In this latest crypto market recap, the cryptocurrency landscape experienced notable volatility on July 31, 2025, influenced heavily by the Federal Reserve’s interest rate decision and hawkish comments from Chair Jerome Powell.

Crypto Market Recap – Price Movements and Liquidations

The crypto market recap wouldn’t be complete without dissecting price action:

- Bitcoin Dips Below $116,000: BTC fell 0.5-1% to around $117,000-$118,000 amid Fed-induced sell-offs, with over $200 million in long positions liquidated.

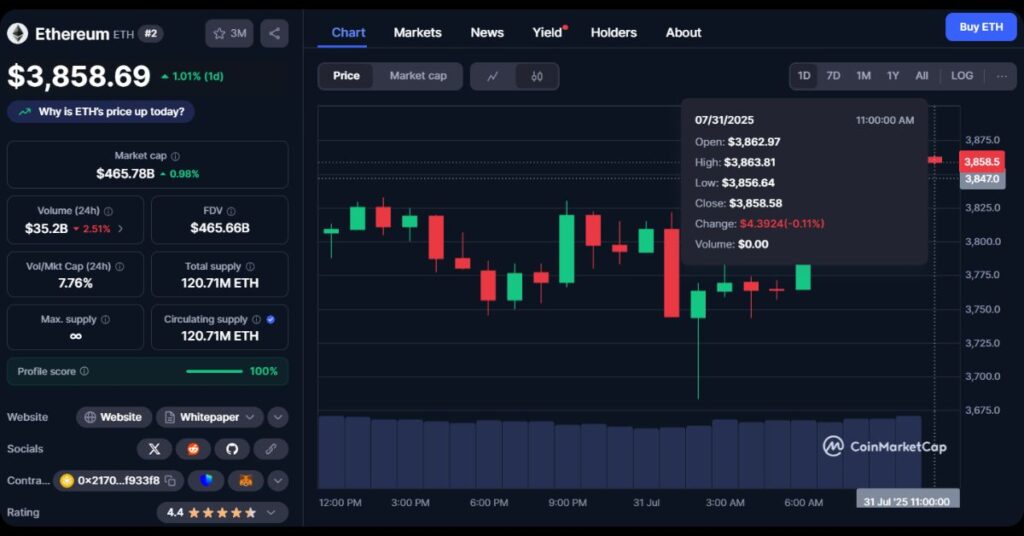

- Ethereum Leads but Slips: ETH dropped 1.08% to $3,700-$3,800, yet analysts predict a rebound to $4,000-$5,000 by year-end, driven by ETF inflows.

- Altcoin Spotlights: OMNI skyrocketed 200% post-Upbit listing, while SOL and AVAX declined 4-5%, and meme coins like BONK and PENG shed 10% before partial recovery.

Meme Coin Highlights

- $Dogcoin (Dogcoin): The Dog with a lore, inspired by the official BONK account.

- $SB (superbad): An interactive web labyrinth in the spirit of Superbad (1997)

- $CHILLHOUSE (Chill House): This Solana meme coin surges over 100% in 24 hours.

- $GEORGE (George’s Coin): This meme coin is in loving memory of GEORGE monkey.

- $RYS (RefundYourSOL): The most advanced fee refund and token-burning platform on Solana.

- $tism (tism): tism is ready to bonk

- $BITBOY (bitboy): Bitboy is here to save the trenches.

- $Block (Block): Blockstreet: Launching into the USD1 Economy

- $sON (something On NASDAQ): Today, the community celebrated Ethereum’s 10th anniversary by ringing the closing bell at NASDAQ.

- $SPX (SPX6900): An advanced blockchain cryptography token with limitless possibilities and scientific utilization.

Institutional and Regulatory Developments

Regulatory shifts and corporate moves dominated this crypto market recap:

- JPMorgan partnered with Coinbase for credit card crypto purchases, signaling mainstream adoption.

- Kraken eyes $500 million funding at a $15 billion valuation, capitalizing on friendlier regulations.

- The White House is set to release a crypto policy report, with Trump pledging to make the U.S. a “crypto capital.”

- Winklevoss twins oppose a CFTC nominee, fearing impacts on the $4 trillion derivatives market.

- MicroStrategy added 21,021 BTC, while firms like BitMine and BTCS bolstered ETH and BTC holdings.

Stablecoins gained traction, with BlackRock forecasting their dominance in payments, alongside new regulations in Hong Kong and South Korea.

Outlook and Final Thoughts

This crypto market recap highlights a resilient sector amid uncertainty, with potential for recovery if regulatory tailwinds persist.

Stay ahead of the curve, follow the MevX blog for daily crypto market recaps and in-depth analysis!

Share on Social Media: