TLDR:

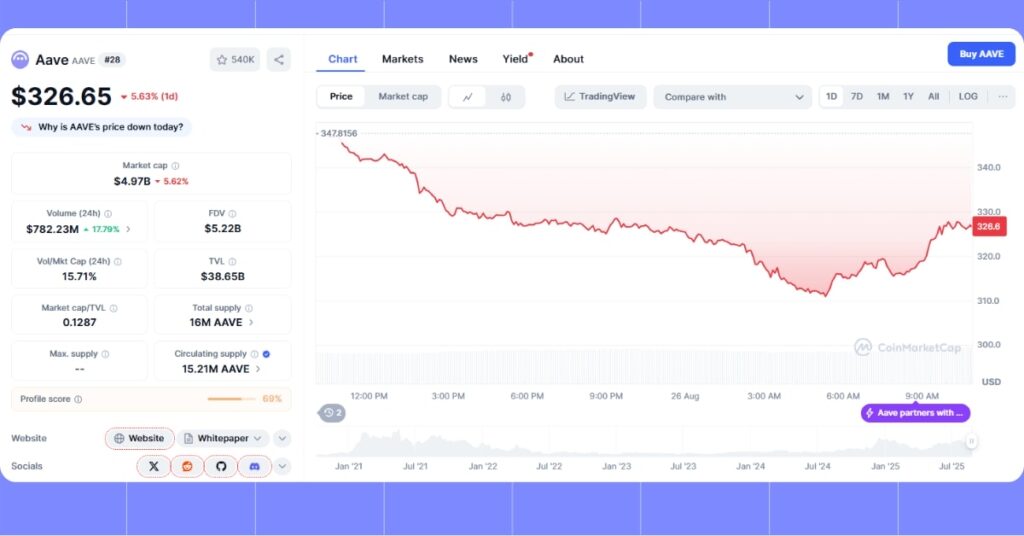

- Market: AAVE dropped more than 5% from $385 to under $350, and WLFI’s pre-market price dropped from $0.45 to $0.25 following a dispute concerning 7% token distribution.

- Narrative: Aave’s proposed 7% WLFI token allocation and 20% fee agreement to assist WLFI’s DeFi platform was dismissed as “fake news” by WLFI, causing concerns over governance transparency and market fluctuations.

Aave (AAVE) and World Liberty Financial (WLFI) are reeling from a governance dispute, with AAVE dropping over 5% from $385 to below $350, and the pre-market value of WLFI decreasing from $0.45 to $0.25. At the center of the scandal is a 2024 governance proposal of an Aave DAO to establish WLFI on Aave V3, with a proposal to award Aave 7% of WLFI’s 100 billion token supply (7 billion tokens) and 20% of protocol fees. Aave’s Stani.eth confirmed the existence of the deal on August 23, 2025, that it could inject $2.5B to Aave’s treasury. However, WLFI’s team, backed by the Trump family, denied the 7% allocation as “fake news” to Wu Shuo Blockchain, with suspected team member Dylan_0x (@0xDylan_) repeating the denial, causing an 8% fall in the value of AAVE.

The discussion shows transparency issues relating to the governance of DeFi. WLFI, having begun in 2024, will list 20% of presale tokens (funding rounds of $0.015 and $0.05) for trading on 1st September 2025, allocating 80% to community governance. Founder team, advisor, and partner tokens are left locked. dForce founder Mindao disparaged the proposal of sloppily sorting out things, guessing WLFI will abandon ship and throw in the towel in a bid to garner more traction for its USD1 stablecoin. X user Laolu quotes botched DeFi deals similarly, for example, SPK’s reduced 1% stake. Aave’s previous squabble with Polygon over a $110M earning plan is reminiscent of this tension. Investors are cautioned to expect volatility when WLFI’s launch is near and transparency relating to governance is non-existent.

Read more DeFi narratives on the MevX Blog!

Share on Social Media: