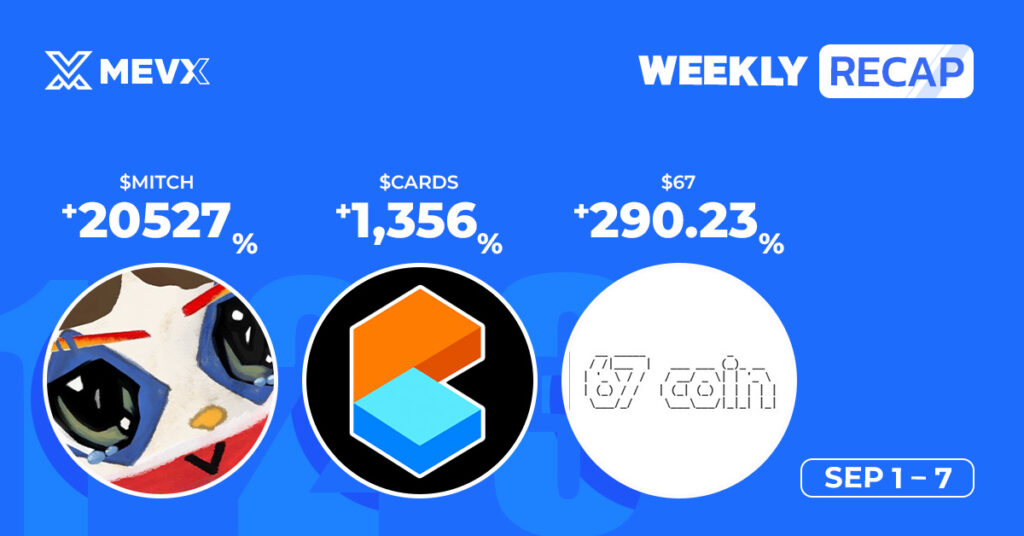

Meme Coin Weekly Recap: September 1 – 7, 2025

The week of September 1 – 7, 2025, saw Solana memecoins like $WLFI, $CARDS, $ZARD, $PICKLE, $MITCH, and $USDUT lead with explosive growth, tapping cultural and collectibles themes. Ethereum’s memecoin scene grew, but Solana’s dominance and Trump-driven hype stole the spotlight, tempered by whale dumps and scam risks.

$WLFI: Trump-Fueled Surge and Crash

$WLFI, World Liberty Financial’s governance coin, debuted September 1 on Ethereum, reaching a $9.5 billion all-time high (ATH) market value at $0.31-$0.35 before plummeting 40% to $0.23 with a 24-hour volume of $1.96 billion. Supported by the Trump family (22.5 billion tokens) and Justin Sun ($75M to $750M), it released 24.6% of its 100 billion supply, prompting $49 million in whale selling. A 47 million coin burn value of $11.34M and Sun’s wallet freeze value of $900M were intended to dampen volatility, yet bearish sentiment placed it ninth in the top 100 cryptos.

$CARDS: Pokémon Cards Go On-Chain

$CARDS, linked with Collector Crypt, achieved a market capitalization of $324.4 million with 24-hour volume of $27.5 million by September 3. First released on August 29 on Solana’s Raydium, it powers a marketplace that sells Pokémon card NFTs and generates a gacha mechanism-driven transaction volume of $145 million. Having a 2 billion supply and a liquidity of $5.1 million, it surged 600% in 1 day, blending meme mania and $30 billion collectibles marketplace functionality, but anonymity on the part of the team gives a rug-pull fear.

$ZARD: Charizard Reserve Rides Nostalgia

$ZARD reached a peak of $7.1 million and is currently at $3.2 million with $3.9 million in volume. Released on Pump.fun, it pays for a Strategic Charizard Reserve of PSA-graded Pokémon cards from protocol fees, kept on-chain in Beezie storage. A 55% decline from ATH signals volatility in its “scarcity, storytelling, status” narrative, on the upside affected by X hype and on the downside by regulatory risks.

$PICKLE: Pickleball Vault Fuels Hype

$PICKLE hit a $1.9 million ATH, trading at $1.1 million with $3 million in volume. On Pump.fun, it capitalizes on pickleball’s U.S. advance and Ben Johns’ celebrity, spending fees on ~3,900 scarce 2023 Leaf cards for PickleVault. Its loop-based feedback propelled card costs parabolically, following in the footsteps of $CARDS’ template, but volatility and Solana’s scam-friendly ecosystem beget a sense of caution.

$MITCH: Meme Trader’s Wild Ride

$MITCH hit a $41.58 million ATH in two hours on September 3, now at $33 million with $24.1 million volume. Created by Solana trader Mitch, it rides his $8M-to-$500K portfolio saga, with 80% supply locked and giveaways via livestreams. Its entertainment focus and 20% drop signal extreme volatility, fueled by X buzz but reliant on Mitch’s fame.

$USDUT: Anti-Stablecoin Volatility Play

$USDUT touched a $5.84 million ATH, now at $2.7 million with $3 million in volume. Pumped on Pump.fun, it positions volatility as a selling point, ridiculing stablecoins such as Tether. Its “unstable by design” tagline attracted speculative investors, yet a 54% correction and absence of centralized listings demonstrate extreme-risk reliance on hype.

Solana’s Viral and Thematic Tokens

$BREWSKI, $PEPECHU, $PokeSol, $BETLY, $STREAMER, $PEPENA, $Conor, $SIM (SimpCoin), and $SIM (Human Simulation) led Solana’s meme surge. $BREWSKI ($2.66M ATH) rode Druski’s 130M-view whiteface skit, dropping 44%. Pokémon-themed $PEPECHU ($3.7M volume), $PokeSol ($6.5M), and $Satoshi ($3.3M) saw 26,000+ transactions. $BETLY ($2.1M ATH) simplified prediction markets. $STREAMER ($11.31M ATH) donated fees to streamers, dropping 51%. $PEPENA, $Conor (McGregor satire), $SIM (e-girl fees), and $SIM (life simulation) hit 25,000+ transactions. Others like $Trashy ($1.4M, Matt Furie), $CLXM (Pokémon NFTs), $NOICE (Farcaster tipping), $DUSD (deflationary parody), and $JUMBA (degen) fueled Solana’s chaotic ecosystem.

Ethereum and Base Memecoins

$GROKAN, $Cope, $Blunt, $ts, $MILO, $FOMO, $FLY, $Healtwy, $AI4, $CMM, and $holo emerged on Ethereum/Base. $GROKAN tied to Grok AI apps, $Cope pushed “American dream” grinding, $Blunt leaned on weed humor, and $holo explored surreal narratives. High transaction volumes (25,000+) signaled early adoption, but lack of utility and rug risks persisted.

MevX’s Early Calls

MevX flagged $WLFI (36x presale gains), $CARDS (+600%), $MITCH, and $USDUT early, using wallet tracking and sniper tools to spot 100x-2000% potentials, with $PEPECHU, $PokeSol, and $BETLY on watchlists.

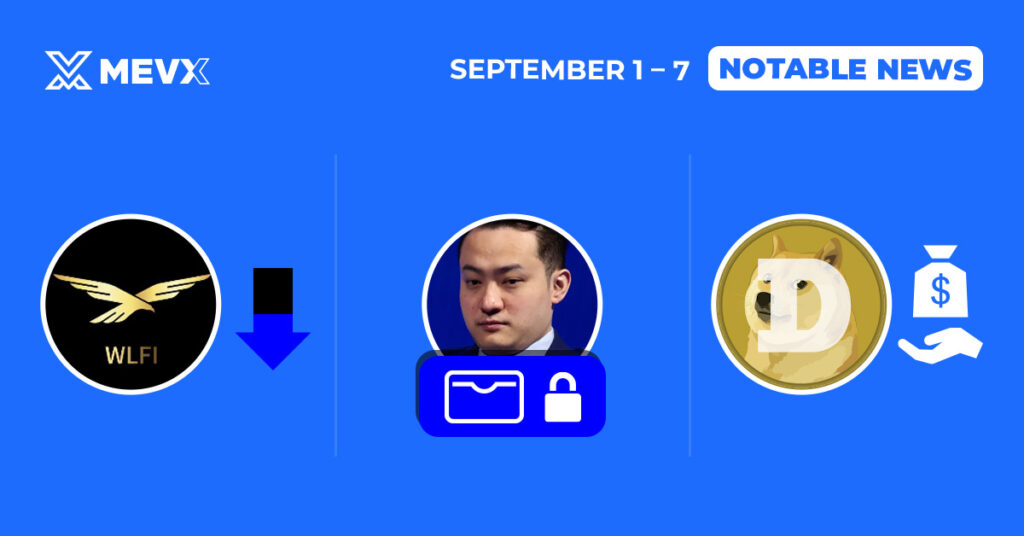

Other Notable News: September 1 – 7, 2025

Institutional moves, regulatory shifts, and security issues shaped the week.

Market Dynamics and Institutional Plays

Bitcoin held $110,000-$112,000 despite $370-$805M liquidations; Ethereum saw $1.2B ETF inflows but $61-$196M outflows. Solana’s $213 price and $11.76B TVL fueled meme growth. Yunfeng Financial (Jack Ma-linked) bought 10,000 ETH ($44M) for Web3/RWA. CleanCore’s $175M DOGE treasury with House of Doge lifted DOGE 1.5% to $0.21, but ZONE stock crashed 52.7%. Strategy added 4,048 BTC ($449M); BitMine held 1.87M ETH ($8.1B).

Trump-Linked Projects

$WLFI’s $9.5B ATH crashed 50%; Sun’s wallet freeze ($900M) and 47M token burn aimed to stabilize. American Bitcoin (ABTC) debuted on Nasdaq, spiking 110% to $2.1B cap, holding 2,443 BTC ($273M). Trump’s deregulation push (GENIUS/COIN Acts) raised conflict-of-interest fears.

Regulatory and Security Updates

SEC delayed 21Shares SUI ETF to December for listing rules. SEC/CFTC approved spot trading; Polymarket gained U.S. approval post-$112M acquisition. Ripple’s RLUSD ($700M cap) expanded to Africa for payments. August hacks cost $163-$173M, including Venus ($27M) and Bunni ($8.4M). Ethereum Foundation sold 10,000 ETH ($43M) for R&D.

Tech and Stablecoin Developments

Coinbase’s Mag7 + Crypto Equity Index Futures (launching September 22) blends tech stocks and BTC/ETH ETFs. Avalanche-Toyota built robotaxi infrastructure; Tether entered gold mining; Binance invested $53M in Mexico. Ripple’s RLUSD powered Kenya’s climate insurance pilots.

Conclusion

The week of September 1 to 7, 2025, underscored memecoins’ speculative passion, as Trump-booster $WLFI’s upsurge, $CARDS and $ZARD’s RWA tokens, and $MITCH’s trader drama spearheaded Solana’s move. Volatile sarcasm came in the form of $USDUT and $BREWSKI, and Ethereum’s memecoins gained ground. Whale dumps, hacks, and regulatory hold-ups require caution despite institutional ETH/DOGE purchases and Coinbase’s futures launch indicator of mainstream growth. Navigate through the high-risk domain via MevX’s tools. Daily commentary waits on the MevX Blog.

Share on Social Media: