The Permanent Liquidity Program (PLP) is launching its third version with a staggering $100 million reward pool on March 25, 2025, as it sets out to turbocharge token liquidity and lead the charge in listings on centralized exchanges (CEXs). The ambitious initiative begins a three-month testing phase with long-term extension potential, with meme coins, AI, DeFi, gaming, and other projects as its focus. With an $800,000 per-project max reward and a strict weekly review process, PLP is set to transform the crypto space in 2025. Here’s an inside look at how it works, who can benefit, and why it’s a game-changer for token ecosystems.

What Is the Permanent Liquidity Program?

Permanent Liquidity Program (PLP) is a strategic plan to make tokens liquid and list them easily on large centralized exchanges. The third phase follows earlier phases with a $100 million fund, much larger than the $4.4 million provided earlier. To be in effect initially from March 25 to June 25, 2025, with the potential to be further extended based on performance, PLP seeks to build a healthy ecosystem for tokens by making them highly tradable and accessible.

This fund is dedicated to supporting projects across different industries, including meme coins, innovative AI use cases, DeFi projects, and fun gaming economies. By merging the provision of liquidity with CEX listing incentives, PLP will be able to entice high-quality projects, increase trading volumes, and increase token visibility globally.

How Projects Qualify for PLP Rewards

To access this $100 million pool, projects must meet strict criteria designed to ensure quality and community strength:

- Tokens must launch after the announcement on March 25, 2025, prioritizing new initiatives.

- Projects must be fully native to the BNB Chain ecosystem, aligning with platform objectives.

- Tokens need to be active for at least 48 hours before reward eligibility, allowing initial market performance to show.

- A minimum market capitalization of $5 million is required, signaling a solid base.

- At least 10,000 unique wallet holders must own the token, reflecting broad adoption.

- Average daily on-chain trading volume should reach $1 million or higher, ensuring strong liquidity.

- Ownership distribution limits the top 10 non-CEX wallets to 10% of the total supply (excluding CEX wallets and those linked to Changpeng Zhao), preventing excessive control.

Evaluations happen every Tuesday, beginning April 1, 2025, using data from the prior Monday to the current Monday. Official snapshots are captured at 23:59:59 UTC each Monday, offering a consistent checkpoint. For instance, the first evaluation on April 1 will review data from March 24 to March 31, 2025, with the snapshot on March 31 setting the stage.

Reward Structure: Up to $800,000 per Project

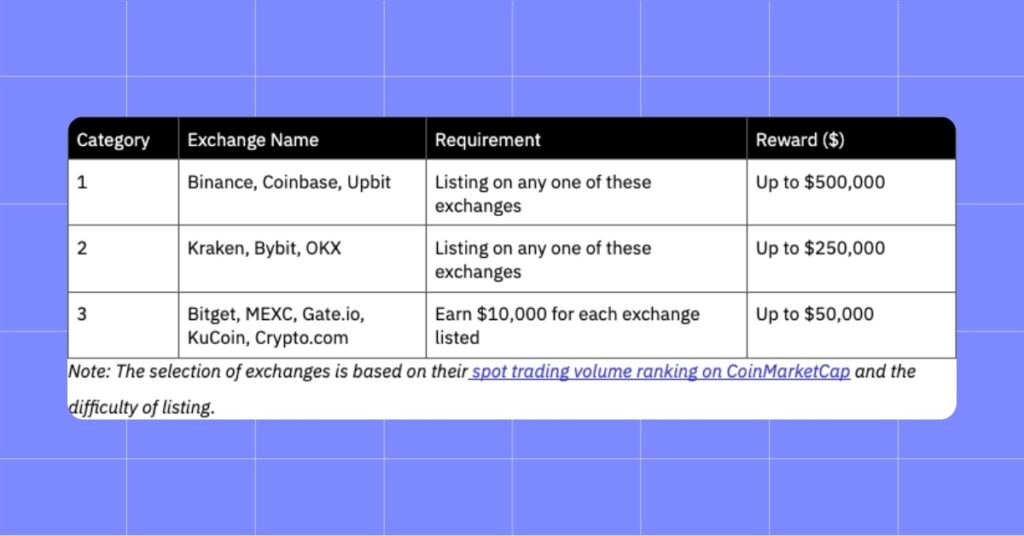

Projects that qualify and secure CEX listings unlock tiered rewards, encouraging widespread market presence:

- Listings on top-tier exchanges (global leaders) earn $200,000.

- Mid-tier exchange listings yield $100,000.

- Other or niche exchange listings bring $50,000.

A project achieving all three tiers can claim up to $800,000, providing significant growth capital. These rewards are delivered as perpetual liquidity on PancakeSwap, a key decentralized exchange in the ecosystem. Liquidity can be one-sided (using BNB) or two-sided (BNB plus the project token), customized to each pool’s requirements. This setup ensures stable trading conditions over time, vital for token longevity.

Why This Program Matters in 2025

PLP has strict standards. Any projects that are found to be involved in fraud or rug-pull risks are eliminated from the beginning. This protects the investors and instills trust, solving a common problem with crypto launches. The cap on non-CEX wallet ownership also restricts manipulation, encouraging fairness.

The $100 million PLP launch is comparable to a healthy crypto market in 2025. With meme coins like BUBB up 1051% to a $20 million market cap on Mar 22 and Morning Routine reaching $19 million on Solana, token ecosystems are chaotic. PLP’s liquidity and CEX listings focus ride this wave, giving projects a springboard to expand exponentially. With verticals like meme coins, AI, DeFi, and gaming, it’s still a lean ecosystem that can expand.

The central pillar is the two-week cycle of evaluation, snapshot at 23:59:59 UTC. Starting April 1, 2025, the cycle gives projects regular updates, enabling them to adjust strategies and achieve milestones like the $5 million market cap or 10,000 holders. It’s a disciplined yet adaptive system, a blend of order and promise.

How PLP Boosts Token Growth

For the qualifying projects, PLP has significant advantages:

- Enhanced Liquidity: Reliable liquidity on PancakeSwap facilitates smoother trading, reduces price volatility, and fosters trust.

- CEX Exposure: Listings on major exchanges increase exposure, drawing in institutional and retail investors.

- Scalability: Incentives of up to $800,000 provide growth capital, marketing capital, or operating capital.

- Community Growth: Compelling the 10,000 holders requires projects to establish strong communities.

Let’s say a meme coin launches on or after March 25. If it reaches a $5 million market cap, 10,000 holders, and $1 million daily volume by March 31, it can receive a high CEX listing on April 1 with $200,000 of liquidity backing. Two more listings can add $800,000, which drives it further.

Potential Challenges and Considerations

The $100 million fund is attractive, but its lofty hurdles ($5 million market cap, 10,000 holders, $1 million volume) could keep lower-scoped projects out. This might be appropriate for more established tokens, possibly stifling diversity. The three-month pilot also raises questions: will it be extended past June 25, 2025, or will it shift if performance is poor? Projects only have a brief window to qualify, so competition will be fiercer.

Scam prevention is essential. Quick elimination of rug-pulls is effective but requires constant monitoring. Investors are supposed to research tokens extensively, since PLP support does not assure profitability.

Table: PLP Key Metrics and Timeline

| Aspect | Details |

| Reward Pool | $100 million |

| Trial Duration | March 25 – June 25, 2025 (extendable) |

| Supported Sectors | Memecoins, AI, DeFi, gaming, etc. |

| Market Cap Minimum | $5 million |

| Holder Minimum | 10,000 unique wallets |

| Daily Volume Minimum | $1 million on-chain |

| Top 10 Non-CEX Cap | 10% of total supply |

| Evaluation Day | Tuesdays, starting April 1, 2025 |

| Snapshot Time | Mondays at 23:59:59 UTC |

| Max Reward per Project | $800,000 (all CEX tiers) |

| Liquidity Type | Perpetual on PancakeSwap, one/two-sided |

What’s Next for PLP and Token Ecosystems

As of March 25, 2025, the third phase of PLP is currently in progress, with the first review on April 1 on the horizon. Memecoins, AI, DeFi, and gaming tokens have the best chance to list, grow, and launch on CEXs. The $100 million pool can also create a token craze, mirroring spikes like BUBB’s 1051% growth. If prolonged past June, PLP could change liquidity support in crypto forever.

For creators, reaching the $5 million market cap, 10,000 owners, and $1 million volume by March 31 can earn them rewards ahead of time. Investors must watch for weekly snapshots of breakout stars. Find official sources on how to take part, as this $100 million injection may be 2025’s crypto spark.

Find the Latest news on the MevX Blog!

Share on Social Media: