The crypto market recap reveals a mix of bullish momentum and cautious signals on July 23, 2025. As Bitcoin hovers near critical resistance levels and altcoins like BNB surge to new heights.

Crypto Market Overview

This crypto market recap dives into the day’s top stories, providing essential insights for traders and enthusiasts alike.

Bitcoin’s Resistance Battle in the Crypto Market Recap

Bitcoin (BTC) continues to dominate discussions. After rebounding from support at $116,800–$117,200, BTC faces strong selling pressure at the $120,000–$120,500 resistance zone. Key influences include:

- Geopolitical tensions in the Middle East.

- Federal Reserve monetary policies.

- Upcoming U.S. presidential elections.

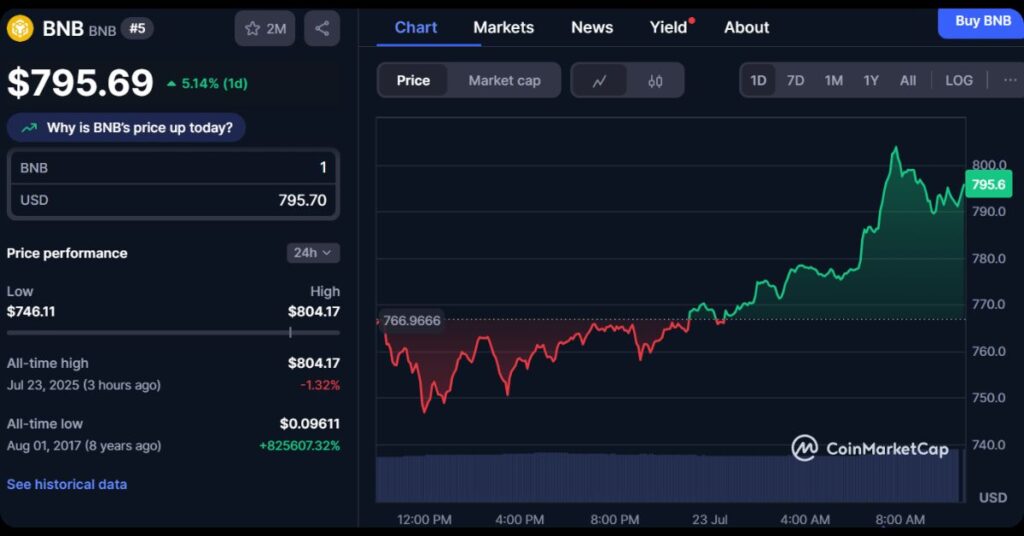

BNB Hits All-Time High

Binance’s BNB token stole the spotlight by surpassing $800, marking a new all-time high (ATH).

This surge hints at potential major announcements from Binance, such as new Launchpool projects after a two-month hiatus.

BNB’s performance highlights altcoin strength amid Bitcoin’s consolidation.

Meme Coin Highlights

- $Ani (Ani Grok Companion): This meme coin hits a new ATH today.

- $DNUT (Krispy Kreme, Inc.): A Solana meme coin rides meme stock hype as WallStreetBets’ next big bet.

- $TRUST (Trustra): Trustra brings borderless commerce to Solana, letting anyone list, buy, or sell goods and services with escrow‑protected orders.

- $AIRFRY (airfryer coin): best invention of mankind ever, good tech, easy cook

- $memecoin (just memecoin): It continues surging today up to 85%

- $boner (boner): A new meme coin on Solana surges nearly 500%

- $XAU (XAU9999): Ethereum-based token launched stealthily, draws inspiration from gold’s ticker symbol (XAU)

- $ANI (Animecoin): The first ever Animecoin from the Bitcoin forums in 2014, created by the user ”Ani-Chan”

- $PENGU (Pudgy Penguins): This penguin hits a new ATH today.

ETF Flows Shift Focus

Crypto ETF inflows painted a telling picture on July 22, impacting the July 23 crypto market:

- BTC Spot ETFs: Net outflows of $68 million, with $3.96 billion in trading volume, indicating investor rotation away from Bitcoin.

- ETH Spot ETFs: Strong inflows of $534.7 million and $2.97 billion volume, showing growing confidence in Ethereum.

- SOL ETFs: Modest inflows of $12.6 million, reflecting interest in high-performance blockchains.

These trends suggest a diversification strategy, with ETH and SOL gaining traction in the crypto market recap narrative.

Overall, the July 23 crypto market recap showcases vibrancy with BNB’s ATH and ETH inflows, tempered by Bitcoin’s resistance and regulatory pauses. Macro factors like Fed policies and geopolitics remain pivotal.

Stay ahead in the crypto world. Follow MevX blog for daily updates and in-depth crypto market recap articles.

Share on Social Media: