Bitcoin, the first and most prominent cryptocurrency, has solidified its place in financial history. On December 5th, 2024, Bitcoin passes $100,000 marking a milestone in its remarkable journey from obscurity to global recognition. This achievement not only highlights its value as a digital asset but also underscores its growing acceptance as a legitimate financial instrument. In this article, we will analyze the rapid growth of Bitcoin, focusing on its historical price surges, its role as a store of value, and what the future holds as it sets its sights on the $1,000,000 mark.

A Historical Overview of Bitcoin’s Price Milestones

Look at Bitcoin started from scratch until now:

From $0 to $1,000

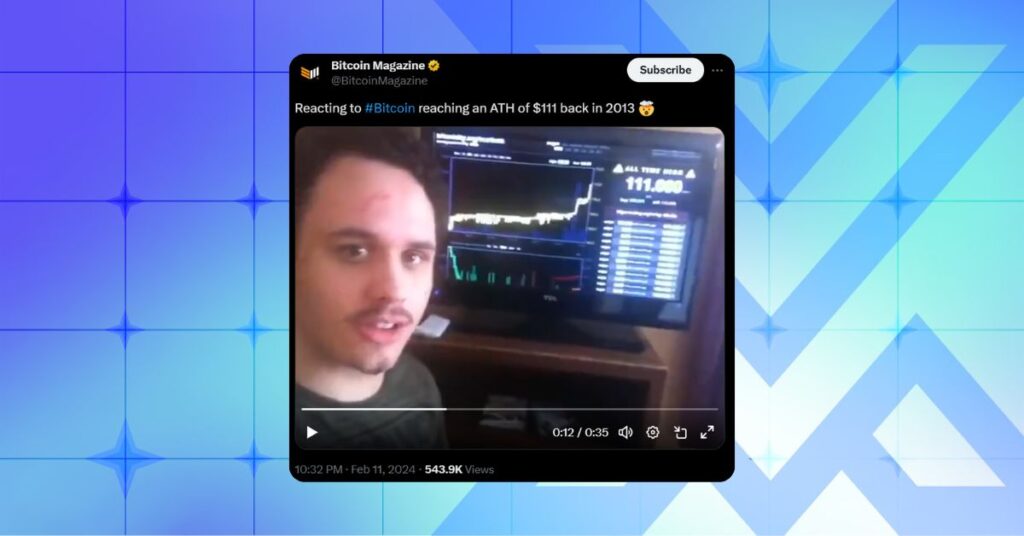

Bitcoin’s journey began in 2009 when Satoshi Nakamoto introduced it as a decentralized digital currency. Initially valued at $0, Bitcoin’s first major price milestone occurred in April 2013, when it broke the $100 mark. By December of the same year, Bitcoin passes $1,000, a tenfold increase within months, signaling its potential to disrupt traditional financial systems.

The $10,000 Breakthrough

The infamous bull market of 2017 saw Bitcoin’s price exceed $10,000 in November, driven by increasing retail investor interest and media attention. This period demonstrated Bitcoin’s potential as both a speculative investment and a hedge against inflation, setting the stage for further institutional adoption.

The Historic Milestone: Bitcoin passes $100,000

Fast forward to December 5th, 2024, Bitcoin officially passes $100,000 for the first time. This milestone was fueled by a combination of factors: growing institutional investment, adoption as legal tender by certain nations, and widespread acceptance as a store of value. Bitcoin’s ascent to this level solidifies its status as a mature and globally significant asset.

Bitcoin as a Store of Value

Bitcoin’s rise from $0 to $100,000 underscores its evolution from a niche technology to a robust store of value. Unlike traditional assets, Bitcoin’s scarcity (capped at 21 million coins) and decentralized nature make it a hedge against inflation and currency devaluation. Investors and institutions alike now recognize its potential to preserve wealth over the long term.

Moreover, Bitcoin’s utility extends beyond investment. It has been adopted for everyday transactions and remittances and as a tool for financial privacy. The growing adoption by nation-states as legal tender further legitimizes its use case, offering financial inclusion to millions of unbanked individuals worldwide.

Institutional Adoption and Market Dynamics

Wall Street firms, traditionally skeptical of cryptocurrencies, are now integrating Bitcoin into their portfolios. The launch of Bitcoin ETFs and the involvement of major financial institutions have increased liquidity and reduced volatility, making the market more accessible to both retail and institutional investors.

Additionally, pro-Bitcoin legislation in various countries has created a more favorable regulatory environment, further driving adoption. These developments signal a paradigm shift, where Bitcoin is not just an alternative asset but a fundamental component of modern financial systems.

The Road to $1,000,000

The question is no longer if Bitcoin will reach $1,000,000, but when. Analysts predict that the journey from $100,000 to $1,000,000 will be considerably faster than its rise from $0. As adoption grows and demand continues to outpace supply, Bitcoin’s value is expected to skyrocket.

Factors such as limited supply, increasing utility, and macroeconomic conditions (e.g., inflation and currency instability) will likely accelerate this growth. As more individuals and institutions recognize Bitcoin’s potential, its path to $1,000,000 seems inevitable.

Explore ORDI: A Revolutionary Meme Coin Crypto Built on Bitcoin

Conclusion

Bitcoin passes $100,000 represents a historic milestone in the evolution of digital assets. Its journey from $0 to six figures reflects its resilience and growing significance in the global economy. As Bitcoin sets its sights on $1,000,000, it continues to redefine the financial landscape, offering a decentralized, inflation-resistant store of value for the digital age.

FAQs

1. Why is Bitcoin considered a store of value?

Bitcoin’s fixed supply, decentralization, and resistance to inflation make it an ideal asset for preserving wealth over time.

2. How did Bitcoin reach $100,000?

The $100,000 milestone was achieved through increased adoption, institutional investment, and favorable market dynamics.

3. What factors could drive Bitcoin to $1,000,000?

Key factors include continued institutional adoption, limited supply, global macroeconomic trends, and technological advancements within the Bitcoin ecosystem.

Share on Social Media: