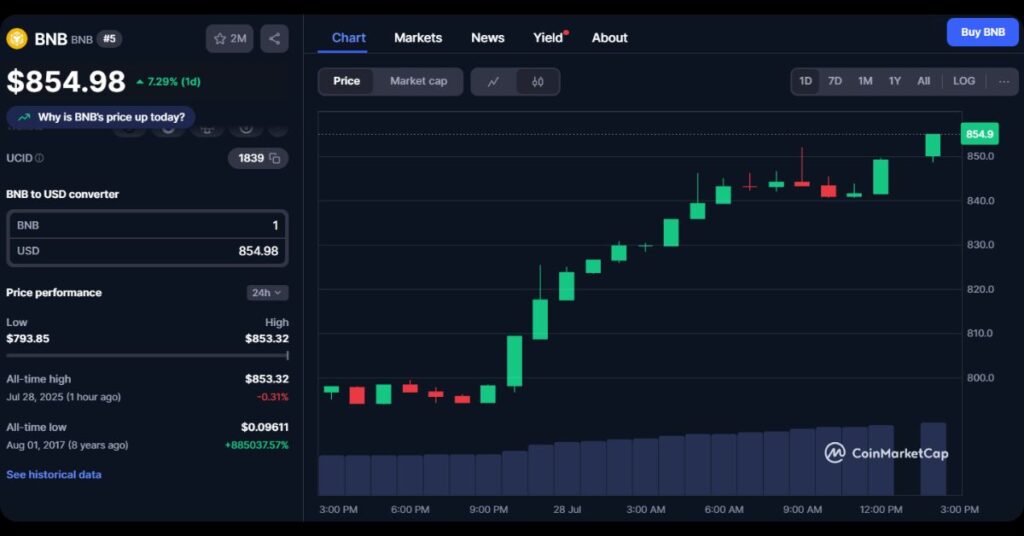

BNB hits new ATH of $853.32 on July 28, 2025. This milestone marks a significant rally, with BNB experiencing a 6-7% daily increase and over 12% weekly growth, pushing its market capitalization beyond $118 billion.

BNB Hits New ATH – Factors Driving

According to recent market analyses, the BNB ATH is supported by robust on-chain metrics and external market dynamics. Key drivers include:

- Increased Trading Volume: BNB’s daily trading volume spiked by 35-54%, reaching up to $3.33 billion, indicating heightened liquidity and investor participation.

- Institutional Demand: Growing interest from institutional players has fueled the rally, with whale activity and large-scale accumulations playing a pivotal role in price momentum.

- Ecosystem Growth and Token Burns: Ongoing developments in the BNB Chain, including deflationary mechanisms like quarterly token burns, have enhanced scarcity and utility, supporting long-term value.

- Altcoin Season and Market Rotation: As Bitcoin stabilizes, investors are rotating into altcoins like BNB, amplified by positive crypto market sentiment and Ethereum ETF inflows exceeding $4 billion.

- Technical Indicators: Favorable metrics such as RSI suggest sustained upward momentum, though risks of volatility remain.

This BNB ATH not only surpasses previous peaks but also positions BNB ahead of competitors like Solana in market cap rankings. However, the rally has triggered over $180 million in liquidations, highlighting the inherent risks in volatile markets.

Analysts note that while ecosystem improvements drive organic growth, external factors like regulatory developments could influence future trajectories.

In summary, BNB’s new ATH underscores its resilience and evolving role in decentralized finance. For more insights on cryptocurrency trends, follow our blog and explore BNB chain trading opportunities on the MevX platform.

Share on Social Media: