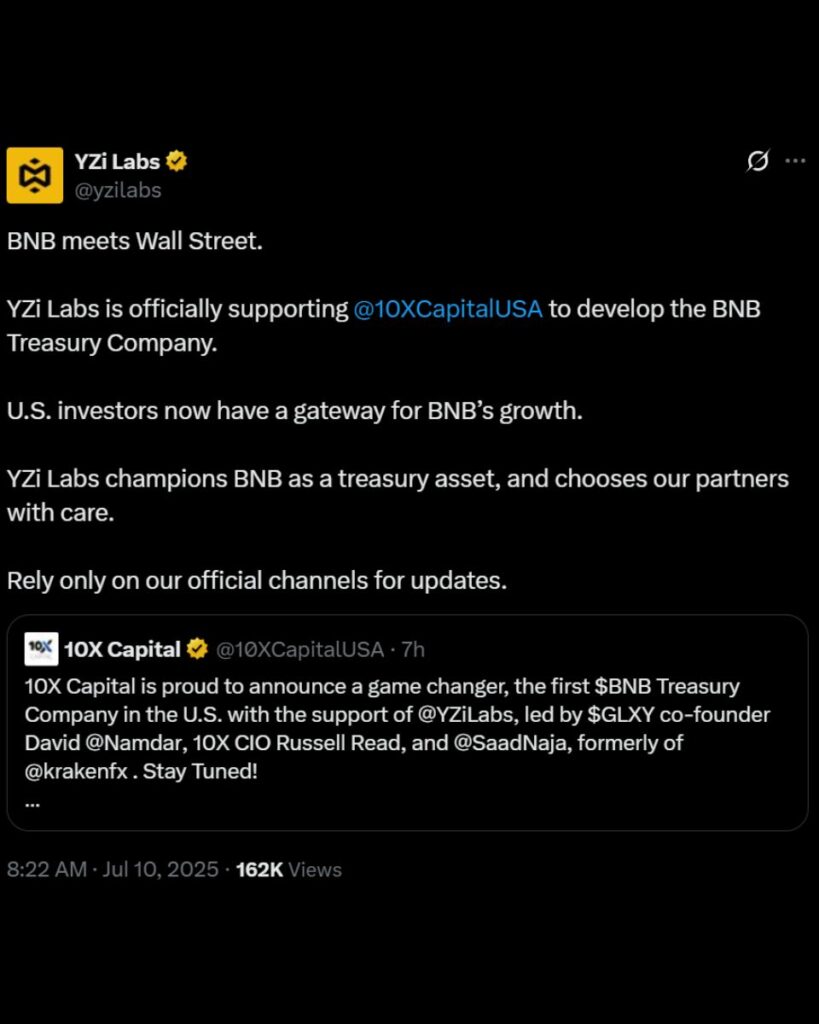

Backed by YZi Labs and 10X Capital, BNB Treasury Company aims to seamlessly integrate decentralized finance (DeFi) with traditional finance (TradFi), offering investors a unique opportunity to engage with Binance Coin (BNB) through a regulated, publicly listed entity. So, what makes BNB Treasury Company a compelling development in the crypto world?

What is BNB Treasury Company?

BNB Treasury Company is designed to hold and manage BNB, the native token of the BNB Chain, which boasts a market capitalization of approximately $94.22 billion as of July 2025. Led by David Namdar, a veteran from Galaxy Digital, the company provides U.S. investors, both institutional and retail, with a compliant pathway to invest in BNB’s growth.

By preparing to list on a major U.S. stock exchange, BNB Treasury ensures transparency and regulatory alignment, overcoming barriers that have historically limited direct crypto investments in the U.S.

YZi Labs: The Powerhouse Behind the Scenes

YZi Labs is a global investment firm managing over $10 billion in assets. With a focus on Web3, AI, and biotech, YZi Labs supports innovative ventures across all stages, nurturing over 300 projects worldwide.

Its incubation programs have propelled more than 65 portfolio companies, showcasing its expertise in fostering cutting-edge technologies like BNB Chain, which underpins BNB Treasury Company’s vision.

10X Capital: Driving Digital Transformation

10X Capital specializes in digital assets and infrastructure. This forward-thinking investment firm combines expertise in asset management, corporate development, and capital markets to build disruptive strategies.

By supporting BNB Treasury Company, 10X Capital leverages its global reach to create a robust digital assets treasury, bridging the gap between traditional and decentralized finance.

Key Features of BNB Treasury Company

- Strategic Partnerships: Supported by YZi Labs and 10X Capital, with collaboration from firms like Cohen & Company Capital Markets and Clear Street LLC for capital raising.

- On-Chain Acquisition Engine: Acts as a “treasury” for BNB, using on-chain capital to acquire off-chain assets, merging DeFi and TradFi.

- Institutional Appeal: Provides a regulated avenue for institutional investors to access BNB without relying on crypto exchanges.

- Transparency and Governance: Commits to regular asset reporting and active engagement with the BNB Chain community.

Why It Matters

BNB Treasury Company aligns with a growing trend of publicly traded firms, such as Nano Labs and Build & Build Corporation, adopting cryptocurrencies as treasury assets.

By amassing significant BNB holdings, the company could enhance BNB’s liquidity and mainstream adoption, positioning it alongside Bitcoin and Ethereum as a preferred institutional asset.

However, investors should remain mindful of market volatility and regulatory uncertainties.

What’s Next for BNB Treasury Company?

With plans to finalize its initial funding in the coming weeks, BNB Treasury Company is set to redefine crypto investment strategies.

Want to stay informed about this transformative venture? Follow MevX blog for the latest updates on BNB Treasury Company and other crypto innovations!

Share on Social Media: