Bitcoin has taken a bruising tumble, Dipping below the $80,000 mark to $79,320 on Mar 11th, a 6% drop in just 24 hours that has the crypto world on edge. With whispers of a further slide toward $70,000, fear is creeping in, but a tweet from Changpeng Zhao (CZ), the former Binance CEO, offers a gritty reminder of what it takes to win in this game.

The Drop and the Dread

The numbers tell a stark story: Bitcoin’s 12% plunge over two days has erased billions from its market cap, dragging altcoins like Ethereum and Binance Coin down with it. Macro pressures are partly to blame—rumors of U.S. Federal Reserve rate hikes have spooked risk-hungry investors, while profit-taking from early adopters has added fuel to the fire. Technical charts show $80,000 as a broken support level, with stop-loss orders kicking in to accelerate the fall. On X, the chatter is grim: “Here we go again,” one user mutters, while another predicts “$70,000 incoming.” The ghosts of bear markets past are stirring, and the unease is palpable.

This isn’t uncharted territory, though. The scars run deep from previous crashes. In 2018, Bitcoin plummeted from $20,000 to $3,200, an 84% wipeout that left the market in tatters for years. In 2022, it crashed from $69,000 to $16,000, a 77% drop driven by soaring inflation and regulatory dread. Altcoins fared worse, with many fading into obscurity. Now, as Bitcoin teeters and the broader crypto market bleeds, those haunting memories resurface. But here’s the kicker: each time, Bitcoin clawed its way back. The HODLers who endured the pain came out on top.

Toward $70K—But Not the End

Analysts see a path to $70,000 if the slide continues. If the $78,000 support buckles, the next stop could be $75,000, with $70,000 looming as a plausible floor. Regulatory rumors—like tighter U.S. oversight of exchanges—and a cooling memecoin frenzy aren’t helping. One X post ties the drop to disappointment over a hyped-up U.S. Bitcoin reserve plan that failed to spark bullish fire. Another points to big players cashing out, amplifying the “risk-off” mood. The charts back this up: Bitcoin’s Relative Strength Index is flirting with oversold levels, signaling a potential bounce—but only if buyers step in.

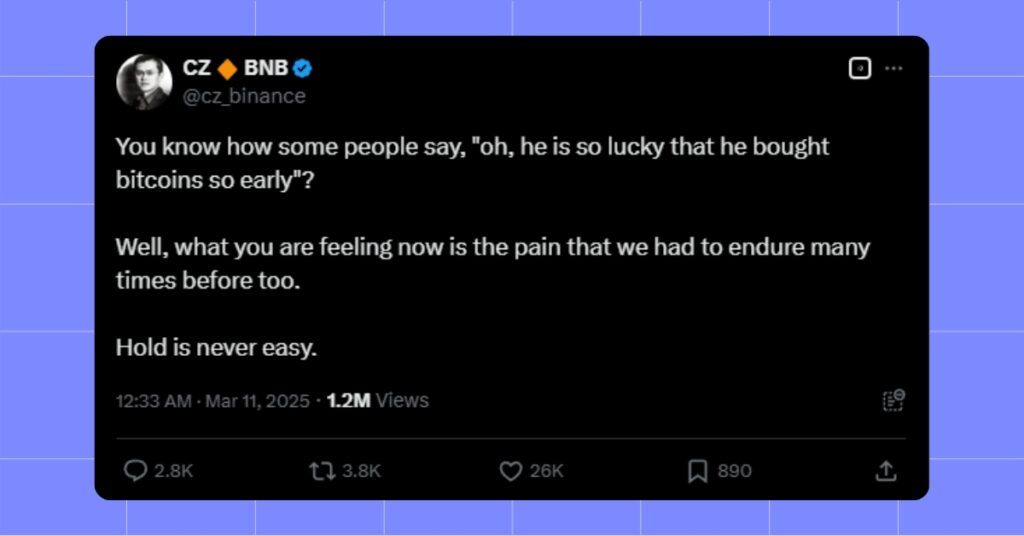

Yet, this isn’t a death knell. Corrections like this are par for the course in crypto’s wild ride. The 2018 and 2022 crashes felt apocalyptic too, but Bitcoin didn’t just survive—it soared to new highs. Today’s $70,000 scare could be tomorrow’s buying opportunity. “Zoom out,” one X user urges. “This is just noise in a bigger bull run.” CZ’s tweet echoes that sentiment, framing the pain as a rite of passage for those chasing the long-term payoff.

HODL And Wait

CZ knows the drill. He’s seen the dark days and lived to tell the tale. His message isn’t just nostalgia—it’s a battle-tested truth. Holding through volatility is brutal, no question. Watching your portfolio shrink 12% in two days stings, and the altcoin bloodbath—some down 20% or more—only deepens the wound. But the data backs him up: those who sold in 2018’s despair missed the 2021 peak; those who panicked in 2022 regretted it by 2024. HODLing isn’t easy, as CZ says, but it’s the cornerstone of crypto success.

The X community is split, as always. Some see a repeat of past crashes, with one user lamenting, “It’s 2022 all over again.” Others hold firm: “Down 15% this week, but I’m not selling. CZ’s right—this is the grind.” The optimists point to Bitcoin’s resilience, its market cap still towering above $1.5 trillion even after the hit. If history repeats, the dip to $70,000 could be a pit stop, not a graveyard.

Looking Ahead

So, what’s next? The road to $70,000 might be bumpy, but the climb back isn’t far-fetched. Analysts peg $78,000 as a line to watch—if it holds, a rebound to $85,000 could be in play by spring. If it breaks, brace for a deeper dip, but don’t bet against recovery. Crypto’s playbook is clear: volatility is the price of admission, and patience is the profit. CZ’s words ring true in this storm—holding is a test of nerve, but it’s the ones who stay the course who write the victory tales.

Bitcoin’s dropped below $80,000, and the ghosts of crashes past are rattling their chains. The slide to $70,000 looms, but it’s not the end—it’s a chapter. HODL through the pain, as CZ urges, because in crypto, the scars heal, and the rewards come to those who wait.

Find more articles on the MevX Blog!

Share on Social Media: